On-chain data suggests Bitcoin miners seem to have dumped big recently as their outflow has spiked to the largest value since more than a year ago.

Bitcoin Miner Outflows Have Observed A Large Spike Recently

As pointed out by an analyst in a CryptoQuant post, F2Pool miner wallets transferred a huge amount of coins shortly before the price of BTC observed a downtrend.

The “miner outflow” is an indicator that measures the total amount of Bitcoin moving out of wallets of all miners during a given period.

When the value of this metric spikes up, it means miners have withdrawn a large number of coins from their wallets.

Such a trend could be bearish for the price of the crypto as miners may have transferred these coins for selling them.

Related Reading | Peter Thiel Calls ‘Enemy No. 1′ Warren Buffett A ‘Sociopathic Grandpa’ During Bitcoin 2022 Miami

On the other hand, low values of the outflow suggest miners aren’t selling that much right now. This kind of trend can be either neutral or bullish for the BTC price.

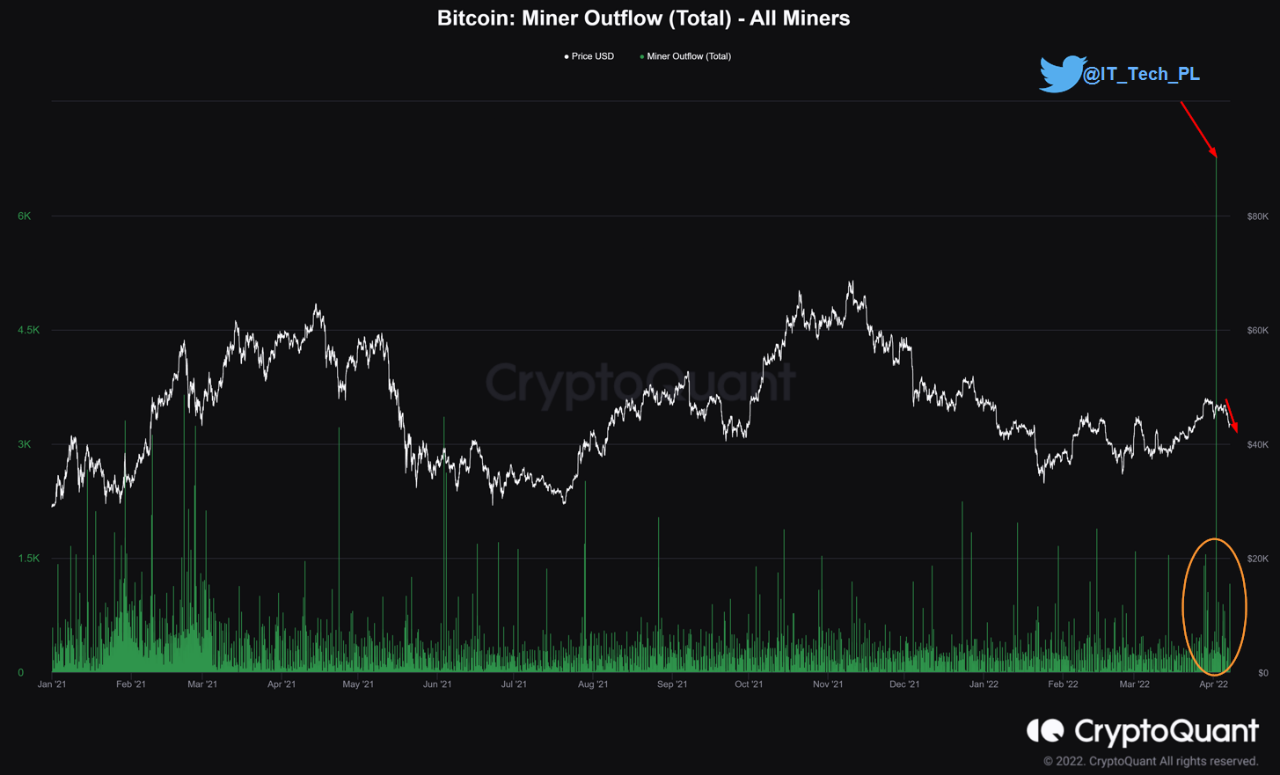

Now, here is a chart that shows the trend in the Bitcoin miner outflows since January 2021:

Looks like the metric's value has shot up recently | Source: CryptoQuant

As you can see in the above graph, the total Bitcoin miner outflow observed a large spike some days ago. Soon after this value occurred, the price of the crypto showed a decline.

Related Reading | Feds Seize $34 Million In Bitcoin From Dark Web Seller – One Of The Biggest Seizures In US

This would suggest that this outflow of over 6k BTC may have been one of the factors behind the recent plunge below $45k. Miner outflows on this scale haven’t been observed since early 2021, more than a year ago.

A modified version of the indicator shows only those outflows that are coming out of the Bitcoin mining pool “F2Pool.” Below is the chart showing its trend.

The indicator seems to have spiked up over a week ago | Source: CryptoQuant

From this chart, it’s apparent that the mining pool F2Pool lead the charge of the Bitcoin dump as outflows from these miners account for almost all the total miner outflows seen that day.

BTC Price

At the time of writing, Bitcoin’s price floats around $43.3k, down 4% in the last seven days. Over the past thirty days, the crypto has gained 13% in value.

The below chart shows the trend in the price of the coin over the last five days.

The price of Bitcoin plunged down all the way to $43k a few days back, and since then it has moved mostly sideways over the past couple of days | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, CryptoQuant.com