On-chain data from Glassnode has revealed how much profit Bitcoin miners are making currently. Here are the exact numbers.

Bitcoin Difficulty Regression Model Puts Cost Of Production At $22,900 Per BTC

In a new tweet, the on-chain analytics firm Glassnode has looked into the current profitability of the BTC miners. Naturally, to estimate the profits that these chain validators might be making, the cost of production that they incur needs to be known first.

To find this cost, the analytics firm has used its “difficulty regression model.” According to Glassnode, the model “is an estimated all-in-sustaining cost of production for Bitcoin (for the average miner).”

As its name may already imply, the model is based on the “mining difficulty” metric. The difficulty is a feature on the BTC blockchain that basically decides how hard miners would find it to mine on the network right now.

The reason such a feature even exists is that the cryptocurrency intends to keep its “block production rate” (that is, the speed at which miners hash new blocks) at a constant value.

Generally, the total computing power connected by the miners (the “hashrate”) can fluctuate a lot, as miners keep entering/leaving the network. With these variations, however, the block production rate also naturally fluctuates, since miners would mine slower or faster depending on how much relative power is available.

Situations like these are where the mining difficulty comes in; the network adjusts the metric up if miners have more hashrate available, leading to their pace being slowed back down to the standard rate, or it adjusts it down if there is lesser power connected.

Because the difficulty is directly related to how much computing power miners have connected, Glassnode thinks that the metric is “the ultimate distillation of mining cost, accounting for all the mining variables into one number.”

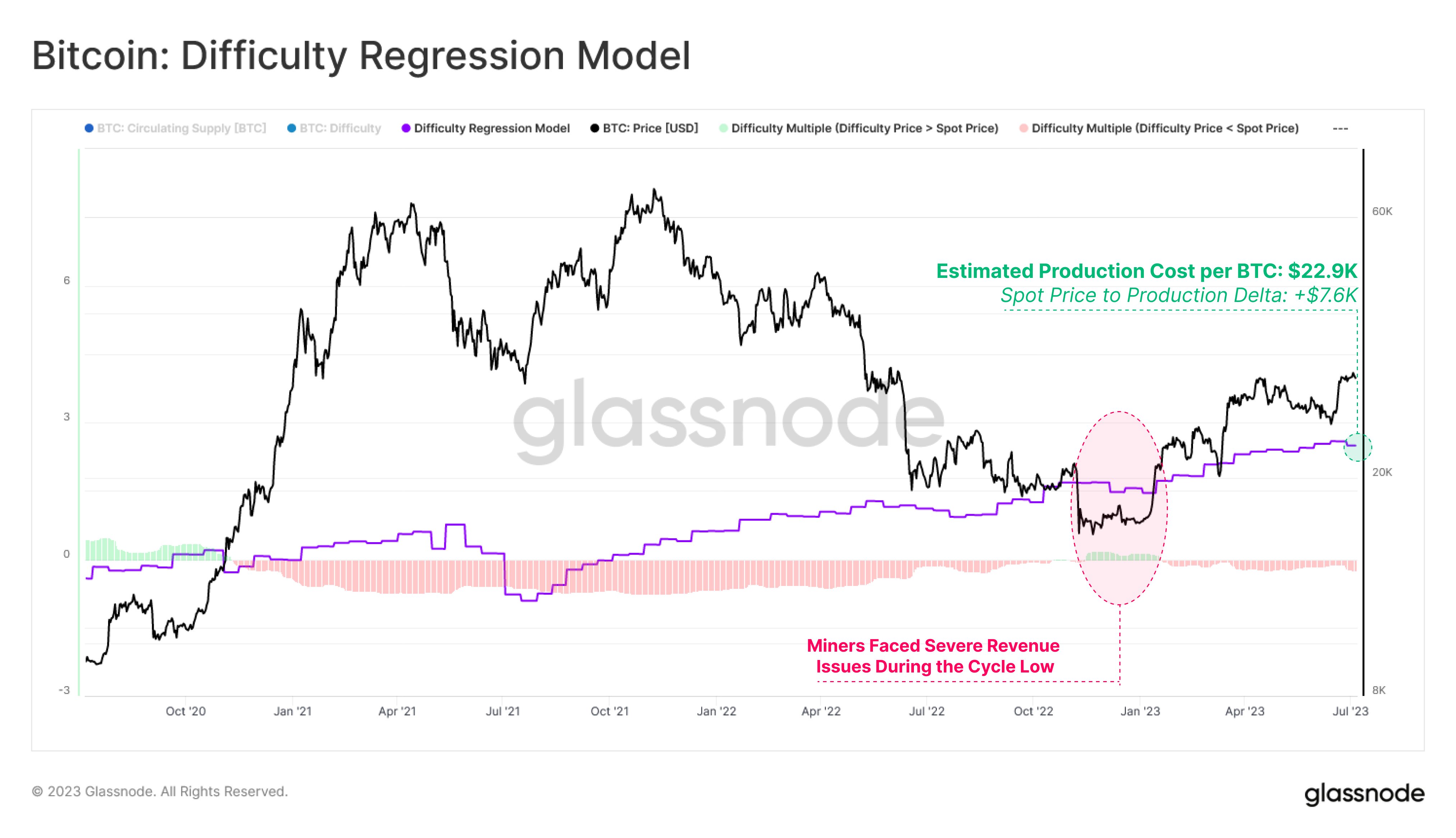

Now, here is a chart that shows how the production cost of the Bitcoin miners has changed over the years, according to the difficulty regression model:

As displayed in the above graph, the cost of producing Bitcoin has been steadily heading up in the last few months, but thanks to the rally, the cryptocurrency’s price has also generally maintained above this level.

At the current value of the model, the cost per BTC stands at $22,900. This implies that at the current spot price of $30,100, the miners are making an estimated profit of about $7,200 per coin that they are mining. Naturally, this suggests that these chain validators are enjoying decent margins right now.

Historically, the periods where miners aren’t making any profits have coincided with bottoms in the price. From the chart, it’s visible that miners were under immense pressure during the lows observed following the FTX crash, as the price had plunged deep below the production cost.

Similarly, the Bitcoin bottom that occurred in March of this year after the rally took a temporary pause and the asset dropped below $20,000 also saw the miners producing at a loss.

BTC Price

At the time of writing, Bitcoin is trading around $30,100, down 2% in the last week.