Jihan Wu, the co-founder of Bitmain, is worried about Bitcoin’s future. Per a report by Colin Wu, the co-founder of Bitmain told Chinese miners there are “environmental protection issues”. Therefore, institutions currently buying or holding BTC could be more concerned about the origins of their coins.

This idea has been gaining momentum amongst some investors. Kevin O’Leary, who recently shifted 3% of his portfolio into BTC, has claimed in various mainstream media news channels that his coins must be “produced with clean energy” and not “mined in China”. O’Leary said in an interview for CNBC:

institutions will not buy [BTC] mined in China, coins that have been mined using coal to burn for electricity, or coins mined in countries with sanctions on them.

Also, Wu added that China has environmental protection priorities. As the reporter highlighted, there is a precedent of crackdowns in the Chinese-based Bitcoin mining activities. In Inner Mongolia, China, the local authorities suspended crypto mining due to the country’s environmental commitments.

Many government officials in this country have raised questions on the cryptocurrency’s “use for the real economy”. However, in a previous report, Colin said the current deputy governor of the People’s Bank of China, Li Bo, could be warming up to Bitcoin and crypto-assets. Bo said BTC “should be used as an investment tool”.

Bitcoin Hashrate Migrating Out Of China?

After blackouts across the Xinjiang province of China halted BTC mining operations in that region, the hashrate for this cryptocurrency has seen a decline. Besides, the network congestion has spiked, and alongside it transaction fees.

At the time of writing, according to explorer Mempool.space, a low priority transaction on Bitcoin’s networks has a cost of 145 sat/vB ($11.20) and a high priority 246 sat/vB ($19.00). Purgeable transactions have a fee inferior to 19 sat/vB. In contrast, a high-priority transaction before the incident has an average cost of 100 sat/vB, more or less, in periods of high congestion.

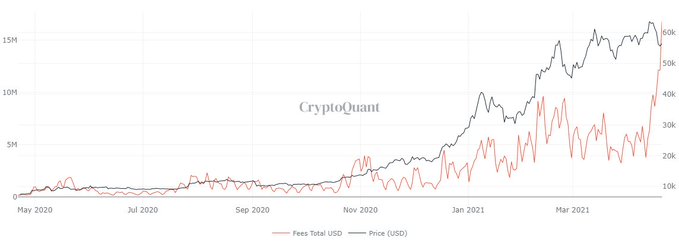

Data from CryptoQuant indicates fees paid to BTC miners have risen considerably over the past week. The chart below shows miners have made over $15 million in this period. The power outage in China has reduced the hashrate by about 20%.

As a result, mining pools in other parts of the world have benefited. The United States seems the biggest winner. The founder of the Digital Currency Group, Barry Silbert, announced via his Twitter handle that BTC mining pool Foundry managed to climb to the 5th position in the top 10 with 7.6% of the total hashrate. Silbert said “Bitcoin hashrate is quickly shifting from China to North America.

BTC is trading at $54.686 with a 3.1% loss in the daily chart. In the weekly and monthly chart, BTC has a 13.1% loss and a 0.4% profit, respectively.