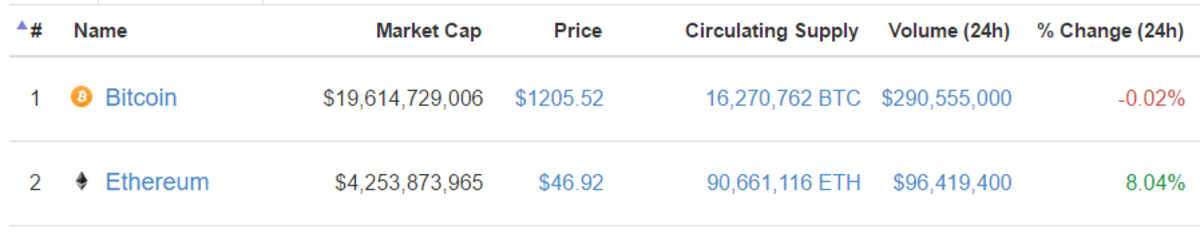

Ethereum continues to have staying power as the #2 digital currency — over a quarter of Bitcoin’s market capitalization.

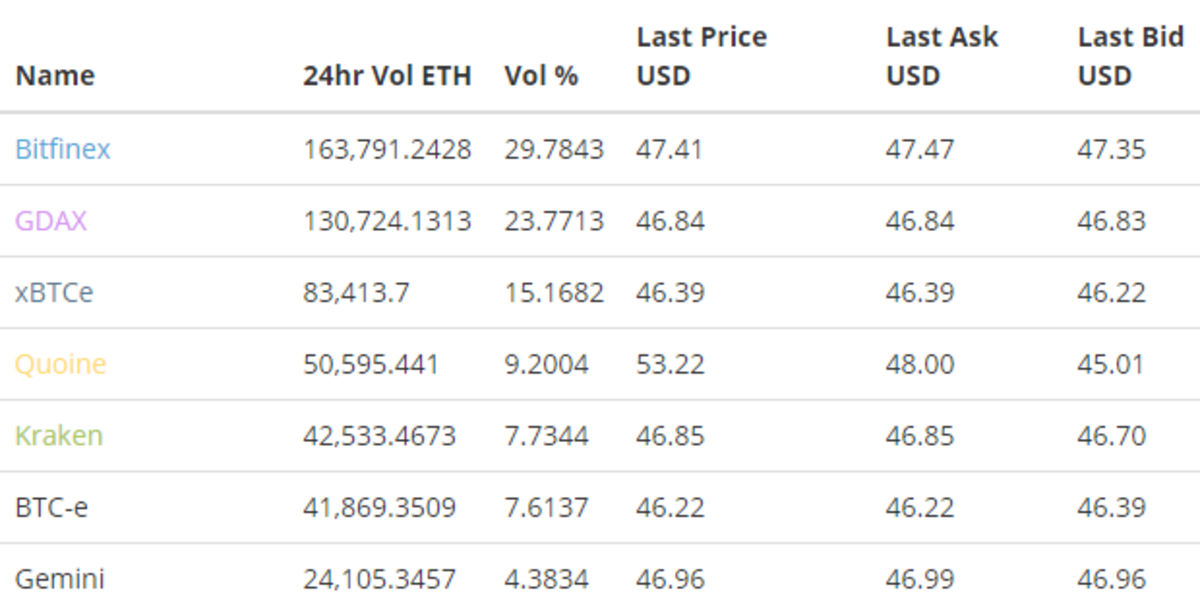

Over the past 24 hours, the largest ETH/USD trading volume has occurred on Bitfinex and GDAX. These exchanges make up over half of this pair’s volume, so you’d expect to have the fastest and clearest signals from these over any others.

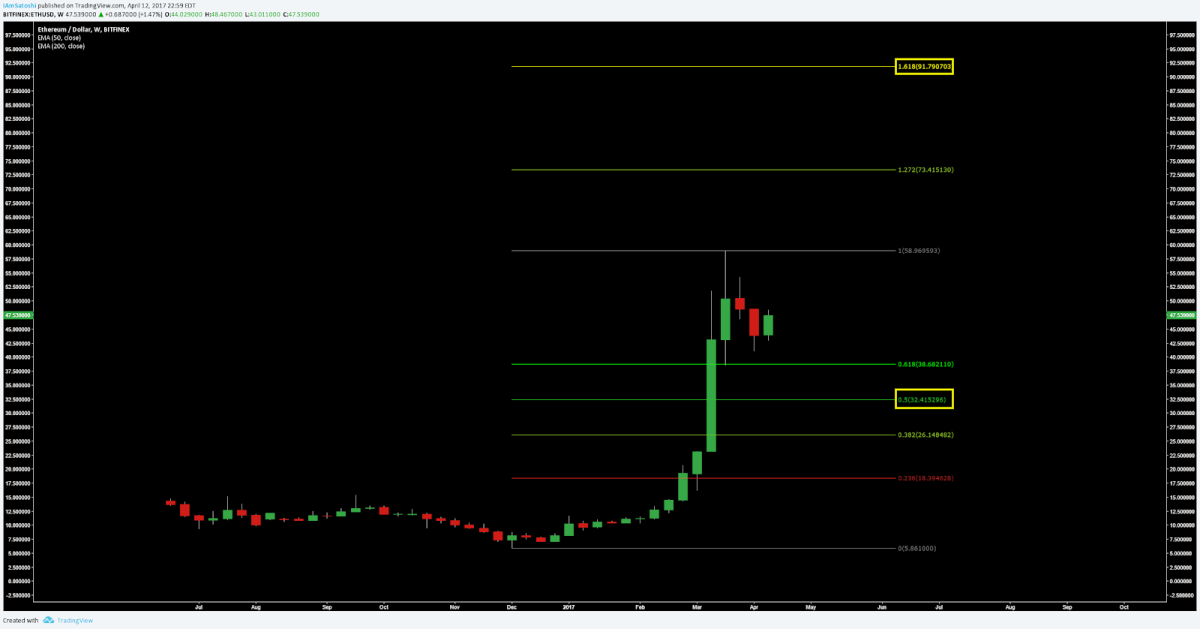

On the weekly timeframe, with limited historic data, the price structure is showing a classic bullish continuation pattern.

The bull pennant suggests that the price is continuing to lean heavily bullish. Over the next few months, it should move higher, between $73–91. Should the pennant fail to move the price higher, expect a test of the 50% of the entire move, or about $32.

After consolidating under the 50EMA for several days, price has cleanly broken the resistance and looks to be moving higher.

This movement, coupled with a failed bearish completion of the head and shoulders reversal pattern, suggests that the price will soon test the previous local resistance at $50-54. Whether or not the failure of this pattern is related to USD withdrawals being halted on Bitfinex is uncertain, but it may be playing a role. Bitfinex attempted to challenge Wells Fargo’s denial of a $180 million dollar USD wire transfer out of Bitfinex, but Bitfinex has withdrawn that challenge. It would not be unusual for the market to flee USD-tethered products if USD withdrawals were halted, causing selling pressure and a resultant drop in price. But the exact opposite has occurred.

Lastly, the four-hour Heikin-Ashi candlesticks, which measure momentum, are also showing a strong bullish break from consolidation. With both higher opens and closes than the previous candles, momentum alone suggests that the price will go much higher.

The 50/200EMAs on the one-hour time frame have crossed bullish as well. The previous bullish EMA cross signified the bottom of a large thrust upward to new all-time highs.

Summary

- Ethereum dominance amongst alts continues. Most of the USD pair is traded on Bitfinex and GDAX.

- If the bullish pattern on the weekly plays out, expect between $73-91 by the end of this year.

- A failed breakdown of a bearish chart pattern on lower timeframes suggests price will test local highs, $50-54, over the next few days.

- USD withdrawals being halted on Bitfinex may be affecting price in a divergent manner.