After days of stagnation, the crypto market finally broke higher on Wednesday. In the past 24 hours, Bitcoin has gained 4%. Most altcoins have registered similar gains over that same time frame.

Signs are growing that this bull trend will continue, with BTC bouncing off key supports during the recent retracement. But as cryptocurrencies scale higher, there are signs indicating that Bitcoin will be the asset outperforming the rest of the pack.

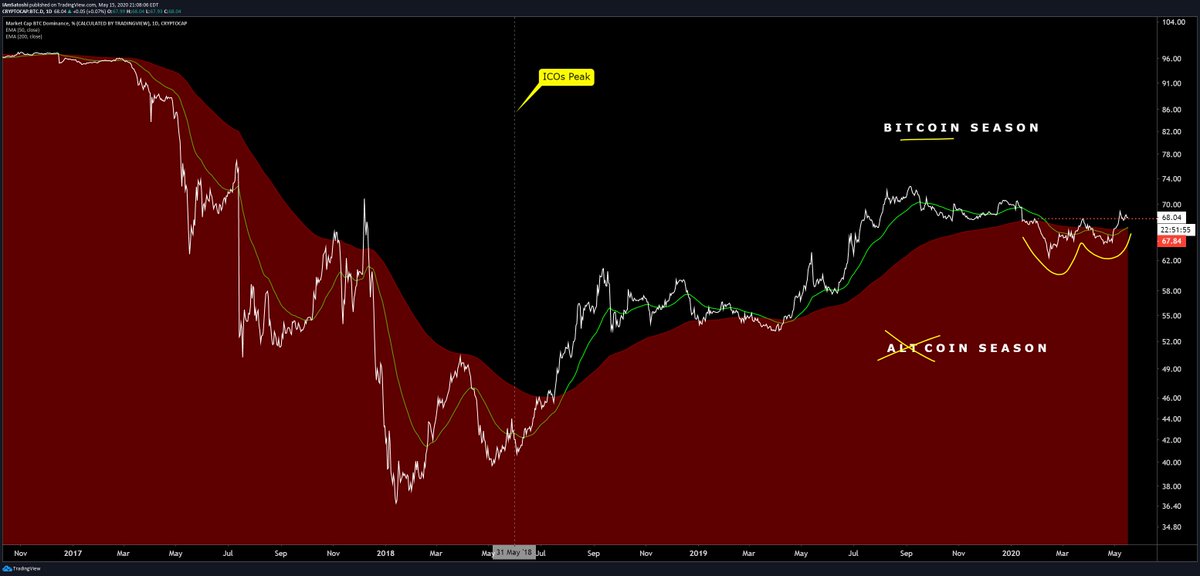

Bitcoin Dominance Flashes Bearish Technical Signs

A crypto trader recently shared the chart below. The chart shows that Bitcoin dominance is reaching two key resistances: 1) a moving average and 2) a horizontal resistance.

The analyst that shared this chart indicated that Bitcoin dominance is ready to revert lower due to these resistances. He wrote: “Ok, one kiss goodbye then continue dying please.”

Though there are expectations that it will be Bitcoin that comes out on top this time around.

Brave New Coin crypto trader and analyst Josh Olszewicz noted that Bitcoin’s dominance printed a textbook bearish sign. He observed on May 15th that the chart formed a golden cross.

A golden cross forms on a chart when a “relatively short-term moving average crosses above a long-term moving average,” and is often followed by a “bullish breakout,” according to Investopedia.

Previous golden crosses forming on this chart have preceded large Bitcoin rallies against altcoins.

The bearish outlook on altcoins relative to Bitcoin has been echoed by the lead technical analyst at crypto research firm Blockfyre.

“ETH heading for levels not seen since 2016. LTC trading below 2014-2016 prices. XRP heading for levels from 2014, 2016, and 2017. The alt market looks like it could capitulate soon. Seems like the worst is yet to come but afterwards should provide huge opportunities,” he said.

Crypto Loses Fundamental Shine Over BTC

Adding to the fears of a collapse of altcoins, analysts are coming to the conclusion that most crypto assets have lost their fundamental edge over Bitcoin.

In a report titled “Bloomberg Crypto Outlook: Bitcoin Demand Exceeding Supply,” Mike McGlone of Bloomberg indicated that BTC is poised to outperform its “brethren.”

The senior commodities analyst at Bloomberg cited the macroeconomic environment. That’s to say, due to the vast amount of money printing by central banks and governments, the extreme scarcity of Bitcoin is allowing it to be fundamentally more viable than altcoins.

Billionaire macro hedge fund investor Paul Tudor Jones touched on this narrative in his report called the “Great Monetary Inflation.”

The hedge fund manager said that Bitcoin has won the “crypto war,” referencing its hardcapped supply and it being the only investable cryptocurrency:

“I also made the case for owning Bitcoin, the quintessence of scarcity premium. It is literally the only large tradeable asset in the world that has a known fixed maximum supply.”

Featured Image from Shutterstock