According to the latest research by Coinbase, the relationship between cryptocurrencies and stock markets has become remarkable. This interplay is about 50% as of September 2024, mostly due to global monetary easing initiatives carried out by major countries such the United States and China. This study has important ramifications especially for investors trying to negotiate these intertwined markets.

The Impact Of Monetary Policy

The evolution of this link has been much influenced by the Federal Reserve’s aggressive approach to interest rate reduction. Following a recent 50-basis-point rate drop, Bitcoin and cryptocurrencies related stocks saw significant gains.

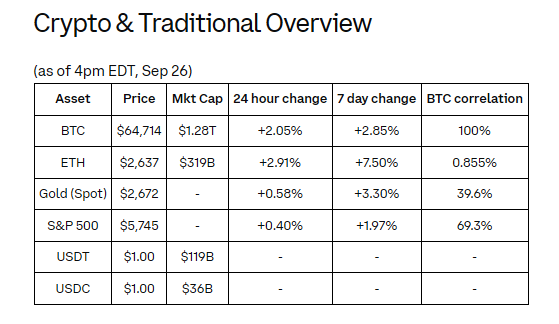

Bitcoin exceeded the $64,000 level, while stocks like Microstrategy and Coinbase also showed increasing momentum. This synchronization suggests that, when the Federal Reserve carries out measures meant to boost economic development, both asset types show positive reactions.

Interestingly, Bloomberg data suggests that the prices of US equity futures have been fluctuating in tandem with those of cryptocurrency. For example, as Bitcoin prices increased, numerous US equities also achieved new all-time highs.

This co-movement suggests a more profound correlation between the manner in which investors assess risk in both markets. Caroline Mauron, co-founder of Orbit Markets, observed that macroeconomic factors are presently driving crypto prices, a trend that is highly likely to persist throughout the Fed’s easing cycle.

Crypto: Changing Market Dynamics

In the past, cryptocurrencies functioned independently of conventional financial markets. Nevertheless, the sensitivity of these digital assets to macroeconomic conditions has increased as they mature.

This transition is evident in Coinbase’s findings, which indicate that Ethereum has outperformed Bitcoin during this period of increased correlation. Ethereum’s 8% increase over Bitcoin in the week following the Federal Reserve’s announcement suggests that investor interest in altcoins may be shifting.

Though Ethereum’s performance has improved, investors continue to be worried about the recent sell-offs by the Ethereum Foundation. The foundation recently sold 100 ETH, therefore bringing the total ETH sold this year to more than 3,500. Such acts have possible effects on market mood as well as continuous growth of projects inside the Ethereum network.

Future Trends And Investor SentimentAs the link between the cryptocurrency market and the stock market grows stronger, investors are rethinking their plans. More and more people in the crypto space want to learn more about areas other than Bitcoin and Ethereum, such as options.

Memecoins such as Shiba Inu and PEPE have recently acquired popularity among investors, with certain sectors—such as gaming and Layer 2 solutions—reporting impressive gains of up to 17% in just one week.

As October approaches—a traditionally strong month for cryptocurrencies—there is conjecture that favorable market circumstances could lead to more price increases across both asset types.

The increasing participation of institutional investors in crypto markets has also affected this trend since their trading patterns usually match those of stocks.

Featured image from Pexels, chart from TradingView