The latest report from Coinshares has revealed that the cryptocurrency market witnessed a significant increase in investment activity last week, with digital asset investment products seeing their largest inflows in five weeks.

This surge comes as investors anticipate potential interest rate cuts by the United States Federal Reserve, which could considerably impact the financial markets, including cryptocurrencies.

Dissecting The Crypto Asset Fund Flows: Bitcoin Leads The Charge

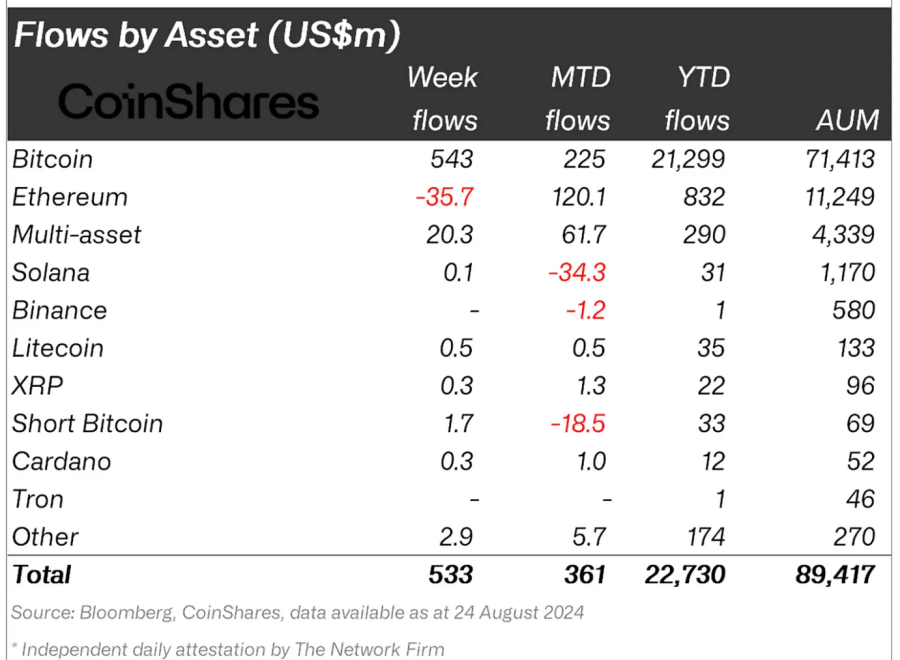

According to the report by CoinShares, the week of August 18 to August 24 saw digital asset investment products record inflows totaling $533 million, marking a notable shift in market sentiment.

Most of these inflows were directed towards Bitcoin-related exchange-traded products (ETPs), which accounted for $543 million.

The report disclosed that the increased interest in Bitcoin investments coincided with comments made by Federal Reserve Chair Jerome Powell during the Jackson Hole Symposium on August 21.

Powell hinted that the first interest rate cuts could occur as early as September 2024, a prospect that has spurred investors to reposition their portfolios in anticipation of a potentially more favorable environment for risk assets like cryptocurrencies.

According to CoinShares, Bitcoin alone emerged as the primary beneficiary of this renewed investor interest, funneling the bulk of inflows into Bitcoin-related ETPs. BlackRock’s iShares Bitcoin Trust (IBIT) led the pack, recording $318 million in inflows over the week.

CoinShares noted in the report:

Interestingly, the majority of those inflows were on Friday, following the dovish comments from Jerome Powell, indicating Bitcoin’s sensitivity to interest rate expectations.

Ethereum Performance In The Fund Flows

On the other hand, Ethereum-related investment products did not fare well during the same period. Despite new issuers of Ethereum ETFs continuing to attract investments, there were net outflows of $36 million from Ethereum-related products.

The Grayscale Ethereum Trust (ETHE) was a major contributor to this trend, with outflows totaling $118 million offsetting the inflows seen in newer Ethereum ETFs.

Interestingly, new Ethereum ETFs have accumulated $3.1 billion in inflows despite these outflows since their launch on July 23. However, this has been partially counterbalanced by the $2.5 billion in outflows from Grayscale’s ETHE.

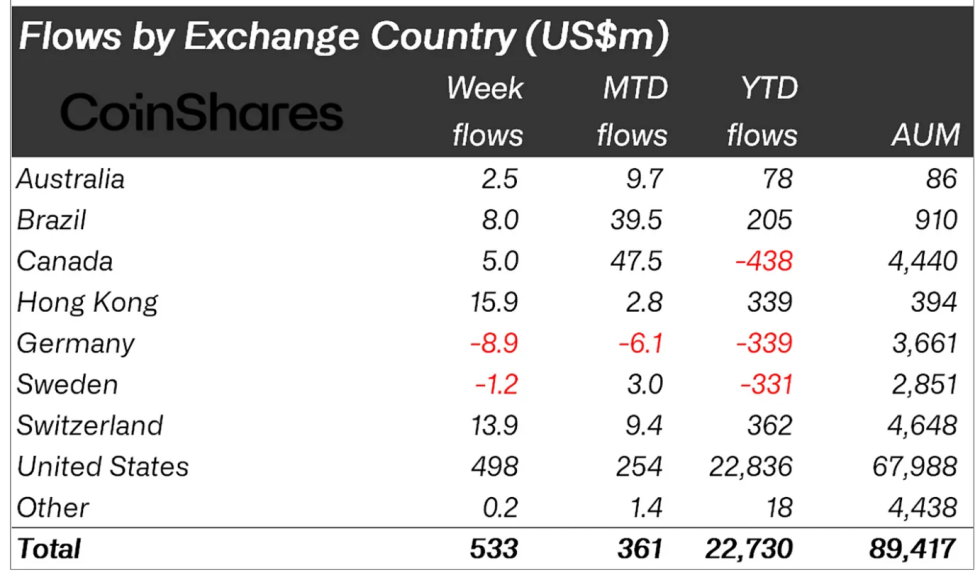

The CoinShares report also highlighted regional differences in investment flows, with the United States leading the way with $498 million in inflows. Other regions, such as Hong Kong and Switzerland, also saw notable inflows, with $16 million and $14 million, respectively.

Conversely, Germany experienced minor outflows amounting to $9 million, making it one of the few countries with net outflows for the year.

Featured image created with DALL-E, Chart from TradingView