Data shows that cryptocurrency long holders have seen liquidations of $365 million in the past day as Bitcoin’s price has crashed below $66,000.

Cryptocurrency Derivative Market Has Registered High Liquidations Today

According to data from CoinGlass, the derivative side of the cryptocurrency market has suffered some major liquidations in the past day following the volatility that assets like Bitcoin have gone through.

The “liquidation” of a contract takes place when it amasses losses of a certain degree, leading to the derivative exchange with which it’s open to forcibly close it off.

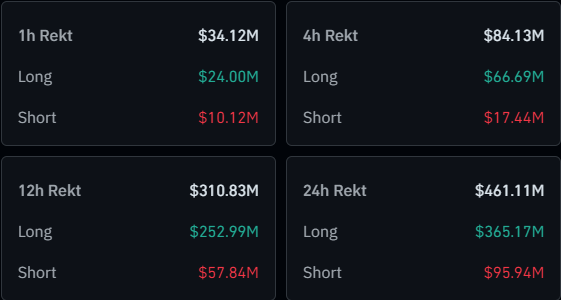

Below is a table that shows the information about the liquidation event that has occurred in the cryptocurrency sector over the last day:

As is visible above, the market has observed total liquidations of more than $461 million in the past 24 hours. 144,049 traders were involved in this flush, with the largest single liquidation standing at over $7 million.

It would appear that the long investors have taken the brunt of this liquidation event, with $365 million contracts of this type seeing forceful closure. This would mean that almost 80% of the total liquidations involved these traders betting on a bullish outcome.

The price action in the sector as a whole has been negative in the past day, with Bitcoin witnessing a drawdown of almost 6%. As such, it’s not surprising to see the liquidations being long-heavy.

Mass liquidation events are popularly known as “squeezes.” Since the event from the past day has been dominated by the long side of the sector, the squeeze would be categorized as a “long squeeze.”

During a squeeze, a sharp swing in the price can result in a large amount of liquidations that only fuel the price move further. This amplified move then causes even more liquidations, and in this way, a cascade of them gets unleashed.

A majority of the latest flushes have come in the past 12 hours alone, as liquidations stand at $310 million for the window. This once again corresponds with the price action, as Bitcoin and others have been the most volatile in this period.

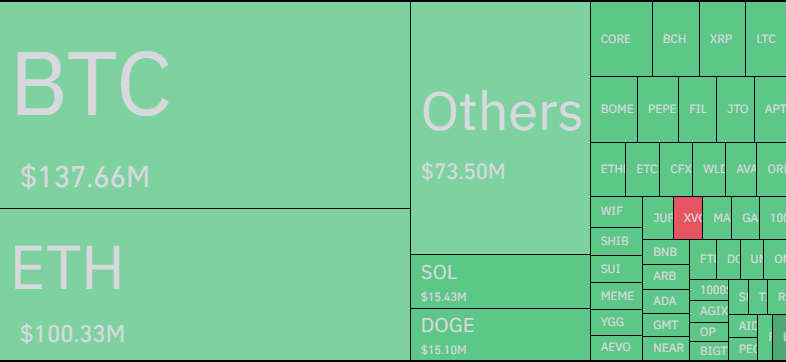

As for how the various individual symbols are responsible for the squeeze, the table below breaks it down:

Bitcoin was responsible for the greatest share of liquidations at $137 million, while Ethereum (ETH) came second at $100 million. Out of the altcoins, Solana (SOL) and Dogecoin (DOGE) have topped the list with about $15 million liquidations each.

In the cryptocurrency sector, mass liquidation events like today’s aren’t exactly an uncommon sight, due to the fact that the coins are in general quite volatile and many platforms offer easy access to extreme amounts of leverage.

Because of these factors, uninformed trading in the derivative side of the cryptocurrency market can prove to be quite risky.

Bitcoin Price

Bitcoin has plunged all the way towards the $65,200 level with its latest drawdown.