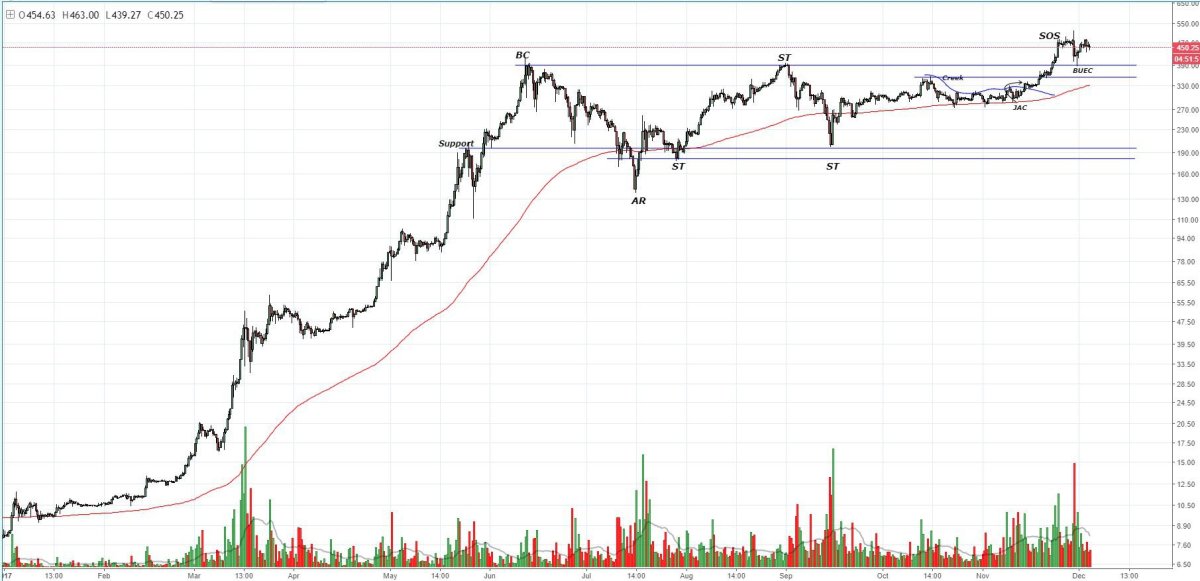

Since its rapid ascent from $8 to the $400s, ether has seen a fair amount of volatility. Over the last few weeks, there has been a surge in volume as it pushed out of its multi-month trading range:

Figure 1: ETH-USD, 12-Hour Candles, Macro Trend

The several months ether spent consolidating appears to have formed a macro Reaccumulation Phase that led to a breakout of the trading range on strong volume; ultimately yielding our current market position in the $450s.

A Reaccumulation Phase is a pause after a strong uptrend that attempts to shake out weak shareholders as the market consolidates toward the stronger holders of a given commodity. A Reaccumulation Phase is intended to torture the weak holders of a commodity into ultimately relinquishing their market share to the stronger market players, before a strong, upward continuation of the previous trend kicks back in.

Some of the characteristics of a Reaccumulation Phase include strong buyback on the dips with high volume and wide candle spread:

Figure 2: ETH-USD, 12 HR Candles, Volume and Price Movement

When analyzing trading ranges, it is paramount to contextualize the price movement and the volume. Doing so reveals the intent of the larger market players and will help give traders insight into the potential strength (or weakness) of their investments. Throughout the length of the trading range, it is common to see several tests of both the upper and lower boundaries (the blue horizontal lines).

One key trait we are looking for when identifying a Reaccumulation Phase is the increase in volume as the stock (or coin in our case) begins to rally toward the latter end of the trading range:

Figure 3: ETH-USD, 12 Hour Candles, Trading Range Breakout

Although the current market trend is somewhat consolidating in these higher price levels, it is a very bullish sign that we have broken out of the trading range and done so on increasing volume. This trend shows that the market is now dominated by demand and all the free-floating supply has been absorbed. As the market begins to test new highs, wait for volume to increase to confirm strength in the upward direction.

Summary:

- ETH-USD broke out of a potential, multi-month reaccumulation phase.

- Increasing volume on the move out of the trading range gives us confidence in a bullish continuation.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTC Media related sites do not necessarily reflect the opinion of BTC Media and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.