Following a devastating bear market last week, several major market players saw a reversal pattern called a Double Bottom Reversal. For reference, please check out the previous BTC-USD market analysis where an in-depth description of Double Bottom Reversals is outlined.

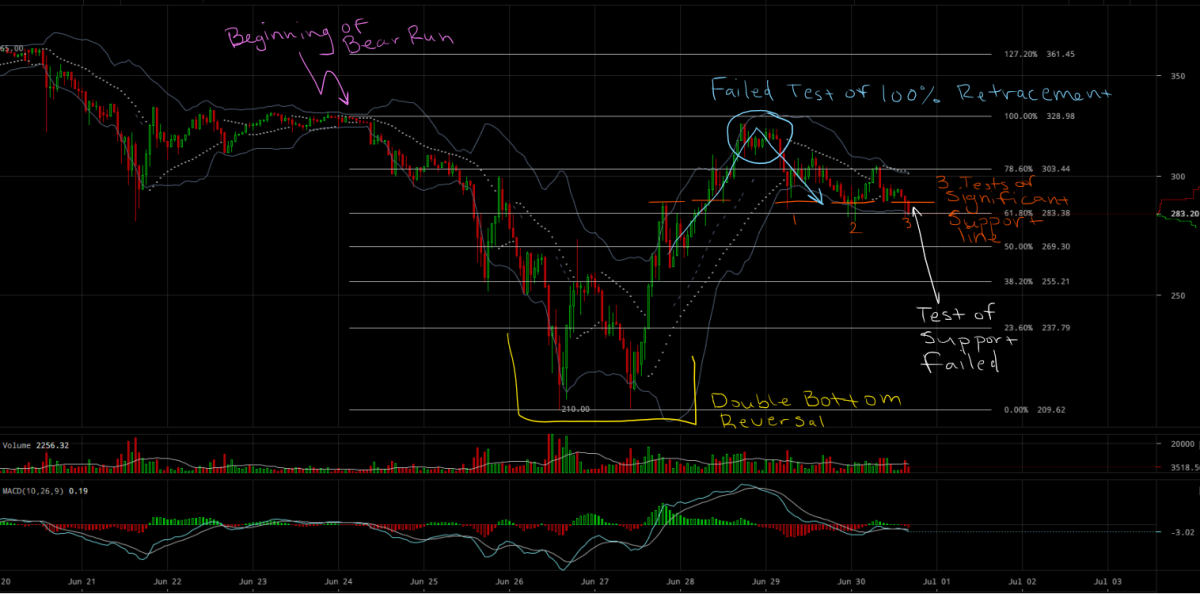

Figure 1: ETH-USD, 4HR Candles, Gemini, Double Bottom Reversal

The buy-back volume seemed very promising on the reversal pattern and it even saw textbook characteristics of a healthy bull rally. However, if we take a closer look at the market move, we can see something slightly concerning regarding the health of the bull trend. To gain some insight, let’s examine the finer points of the reversal pattern:

Figure 2: ETH-USD, 30Min Candles, Gemini, Failed 100% Retracement

The most immediately concerning aspect of this bull run is the failed test of the 100% Fibonacci Retracement. Typically, a healthy Double Bottom Reversal that leads to a prolonged bull run will test the 100% retracement value (sometimes several tests are required) and ultimately yield higher values as the volume supports market interest. However, in our case, not only did this market move see a rejection of the 100% retracement line, but it also continued a trend of decreasing volume. Decreasing volume shows the declining market interest in these high values, and it doesn’t offer much in the way of support for the bullish trend.

The second concerning element of this bull run is the retracement it is currently seeing: The market is testing the 61% Fibonacci Retracement values which coincide with a significant level of support for this run (shown in orange). At the time of this article, this run tested the support level three times and is now moving on to test the 61% value. These lower values are paired with increasing spikes in sell volume.

On the higher timescales, the MACD (an indicator of market momentum) still remains on the bullish side but is beginning to head toward bearish values. The 4-hour MACD has flipped to bearish, and the current market doesn’t show any indication in the near future of slowing its downward climb.

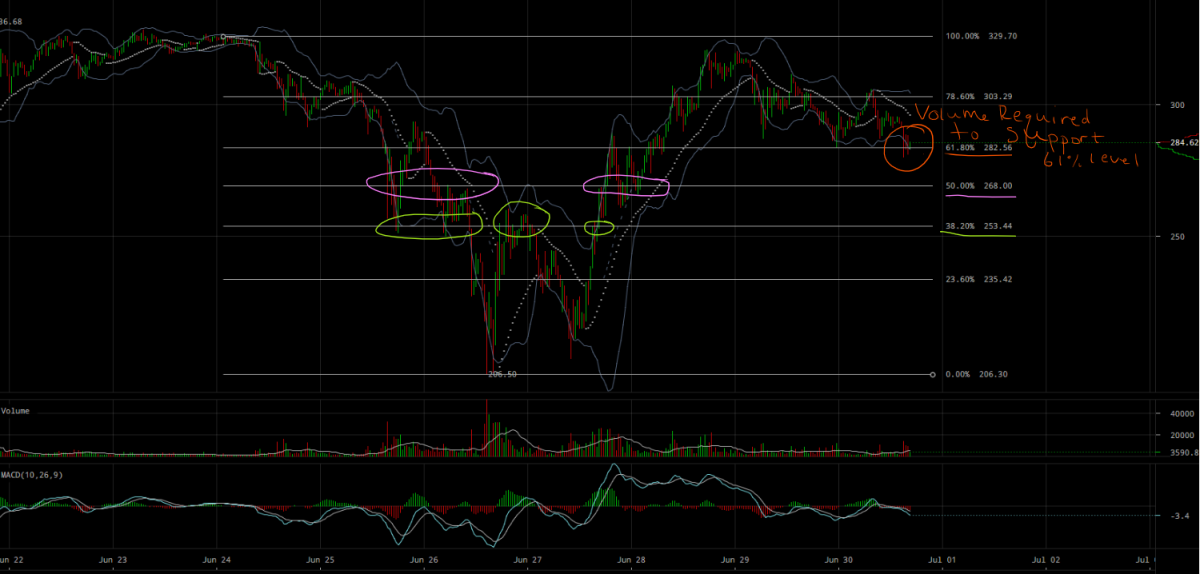

In order to maintain the support at the 61% value, we will need to see an increase in buy volume to stymie the slowly descending trend we are currently witnessing. In the coming hours/days, if the market fails the test of the 61% line, we can expect the following support levels:

Figure 3: ETH-USD, 30Min Candles, GDAX, Expected Support Levels Following 61% Failure

During both the previous bear run and the formation of the Double Bottom Reversal pattern, we saw levels of support/resistance at the 50% retracement values (shown in pink) and the 38% retracement values (shown in green). A further test of those values will prove crucial if the ETH-USD markets are to remain in this pseudo-bullish trend. Failure to see a significant increase in volume will undoubtedly lead to another bear market situation. Given the declining volume throughout this entire reversal, at this moment I’m inclined to lean more toward a bearish outlook in the near future. Until volume begins to pick up, the market will continue to slowly hemorrhage as market sentiment declines.

Summary:

- Double Bottom Reversal failed the test of the 100% retracement from the previous bear trend.

- Until a significant increase in volume is seen, the market will most likely continue this descending trend.

Trading and investing in digital assets like bitcoin and ether is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.