According to a report by CoinShares published today, crypto investment products have experienced a second consecutive week of capital outflows, indicating a potential shift in investor sentiment. The report, titled “Volume 142: Digital Asset Fund Flows Weekly Report,” was authored by James Butterfill.

Crypto Investment Products See Waning Interest

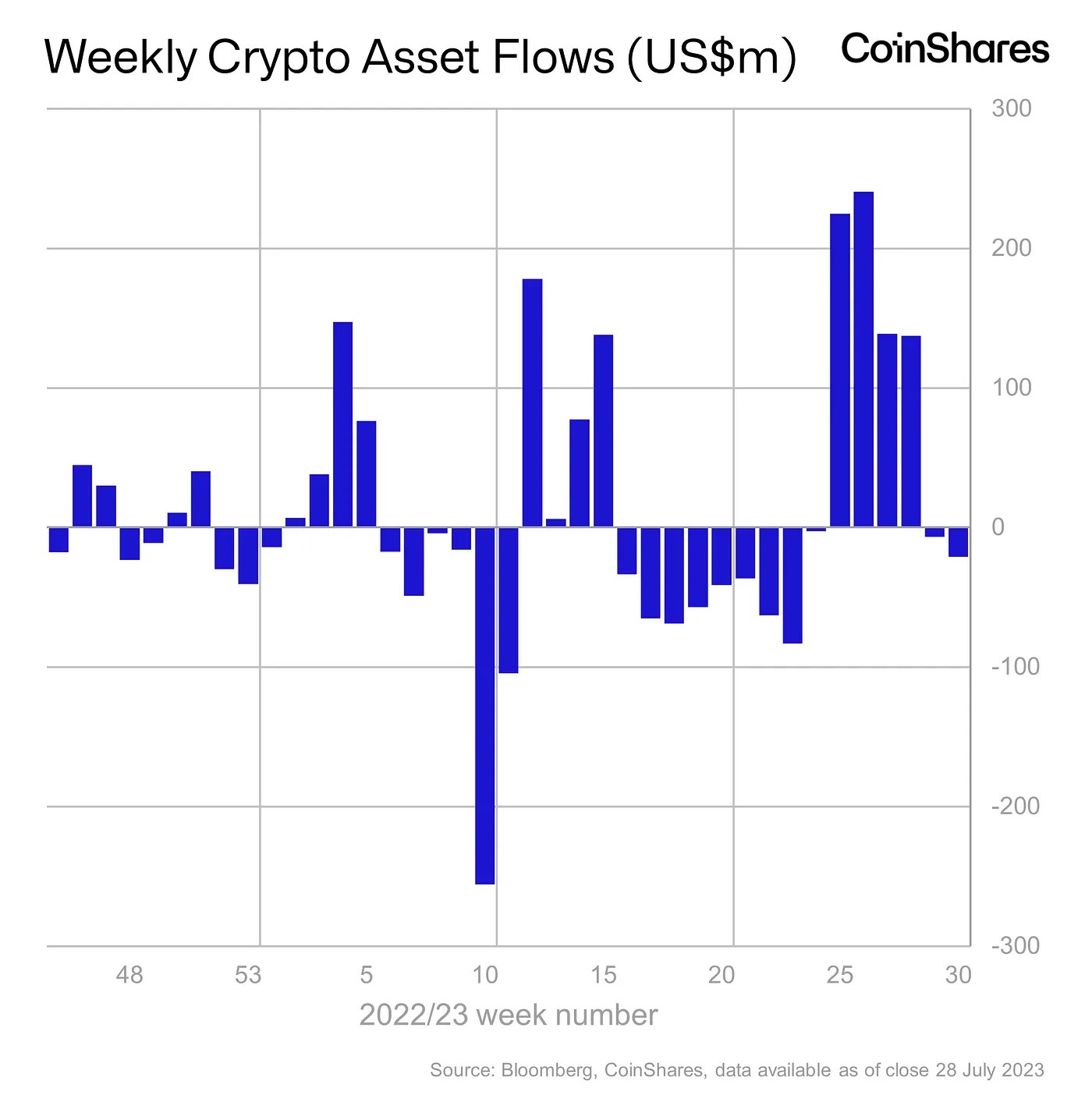

“At the half year mark, digital assets have seen just under $0.5 billion of inflows,” Butterfill noted. However, the recent weeks have seen a change in trend, with outflows totaling $21 million last week. This comes amid a backdrop of low trading volumes, with only $915 million traded last week, a significant drop compared to the $1.5 billion weekly average this year.

In terms of digital assets, Bitcoin saw the largest outflows (-$19.4 million), followed by Bitcoin shorts (-3.1 million) and Ether (-$1.9 million). On the other hand, slight inflows were seen by altcoins including: Litecoin, Solana, XRP and Cardano.

“93% of the outflows were from long-Bitcoin investment products, while short-Bitcoin saw its 14th consecutive week of outflows totalling $3.1 million,” Butterfill added. This suggests that investors have been taking profits in recent weeks, despite the overall sentiment for the asset remaining supportive.

Interestingly, investors seem to be favoring altcoins, with inflows last week totaling $3 million, and for the last 8 weeks seeing inflows totaling $19 million. Cardano, Solana, and XRP saw the largest inflows, totaling $0.64 million, $0.6 million, and $0.5 million respectively.

In terms of outflows by product, the U.S. ProShares ETF and the Purpose Investments Inc ETF saw the largest outflows, at -$11.3 million and -$11.1 million respectively. Meanwhile, CoinShares saw the largest inflow at $3.5 million.

Regionally, North America saw the most significant outflows, with both the US and Canada seeing outflows of $11.1 million and $11.3 million respectively. In contrast, Germany saw inflows of $5 million, while Switzerland and Sweden saw outflows of $3.2 million and $2.6 million respectively.

“The outflows and low trading volume show that investor interest in crypto products is currently waning,” Butterfill opined. “After a promising start to the year with high inflows, the momentum seems to be waning. It is possible that investors are waiting before injecting funds into the market again.”

In conclusion, the recent trend of outflows and low trading volumes could be a warning signal for a coming phase of weakness in the crypto market. As Butterfill suggests, “Overall, there is currently a lack of new momentum that could drive adoption.”

As the crypto market continues to evolve, investors will be closely watching these trends for signs of future market direction. At press time, the Bitcoin price stood at $29,439.