A Bitcoin buying spree by an unknown address has not only piqued the interest of the crypto community but also sparked speculation that a sovereign state nation other than El Salvador might be accumulating the coin.

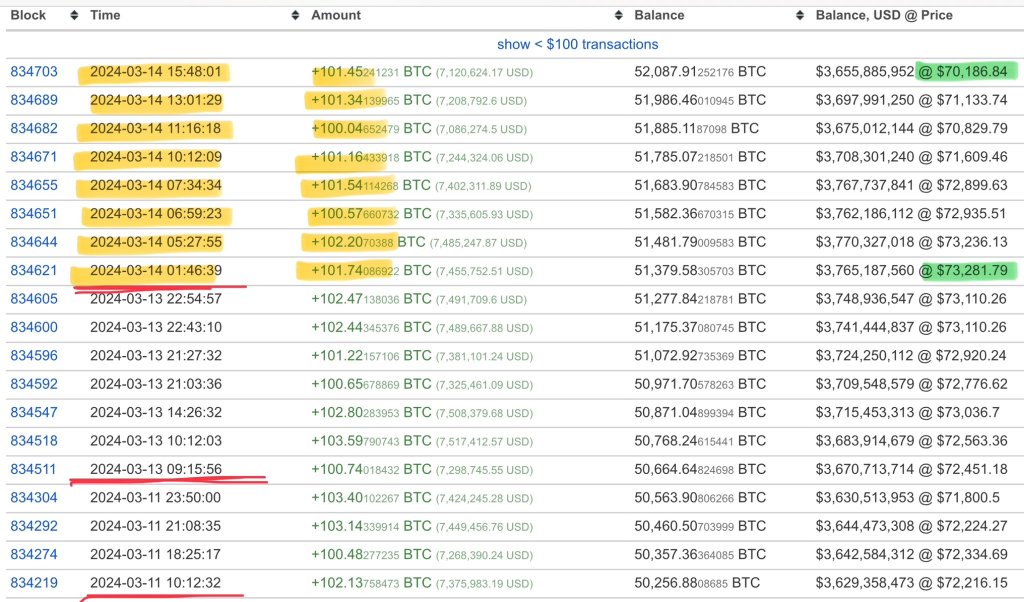

Whale Buying 100 BTC Daily

In a post on X, one user speculates that the whale likely belongs to a “small to medium nation-state” that learned the lesson the “hard way.” The user continues to say that the address might be looking to accumulate as many as possible since they want the “real thing” and not derivatives, including the spot Bitcoin exchange-traded fund (ETF) some United States institutions offer.

Since November 2023, a single wallet address, nicknamed “Mr. 100” due to its consistent daily purchases of around 100 BTC, has been accumulating the world’s most valuable coin. Because of this, there have been discussions to suggest that not only does the buyer have deep pockets, but there is a high likelihood that it is another country besides El Salvador.

The theory behind a nation-state being behind “Mr. 100” is rooted in a key advantage of Bitcoin: self-custody. Unlike traditional assets like gold, Bitcoin doesn’t require a third-party custodian. This unique feature makes it attractive to nation-states, as it eliminates the risk of those assets being frozen or confiscated in case of political disagreements.

Over the years, the United States government has sanctioned individuals, seizing assets and barring them from using the traditional financial rails, causing massive losses. However, unlike fiat, Bitcoin runs on a decentralized network, and transactions are immune to censorship, further enhancing its appeal to nation-states.

More Whales Flocking To Bitcoin

The pseudonymous nature of Bitcoin means the true holders of the whale account can only be deciphered if the owner publicly declares ownership. Already, the possibility of El Salvador controlling the wallet has been discounted. Early this week, El Salvador said they had moved their BTC holdings to a custodian in the country.

Therefore, while the identity of “Mr. 100” remains unknown, the potential of another nation-state accumulating Bitcoin introduces a captivating twist to the ongoing crypto adoption narrative.

If anything, it only further legitimizes the asset class. It might encourage even more to follow the “buy-and-hold” style that has seen early adopters rake in millions.

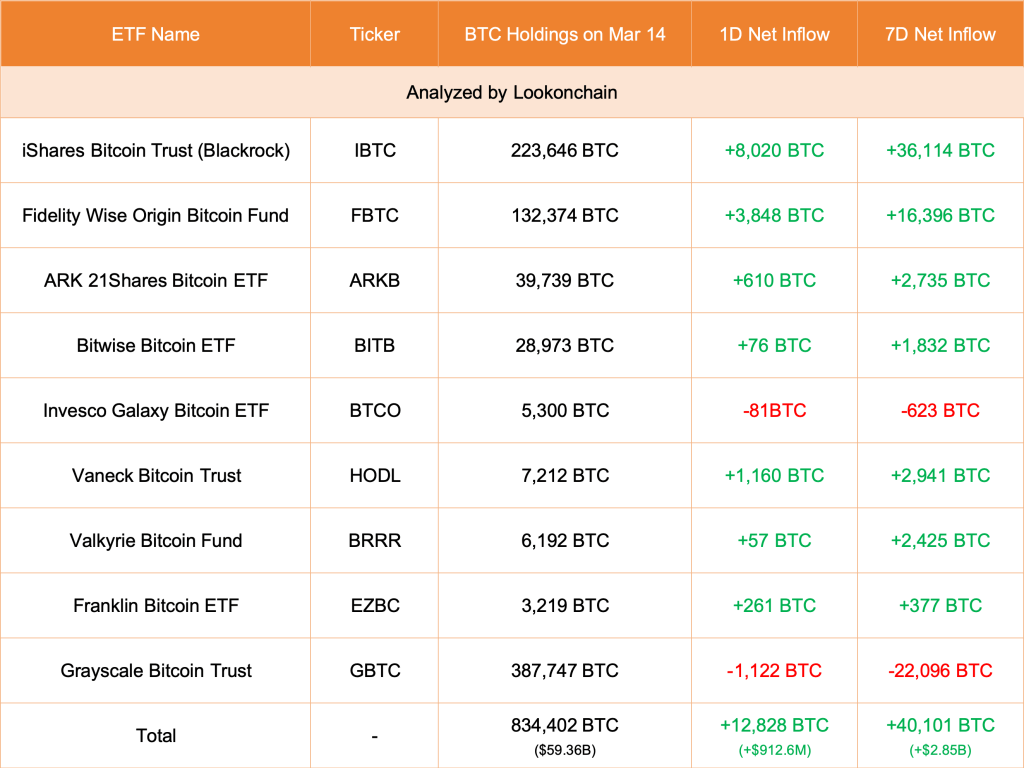

Amid this speculation, Bitcoin is under pressure at press time, trading below the $70,000 level. However, this didn’t prevent institutions from accumulating. Lookonchain data on March 14 shows that BlackRock bought $570 million worth of the coin, pushing their holding above 223,600 BTC.