U.K.-based Bitcoin startup Caricoin recently announced the launch of a Bitcoin wallet for the Caribbean. The wallet has been developed in partnership with Palo Alto-based blockchain security company BitGo.

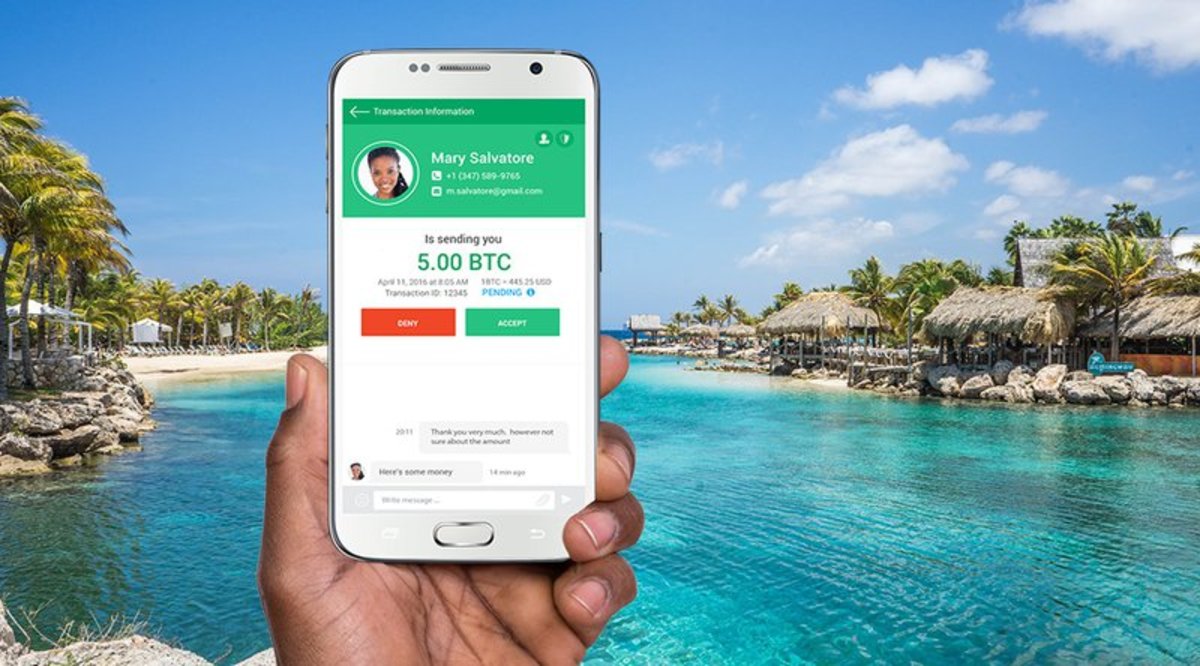

According to a press release by the company, the wallet will provide a mobile money solution to users in the Caribbean where access to traditional banking is limited. The wallet combines elements of social messaging platforms with remittance via Bitcoin. It allows senders and receivers to chat with each other and also comes with the ability to top-up mobile phones with prepaid minutes anywhere within the Caribbean.

Speaking to Bitcoin Magazine, Karsten Becker, CEO of Caricoin, said wallet was developed as an alternative to the traditional banking services for the Caribbean where, according to World Bank 2015 Global Findex Report, nearly 50 percent of the population is unbanked.

“Access to banking services in the Caribbean is difficult at best” Becker said. “The KYC [know-your-customer] process is extremely difficult and antiquated, and out of reach of most people, and the process for small businesses to open a account can take up to 90 days.”

Becker said that unlike traditional banking services where opening an account can take days due to the KYC regulations, the wallet allows anyone to instantly open an account and make digital payments.

“In comparison to banks and the mobile money platforms which are struggling to take off due to over-regulation, we make it extremely easy for anyone to open a account ‒ all you really need is a mobile phone with an internet connection,” Becker said.

He also added that the wallet will help users in the rural areas of the Caribbean where people currently have to travel to pay their utility bills by allowing them to pay bills from within the wallet.

“In some areas of rural Jamaica it can cost more than the amount on the utility bill just to travel to go and pay the bill,” Becker said. “Making payments easier without the red tape is just one of the ways our wallet can help people in the Caribbean, something that saves money for both the people and the companies they support with their hard work.”

Additionally, the company is also working on developing a zero-cost remittance feature to be included in the wallet. According to a world bank report the remittance fees alone in the Caribbean region amount to over $800 million dollars per year.

By allowing users to easily buy and sell bitcoin from within their wallet this feature will allow members of the Caribbean community working overseas to send money back home without having to incur a remittance fee.The transferred funds can be used to pay utility bills or be cashed out to local currency using bitcoin ATMs.