After trading hours on Wednesday, Ethereum Exchange Traded Funds (ETFs) in the United States have exceeded expectations despite a dramatic market weakness earlier this week by producing a notable $98 million influx. For these ETFs, this was the second day in a run of net inflows, highlighting their high use case in the face of market volatility.

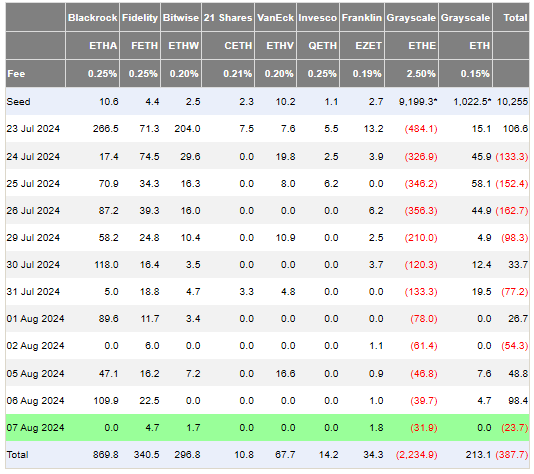

With around $109.9 million, BlackRock’s ETHA topped the inflow and brought its overall holding near to $900 million. Among other noteworthy inflows were Grayscale’s Mini trust with $4.7 million and Fidelity’s FETH with $22.5 million. By comparison, Grayscale’s ETHE went through a $39.7 million outflow in the same frame, figures from Farside Investors UK show.

Crypto Market Recovers After Steep Sell-Off

On August 5, the market for cryptocurrencies slumped significantly; Bitcoin fell below $50,000 while Ethereum had its fastest one-day fall in three years. Since then, both cryptocurrencies have showed indications of recovery; according to most recent figures, Bitcoin is trading at about $57,496 and Ethereum at $2,530.

Along with geopolitical concerns and consequent large liquidations of many asset kinds, the market jitters were ascribed to rising worries of a possible US recession. Driven by fears about the Yen’s declining buying power versus the US dollar, the Bank of Japan’s recent interest rate increase has raised questions across markets that favor riskier assets, which has resulted in general sell-offs.

Ethereum ETF Performance Amidst Market Volatility

Ethereum ETFs, despite the broader market selloff, have been able to bring to the table a decent amount of inflows, which comes as a surprise to some investors. This is a significant change as these items had before seen a run-down of outflows. With a growing number of investors now having an exposure to the volatility via ETFs, market observers argue that the present climate differs from earlier cycles.

These solutions have made it simpler for investors to interact with the crypto market even with notable swings. additional financial institutions could start recommending ETFs to customers as trading volumes rise, hence perhaps generating additional inflows.

Outlook And Future Trends

As the market settles and investors react to the new dynamics brought by spot ETFs, the general mood is a cautious optimism. While the worldwide crypto market valuation saw a slight recovery, rising by 2% over the previous 24 hours to $2.02 trillion, the entire value of Bitcoin spot ETFs as we speak sits at $51.5 billion.

Since Ethereum ETFs act as a gauge for institutional interest and adoption of cryptocurrencies, analysts believe that their performance will be continuously under the lens by the masses. ETFs’ ability to expose digital assets is projected to become more important as the sector develops and regulatory systems change, therefore drawing more mainstream investors to the crypto scene.

Featured image from ReadWrite, chart from TradingView