Latin America’s crypto landscape has shown a distinct preference for centralized exchanges (CEXs) over decentralized exchanges (DEXs), according to a recent report released by blockchain analytics firm Chainalysis.

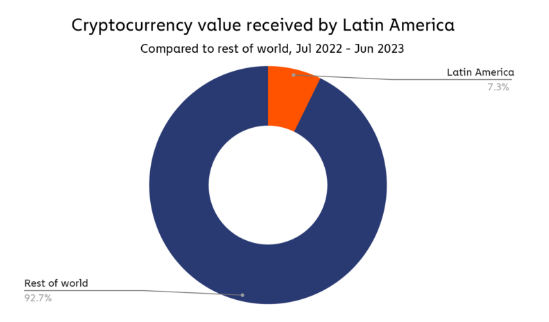

This unique trend, as outlined in the report, has positioned the region as a significant player in the global crypto economy, despite its relatively lower ranking compared to regions like the Middle East and North America (MENA), Eastern Asia, and Eastern Europe.

The report underscored that Latin America exhibited the highest inclination toward centralized exchanges when compared to other regions. While highlighting this preference, the report also pointed out the region’s deviation from extensive institutional activity.

Centralized Exchanges And Crypto Adoption In Latin America

In the wake of the COVID-19 pandemic that gripped the globe in 2020, the role of cryptocurrencies gained prominence, especially in Latin American nations. The report emphasized the vital role played by crypto assets in directly assisting healthcare professionals and aiding the populace during the pandemic.

With traditional payment systems facing hurdles due to the government’s resistance to accepting international aid, often influenced by political motivations, the significance of cryptocurrencies as a viable alternative became even more apparent.

Venezuela, in particular, emerged as a striking example within the regional crypto narrative. With 92.5% of the crypto volume being attributed to centralized exchanges, and a mere 5.6% on decentralized exchanges, the country’s unique socio-political and humanitarian challenges were identified as the primary drivers of this adoption pattern.

Chainalysis pointed to Venezuela’s ongoing humanitarian crisis, where the use of crypto played a pivotal role in facilitating aid and coping with the socio-economic challenges that plagued the nation.

Similarly, Colombia showcased a strong preference for centralized exchanges, with a substantial 74% of the crypto volume leaning towards CEXs, as opposed to a modest 21.1% on DEXs.

Argentina, on the other hand, distinguished itself as a frontrunner within the Latin American crypto landscape, boasting an estimated $85 billion in crypto transaction volume from July 2022 to June 2023. This staggering figure underscores the country’s robust engagement with digital assets, reflecting a maturing and increasingly integrated crypto ecosystem.

Latin America’s Impact On Global Crypto Adoption Index

Despite the challenges and unique trends within the Latin American crypto space, the region has made significant strides in global crypto adoption. Notably, three Latin American countries—Brazil, Argentina, and Mexico—secured positions within the top 20 ranks on Chainalysis’ Global Crypto Adoption Index.

This recognition further solidifies Latin America’s position as a notable player in the global crypto economy, underscoring its potential for further growth and influence within the broader digital asset landscape.

As Latin America continues to navigate its unique blend of economic challenges, socio-political complexities, and evolving technological landscapes, the role of cryptocurrencies is expected to remain pivotal in shaping the region’s financial future.

Featured image from TradeSanta