Senior Exchange Traded Fund (ETF) analyst for Bloomberg Intelligence Eric Balchunas recently discussed the reasons behind his optimisms on a Bitcoin ETF approval in the U.S. The Securities and Exchange Commission (SEC) has constantly shut down these petitions, but certain signals suggest more hope for 2021.

Balchunas said that a Bitcoin ETF approval has become a recurrent topic across the history of the nascent crypto industry. In 2013, Cameron and Tyler Winklevoss filed for the first ETF based on this cryptocurrency and have the first of many failures.

In that sense, Balchunas acknowledged that “there’s been a shift” in 2021. In terms of adoption, Bitcoin and other cryptocurrencies are much “greater” than in past years.

In consequence, there are many more crypto-based products, such as the Grayscale Bitcoin Trust (GBTC). These types of investment products are on the rise due to the high demand for BTC exposure since the cryptocurrency made a run from $10,000 to its all-time high beyond $60,000.

Many banking giants have received pressure from their clients to provide access to BTC and crypto investments, as expressed by J.P. Morgan, Goldman Sachs, and others. Thus, they have allowed their wealthiest customer to have access to Bitcoin.

In addition, institutions and hedge funds have been investing heavily in companies with BTC as part of their treasury, such as MicroStrategy. However, Balchunas said these strategies:

(…) are not ideal for retail investors and the SEC (U.S. Securities and Exchange Commission) knows this.

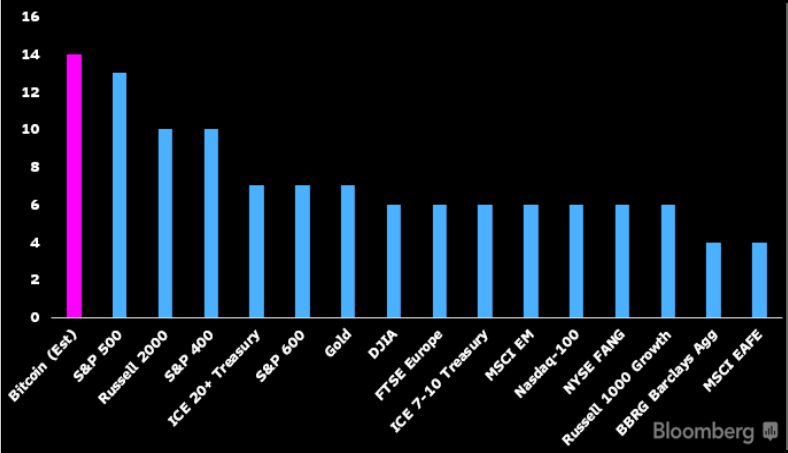

Institutions know this as well. Thus, the amounts of Bitcoin ETF proposals reached a new record with over a dozen petitions filed with the regulator. If they get approved, Balchunas said, they will set a new record on the traditional market:

if the SEC were to approve all the bitcoin ETFs in registration, bitcoin would be the most tracked strategy by a number of ETFs, exceeding SPX and gold and anything else.

Canada Ahead In The Bitcoin ETF Race, U.S. Could Be Next?

In the north, the U.S. is behind its neighbor. Canada has approved several Bitcoin and Ethereum ETFs in 2021.

Talking about the influence of this event, Balchunas said that Canada is known for “being like six months to a year ahead of the U.S.”. The expert has been tracking the performance of these ETFs and believes that they have a “stunning” record.

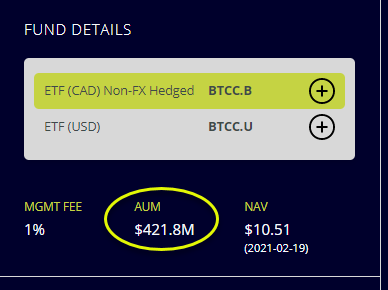

In its first two days since its launch, the Canada Bitcoin ETF collected $421 million in assets. Balchunas said:

Proportionally speaking it is the equivalent of a US ETF taking $8b in first two days. If it were to keep up this pace it will be the biggest ETF in Canada (…)

Finally, Balchunas highlighted the importance of Gary Gensler, the newly appointed SEC Chair in the decision. The market believes Gensler has a better understanding of the crypto industry and cryptocurrencies.

Gensler could have his attention place on meme stocks and trading apps, but the expert believes that the pressure could be building up in the Commission. Balchunas pointed out the potential risk of waiting too long to decide. The first Bitcoin ETF to be approved could have an advantage over the others:

All this just raises the already absurdly high stakes for the SEC who will basically be anointing hundreds of millions in revenue to the issuer who gets approval. How will they decide who? All at once? Even a 24hr head start can make or break.

At the time of writing, BTC trades at $31,761 with a 6.8% profit in the daily chart.