Japanese cryptocurrency exchange Bitpoint, owned by Remixpoint, halted all operations on Friday, July 12. The exchange lost $32 million worth of cryptocurrency in a hack.

Bitpoint Clients Lose $22.7 Million in Crypto

If there is any country in this world where you should be worried about storing your cryptocurrency, it is Japan.

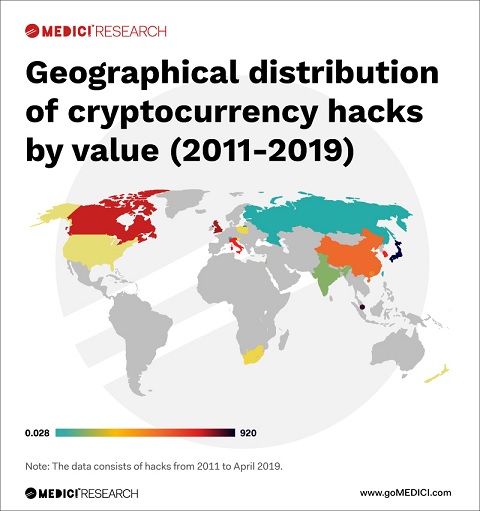

At the end of May, fintech research firm MEDICI reported that out of $2.71 billion worth of crypto lost in exchange and wallet hacks worldwide in a span of eight years, Japan accounts for $920.03 million. In other words, a third of all crypto frauds and thefts are taking place in “the Land of the Rising Sun.”

However, it seems that Japan cannot calm down until it reaches the $1 billion mark, and the hackers are working hard in that direction.

On July 12, crypto exchange Bitpoint announced that it had lost 3.5 billion yen. The hack focused on Ripple (XRP) and other digital coins. The company said that 2.5 billion yen ($22.7 million) of stolen cryptos were owned by clients, while the rest belonged to Bitpoint.

Interestingly, the Japanese Financial Services Agency (FSA) sent Bitpoint an operational improvement order last year. The regulator wasn’t satisfied with the company’s internal control. Ironically, the order was reversed at the end of June. Thus, the recent hack might represent another reason for the FSA to tighten regulation over the local crypto market.

The FSA Should React Soon

The Bitpoint hack comes after a series of major heists that took place in Japan over the years. As you could expect, the country hosted the two largest crypto hacks ever, which involved crypto exchanges Coincheck (2018) and Mt. Gox (2014). The collective losses reached $860 million based on the rates at the time of the two heists.

Currently, the total crypto market cap is over $318 billion. It means more than 0.30% of all the crypto funds were lost in Japan.

We might see a prompt reaction from the FSA to prevent other similar hacking attacks. Discussions around crypto regulation in Japan might restart, putting pressure on the cryptocurrency market.

Do you think the FSA’s response that is about to come will result in another market correction? Share your thoughts in the comments section!

Images via Shutterstock, goMEDICI.com