In the daily chart, Ethereum (ETH) has the biggest gains on the crypto top 10 by market cap. At the time of writing, ETH is trading at $2.433,80 with a 12.7% profit in the past day and 5.6% in a week. In contrast, Bitcoin (BTC) has a 1.6% profit in the same period.

ETH has dominated many areas of the crypto space as a report by Wilson Withiam, a researcher at Messari, indicates. Since the beginning of 2020, there has been an increase in the demand for decentralized finance (DeFi) applications. In Q1, 2021, the total value locked for DeFi protocols has seen a 200% rise and stands at $58 billion, according to DeFi Pulse data.

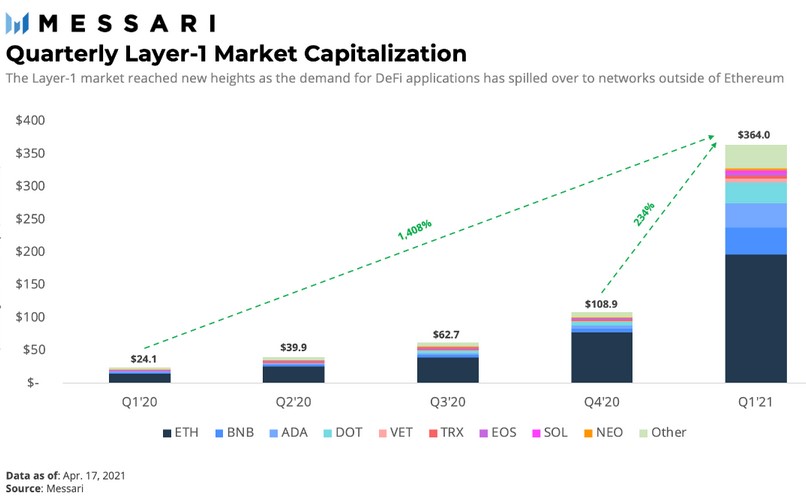

ETH has reigned on top of this sector. The Quarterly Layer-1 Market Capitalization indicates that DeFi demands as “spilled over to networks outside” of Ethereum. Since Q1, 2020 and Q4, 2020, this metric has seen a 1,408% and 234% increase, respectively.

As the chart shows, the Quarterly Layer-1 Market Cap sits at around $364 billion with Ethereum representing close to $200 billion and occupying the undisputed number 1 position. The numbers also indicate a trend. Since 2020, ETH’s network competitors (Binance Smart Chain, Polkadot, Solana, Cardano, VeChain) have been gaining market share in proportion to the demand. Withiam stated:

(Ethereum’s challengers) gained momentum as average Ethereum transaction fees skyrocketed. While Ethereum stands to benefit from the entire Layer-1 sector growing, it also continues to lose market dominance.

Ethereum’s network two-front war

The research believes this sector could be at the start of a “Scaling war”. In that sense, the dominant blockchain has two types of competitors, “vertically integrated” or single stack networks like BSC and Solana. These two have outperformed the top ten layer 1 but must reduce decentralization to gain their advantage, high scalability, and low cost, as stated by Messari’s researcher.

The second type is represented by Polkadot, Avalanche, and Cosmos. These competitors “bring scalability through parallelization”, they operate with several independent chains with a central blockchain and recorded good price performance in the past months.

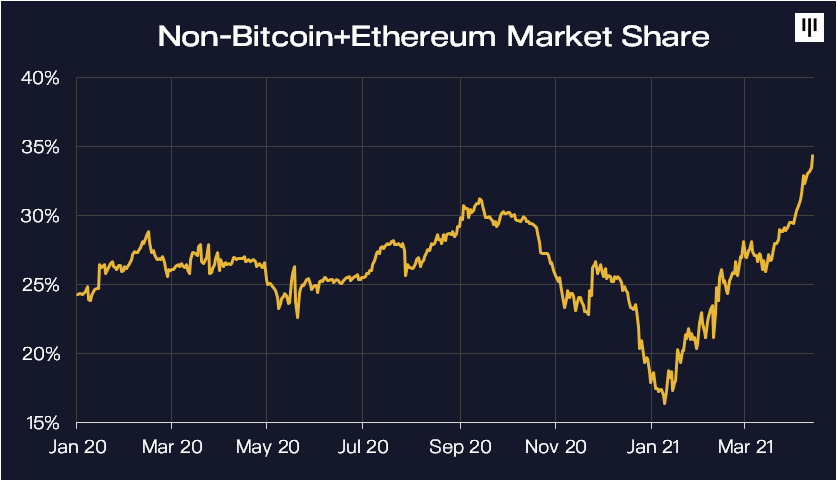

Messari’s data is supported by Pantera Capital and its CEO Dan Morehead. As seen in the chart below, there has been a significant rise in market share by the “non-Bitcoin+Ethereum” sector. To the detriment of Bitcoin’s dominance, this sector’s market share has doubled in the past three months and register a 34% rise. Morehead said:

The non-bitcoin+thereum market share has more than doubled, from 16% to 34%, in the past three months. Watch this space. That’s where the largest gains are likely to be.

Therefore, it seems fair to assume Ethereum’s war has many fronts and could face a “multi-chain future”. Layer-2 scaling solutions and EIP-1559, to be implemented to change the network’s fee model, will be key for ETH to maintain its edge in the short term.

In the meantime, Ethereum reached $1.5 trillion in transactions settle during the first part of 2021, as pointed out by another Messari researcher, Ryan Watkins. In contrast, during Q1, 2020, this metric stood at $116 billion and $31 billion for Q1, 2019. Watkins added:

Prices may do whatever they want in the short-term, but the consistent growth in usage is undeniable. Blockchains will eat the world.