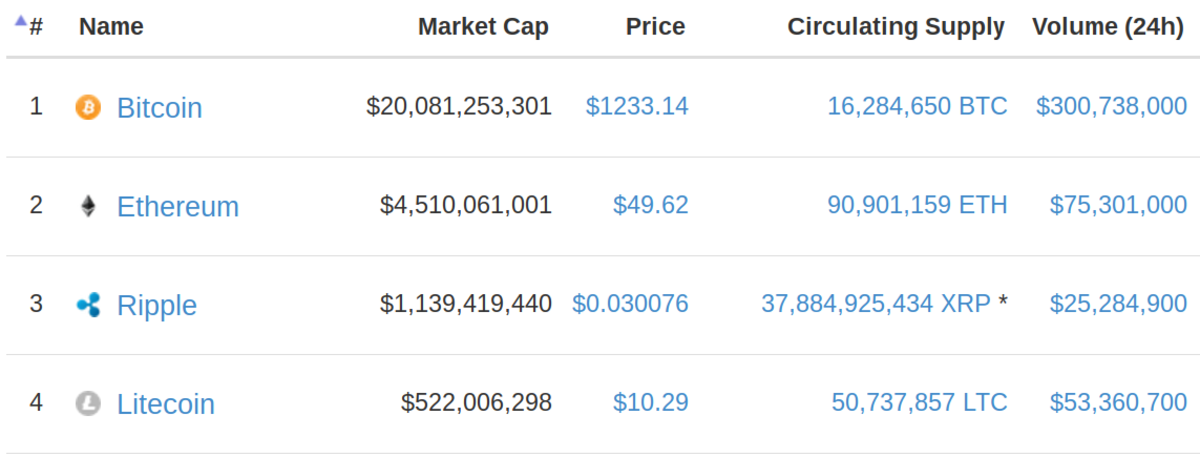

Ethereum (ETH) continues to easily hold the number-two market capitalization, far and above the next highest altcoins. Its volume traded, however, is quite handily surpassed by Bitcoin, and its only trading volume rival at the moment is Litecoin.

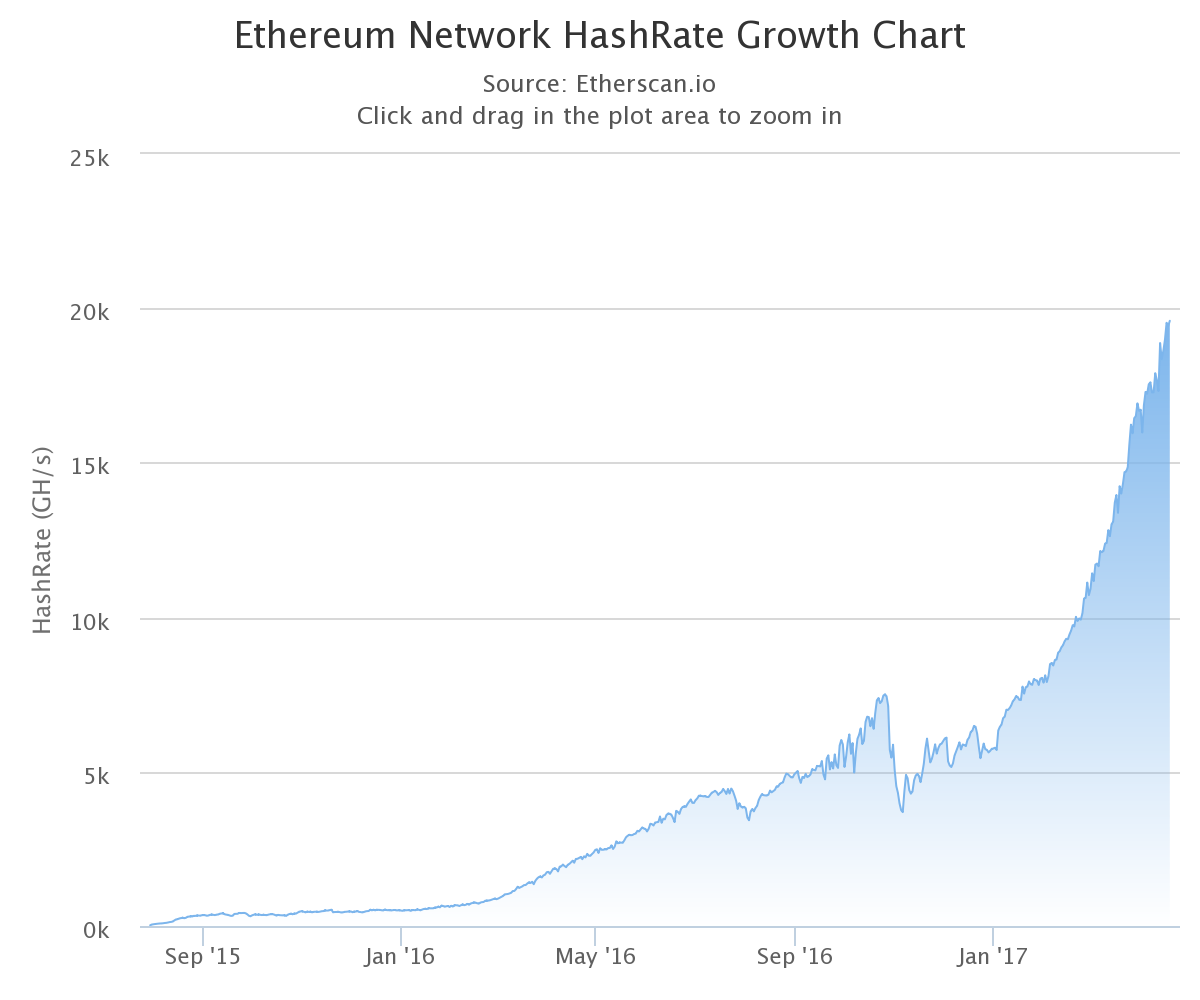

Mining hash rate continues to push all-time highs almost daily, a strong sign that miners, at least, believe in the short- to medium-term future of Ethereum.

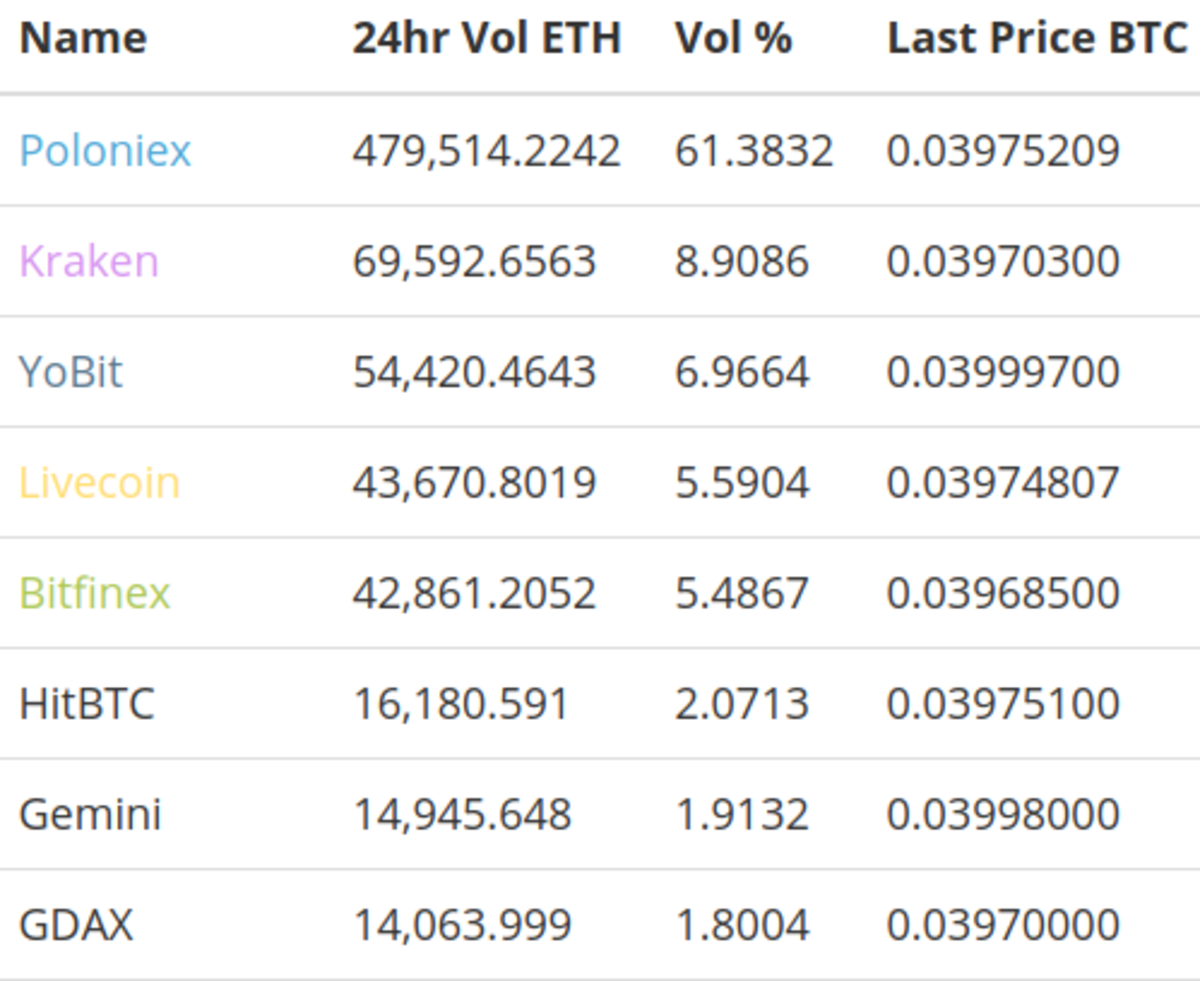

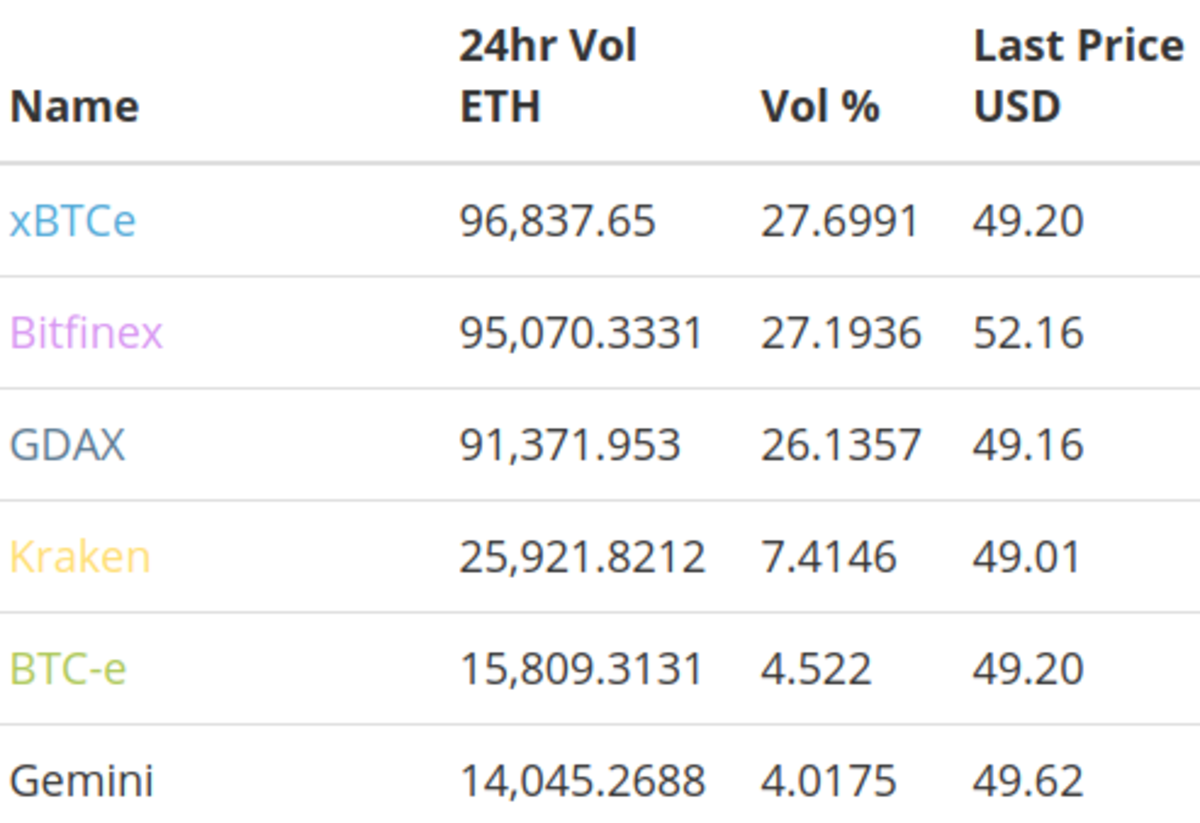

To tease apart Ethereum’s volume traded a bit further, we must look at both ETH/BTC and ETH/USD. The BTC pair leads the traded volume by far.

ETH/BTC is mainly traded on Poloniex, and ETH/USD is split among xBTCe, Bitfinex and GDAX.

For the most part, markets generally move based on the exchange where the volume is the highest. For traders, this suggests that ETH/BTC and signals from Poloniex should be weighted the heaviest when making trading decisions. Regarding ETH/USD, it should also be noted that the exchange price essentially hovers around $49, except on Bitfinex, where it sits $3 higher at $52. This higher rate should not suggest that there are more bullish traders on Bitfinex, rather that it is a byproduct of Bitfinex having trouble processing USD deposits and withdrawals. In order to move fiat funds out of the exchange, traders must first buy ETH or another digital currency. This extra step creates artificial demand pressure, thus raising the price slightly compared to other exchanges.

Bitfinex’s ETH/BTC pair is currently in line with the other exchanges, which is to be expected considering they are having no problem handling ETH or BTC deposits and withdrawals.

The remainder of the article will focus on the Poloniex ETH/BTC pair converted to Bitcoin’s current price ($1,240) in USD.

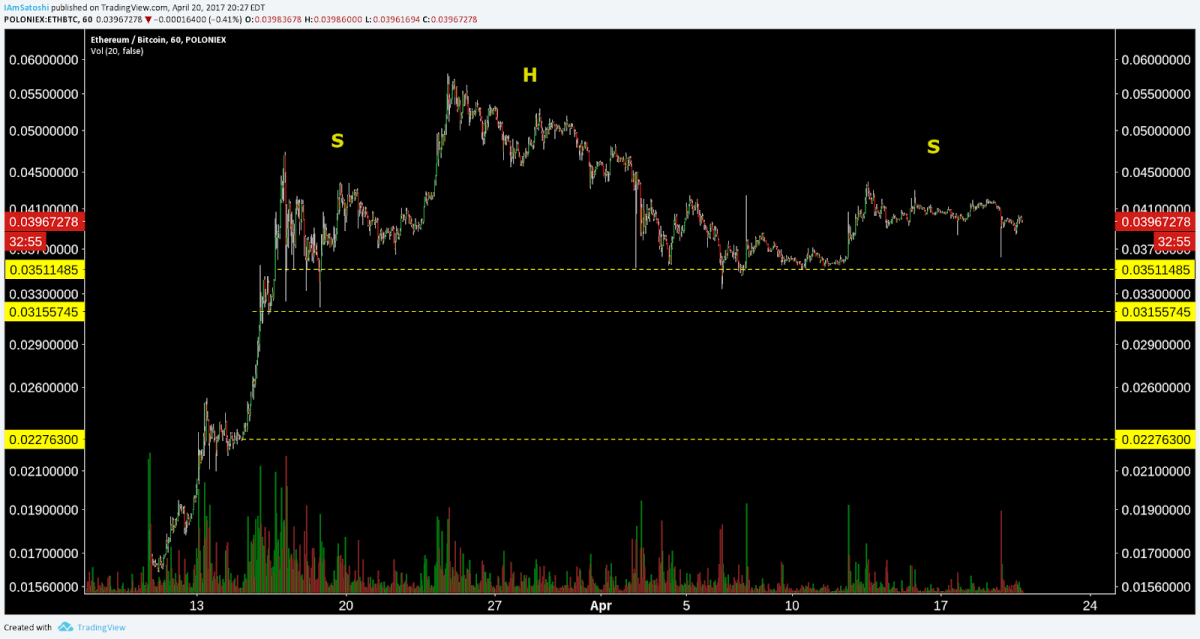

The prevailing chart pattern, with a messy descending volume profile, is the bearish head-and-shoulders reversal.

More important is the zone between $43.40 and $38.44 (0.035 and 0.031), which has seen strong support since it was broken on March 16. Should price close below this zone, it would suggest a reach for the next support, or $28.14 (0.0227). This would likely occur quickly, not only as part of the measured move of the head-and-shoulders completion, but because there is no immediate market memory of support from the move up.

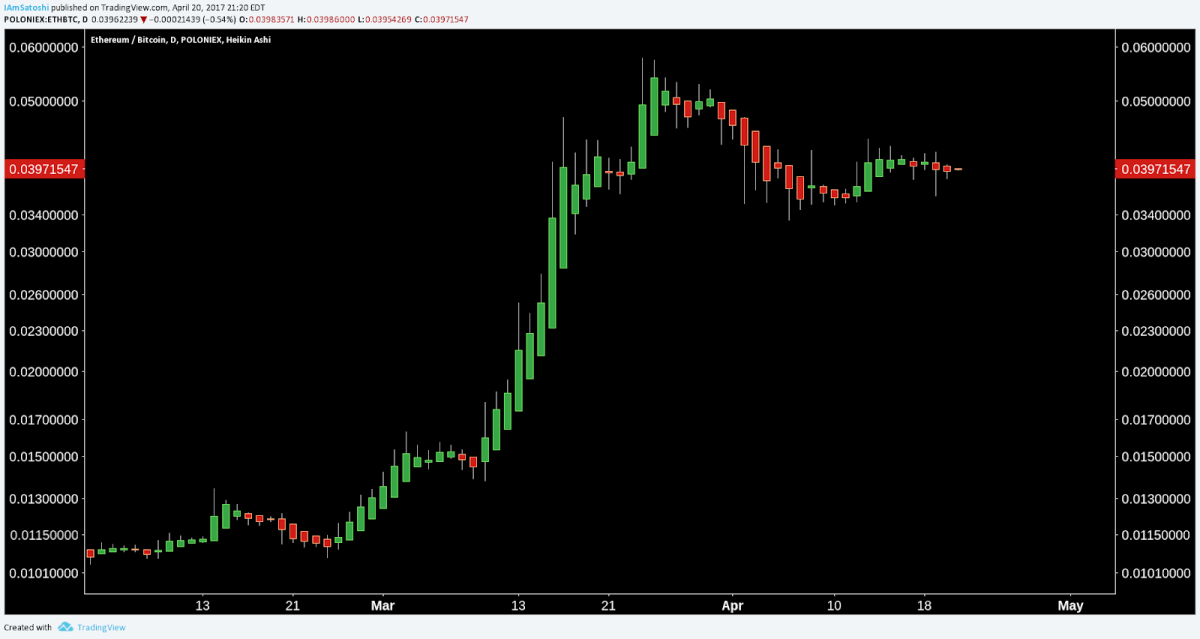

The 50/200 EMA cross on the daily time frame remains heavily bullish. For many traders, so long as the price is above the 200-day moving average, the trend is considered bullish. However, a growing distance between the 50-day and 200-day moving averages may suggest overbought market conditions. The probability of pullback or a sideways trend in price is much greater than bullish continuation.

Should price close below the 50 EMA, it’s reasonable to expect it to reach for the 200 EMA, currently sitting at the same key level as the head-and-shoulders target of $28.14 (0.0227).

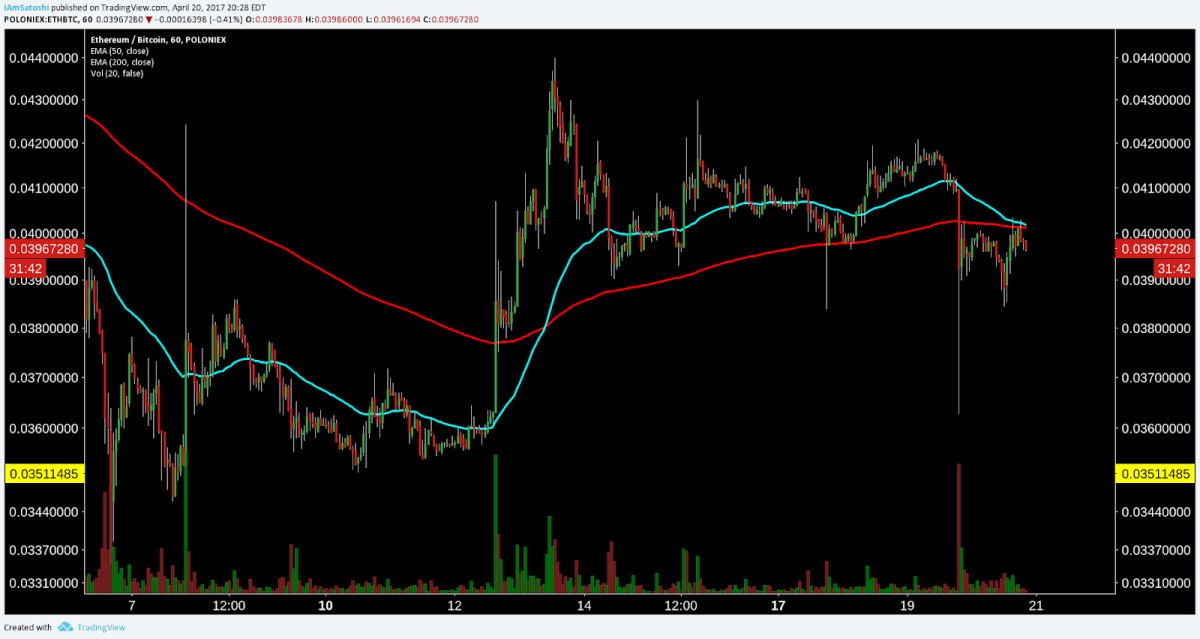

The 50/200 EMA cross on the four-hour time frame remains bullish, and has been so since the cross on February 25, 2017.

A 200 EMA over 50 EMA cross would be a strong long-exit signal as well as a sell or short entry signal.

The 50/200 EMA on the one-hour chart will cross bearish soon, also a sell or short entry signal.

Lastly, on the daily time frame, Heikin-Ashi candlesticks, which measure momentum, are beginning to show bearish movement (red) with size. A break of the head-and-shoulders horizontal support with several large bearish Heikin-Ashi candles should be seen as bearish confluence and give further confidence in a sell or short entry signal.

Summary

- ETH altcoin dominance continues with no true rivals in market cap or volume traded.

- The ETH/BTC pair on Poloniex drives most of the Ethereum trading volume, thus the price.

- A large bearish reversal chart pattern has formed. A break of the key horizontal supports is a strong short-entry signal.

- The 50/200 EMA crosses on lower time frames are flipping bearish. The 200 EMA at ~$28 should act as support and as the ultimate target for a large down move.