German Blockchain loans provider BitBond has partnered with BitPesa to facilitate payments directly to Kenya mobile accounts.

BitBond: Sub-Saharan Africa is 10% of Our User Base

The international partnership comes as Sub-Saharan Africa grows to 10% of BitBond’s user base and BitPesa’s popularity in its native Kenya continues.

BitBond CEO Radoslav Albrecht said in a blog post Tuesday:

This means that a small business owner from Kenya can receive loan funding from investors from all over the world via Bitbond and have the funds paid out to his mobile money account in 20 minutes.

Smaller African enterprises’ lack of access to mature funding options has become a focus in recent times. In catering specifically to businesses, BitBond hopes to provide a major overhaul to the local ecosystem using the Blockchain and Bitcoin as a backbone.

Focus on Developing Market Financing

Earlier this month, Daimler hinted at the possibility of considerable expansion into African markets following its acquisition of a European cryptocurrency transmitter business.

The concept is likely to involve similar facilitation of funding access for local businesses – specifically those in the automotive transport sector – helping resolve the current status quo where loanshark-like operators abound.

“The major problem observed in the automotive sector is lack of adequate financing facilities,” Ethiopian financial services company director Eskinder Desta told industry magazine Autconomy in an article discussing Daimler’s move.

Across the world’s developing economies, a reported 2 billion individuals and 200 million businesses lack the sort of funding options available elsewhere.

“This is an unprecedented level of innovation and convenience in the entire online lending space,” Albrecht added.

Blockchain Channels International Remittance Interest

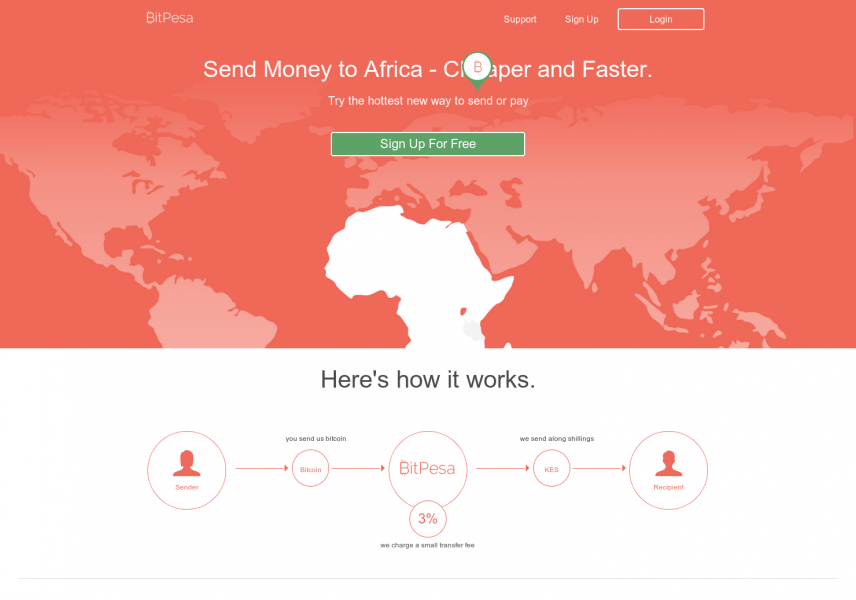

BitPesa offers a raft of cashing out options on the consumer end, first and foremost via Kenyan mobile accounts, the analog equivalent of which – M-Pesa – has held a consumer monopoly for years in lieu of significant banking penetration.

The startup is seeing continued international interest in its remittance functionality. In February, Japanese-Kenyan company Africa Incubator joined up in order to expedite payments to and from the Far East.

“We are always excited to partner with companies that make doing business in Africa easier and more efficient,” BitPesa’s CEO Elizabeth Rossiello continued on the BitBond deal.

Our customers are businesses looking to grow across the continent and beyond. Better access to efficient financing is a tremendous way to boost their growth.

What do you think about BitBond’s plan to increase Blockchain loans to Kenyans? Let us know in the comments below!

Images courtesy of Shutterstock, Bitpesa, Bitbond