Ethereum is a legacy chain that has scaled over time to address the needs of the ever-demanding global user base. To relieve the mainnet of the deluge of transactions, more layer-2 platforms have sprouted.

They are cheaper to transact on and scalable, allowing users to deploy intensive decentralized applications that won’t be feasible on the base layer.

Ethereum Layer-2s Are A Success, But There Is A Problem

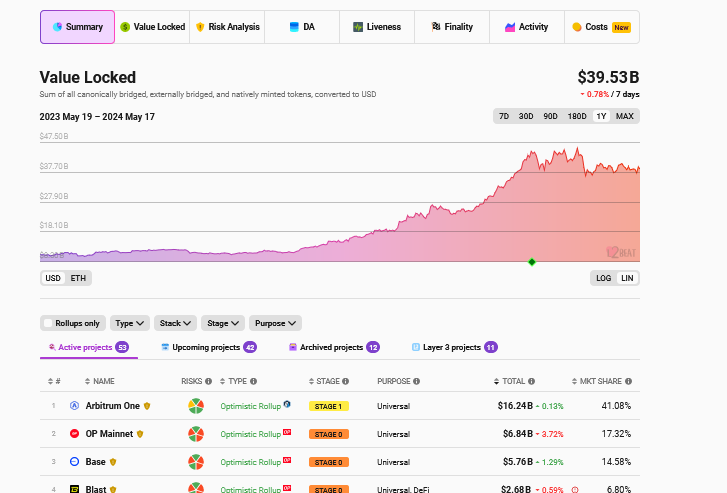

According to L2Beat, layer-2 platforms on Ethereum currently manage over $39 billion in total value locked (TVL). Even so, Nikita Zhavoronkov, a lead developer at Blockchair, is concerned and thinks layer-2s are a “huge legal liability waiting to happen.”

Taking to X, Zhavoronkov argues that layer-2 protocols on Ethereum and Bitcoin are vulnerable to regulator crackdown. In the developer’s assessment, these platforms resemble money service businesses (MSBs), considering how they are designed to operate. Since they are not regulated, the developer said they might be operating illegally.

Top of the list, Zhavoronkov argues that most existing layer-2 solutions are not truly decentralized. They point to using multi-signature contracts or “emergency councils” controlled by limited groups as evidence of centralized control.

Moreover, the developer highlighted the custodial nature of many layer-2s. Users do not directly control user funds based on how these scalable platforms operate. The analyst says this tinge of centralization presents a vulnerability if regulators target these entities.

Zhavoronkov adds that though layer-2 platforms are enablers, working from a trustless base, they function as for-profit businesses, generating revenue from transaction fees. Because some of them, like Optimism and Arbitrum, issue tokens, revenue accrued can impact token prices.

The developer contends that this is why layer-2 platforms are no different from traditional companies than truly decentralized platforms.

More Headwinds For ETH, United States SEC Reported Investigation

Given their mode of operation and model, Zhavoronkov’s assertion that layer-2 solutions could be classified as MSBs under United States laws is a concern. Such a classification could subject these protocols to stringent regulations, compliance requirements, and potential sanctions.

This not only threatens to stifle innovation but also has the potential to hamper Ethereum’s scalability severely.

While some have dismissed Zhavoronkov’s viewpoint as “distorted,” the fact that Ethereum is reportedly under investigation by the United States Securities and Exchange Commission (SEC) adds a layer of complexity to the situation.

Analysts say the SEC’s classification of ETH as a security rather than a commodity like BTC could further delay the approval of spot Ethereum exchange-traded funds (ETFs).