After the collapse of Bitcoinica six months ago, the business of margin trading, a service which at Bitcoinica’s peak attracted a trade volume almost as large as that of MtGox itself, disappeared from the Bitcoin ecosystem almost entirely. Since then, there have been a number of disparate efforts to bring margin trading back. Almost as soon as Bitcoinica fell, a company named RingCoin announced Kronos.io, a product which looked like it could be a superior upstart competitor that would not suffer from the security faults of its predecessor. However, kronos.io was never completed, and RingCoin is now defunct. Another alternative was icbit.se, a service which has been trading options between BTC and USD, gold and even crude oil for months, and is still active now, but has not had anything close to the level of success reached by Bitcoinica. Finally, there is the Bitcoin stock exchange MPEX, which also offers USD/BTC options for trade.

Aside from these three, a number of other minor attempts have been made, some of which turned out to be fraudulent, and none of which successfully brought back what the Bitcoin ecosystem lost when Bitcoinica fell.

The idea behind margin trading is simple. If you have an account at a traditional Bitcoin exchange like BitStamp of MtGox, you have two balances: a BTC balance and a USD balance (or perhaps a CAD or EUR balance, or some other currency, depending on what country you are in). Apart from depositing and withdrawing, the only operation available to you is trading one currency for another, reducing the BTC balance by some value and increasing the USD balance by that value multiplied by the current price (or vice versa), also paying a small spread and commission. If you are participating in the exchange as a trader, your goal is to convert to BTC before the exchange rate goes up, and convert to USD before the exchange rate goes down, slowly increasing the net worth of your account over time. The benefit to society from such trading is that it stabilizes markets; a successful trader who earns a profit will, in doing so, prop up the valleys and dampen the peaks of the Bitcoin price, ensuring a more stable exchange value for all. Margin trading services add only one feature to this model: the ability to have one of your balances go negative. That is, if you have 10 BTC and 0 USD, and you are really sure that BTC will go up in the near future, you can buy more BTC on the market, and have a balance of, say, 15 BTC and -$55 USD. The attraction of doing such a thing is simple: if the value of a bitcoin shoots up by 10%, then the net worth of your account will grow by more than 10%. However, there is also a risk: if the value drops by 10%, the net worth of your account will drop by more than 10% as well. If you are really unlucky and the price drops by so much that the net worth of your account becomes negative, then your balances are “liquidated” and you lose everything. The ratio between the change in BTC price and the change in the net worth of your account is called the leverage, and there is typically a maximum leverage, which in the Bitcoin economy has historically been about 10:1.

This is the service that Bitcoinica was providing for eight months before its shutdown in May. Now, it looks like another competitor is positioning itself to take this niche: Bitfinex. The service that BitFinex is providing offers a number of advantages over what Bitcoinica provided. First, the security that they claim to be offering is much higher. Unlike Bitcoinica, whose online-accessible “hot wallet” was hacked for $222,000 in March, Bitfinex plans to have no hot wallet at all, processing withdraws manually at the end of each day. The API keys that they use to deal with exchanges will be limited to trading, and will not have the ability to withdraw, averting a mistake which proved ruinous to Bitcoinica when $320,000 was stolen from their MtGox account in July. In terms of account security, Bitfinex once again beats Bitcoinica, offering two-factor authentication right from the start.

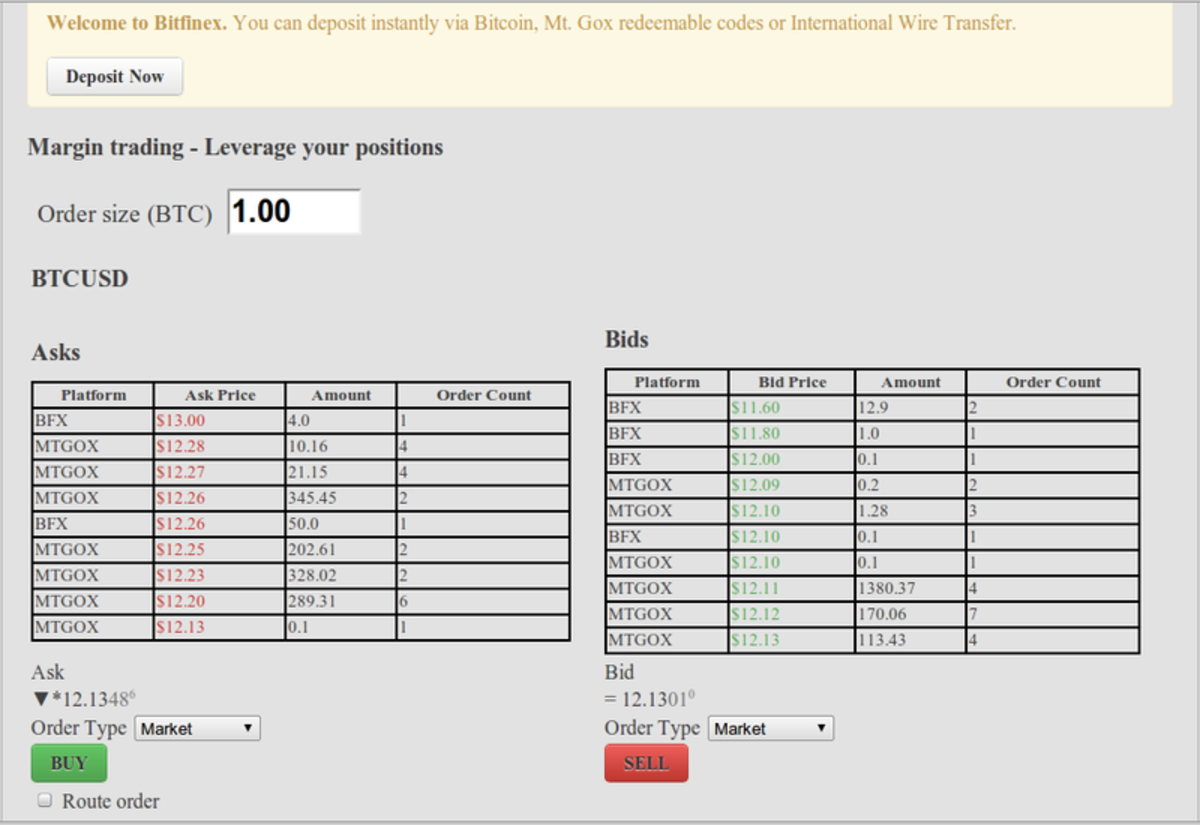

More interestingly, BitFinex will trade with a number of exchanges, offering spreads lower than those that can be found at any single one, and there is even the option to make a special “routed order” which will never be passed on to exchanges and instead attempt to eat up an opposing BitFinex order. As exchanges are bypassed, the fee for taking this option will only be 0.1%. Finally, just like Bitcoinica in the later months of its operation, an interest rate system is in place with which users can deposit money and earn an interest of currently 16.5% annually in exchange for providing liquidity.

However, there is also much to worry about. The BitFinex source code is based on the notoriously insecure Bitcoinica source code that was leaked in July, and one forum poster, Davout, found that one could use one of the same exploits against Bitfinex that worked against Bitcoinica when it was still operational: set the leverage to 10,000, put in a small amount of money, and wait for the price to move. If it moves even slightly down, the leverage effect ensures that the result will be immediate liquidation. If it moves up, however, the size of the account balance will jump up by ten thousand times the increase in the underlying BTC price, securing a profit margin far above 100%. Other issues, such as the use of floating point numbers (a form of binary scientific notation typically used to represent non-integer values in computers but known for their inexactness when trying to store decimal values) to store account balances, were also discovered. Even though Bitfinex’s creator Raphael Nicolle claims that “Bitfinex is now much more powerful and robust”, the discovery of such flaws so soon after Bitfinex’s beta release bodes ill for such an otherwise promising startup.

Secondly, the “no hot wallet” setup that is at the core of BitFinex’s design, although admirable, has a problem of its own: if, over the course of one day, it happens that users are consistently buying more BTC than selling, or vice versa, then in order for BitFinex to be able to honor all of its users’ positions it needs to step in and act as the counterparty to some of its users itself. This kind of setup is known as a bucket shop and is heavily frowned upon (and in many jurisdictions even illegal) because it creates perverse incentives – the shop can potentially make an order on the markets large enough to significantly bump the price up, liquidate all of its users who had opposite positions at high leverage, and keep all of their funds as profits. Even if Nicolle does not want to create a bucket shop, given a no hot wallet setup Bitfinex may have no choice but to periodically temporarily become one.

Also questionable is the founder, Raphael Nicolle, himself. Fortunately, this is not another attempt at an anonymously run financial service; Nicolle has provided a LinkedIn profile which confirms his involvement in BitFinex, and has plans to register the company when they settle on the best jurisdiction to locate their service. However, he was also involved in the Bitcoin investment scheme craze that had reached its peak in the Bitcoin community this summer, strongly supporting the (then only suspected) Bitcoin Ponzi scheme operator Pirateat40 in August, stating “now that Pirateat40 closed down his operatations thanks to all the fud that was going on and growing on the forum, I expect everyone that spreads this fud, accused and insulted Pirate and the people that supported him to apologize.” He even tried to open a 2%-per-week investment scheme of his own in September. Of course, all this does not nearly suggest that Nicolle was, and is now, attempting to defraud; 2% weekly interest rates, or 180% annual, are actually quite reasonable in a volatile startup economy where Bitcoin itself can easily rise and fall by much more than a factor of 2.8 within the same period. His endorsement of Pirateat40 too may simply have been a misguided expression of group solidarity and his ardent support of capitalism. However, for those who are concerned above all with the safety of their money reputational factors are an important consideration, and Nicolle may do well to find some trusted members of the Bitcoin community as partners if he wishes to quickly secure the community’s trust.

Perhaps BitFinex will indeed do what Bitcoinica, Kronos.io, and Icbit could not and provide a secure and lasting margin trading service for the masses. But perhaps this platform too will fail in the same way that Bitcoinica did. When Zhou Tong first released Bitcoinica to the public, he received what proved to be a prophetic reply on the Hacker News message boards: “systems that work with money are attacked hard and often, by intelligent skilled people. Spectacular failure is your destiny if you don’t work very hard to prevent it. Spectacular failure may be your destiny even if you do work very hard to prevent it. You should plan accordingly.” The quote applies just as strongly in this case. Nicolle is clearly trying hard to create a strong security setup for BitFinex so that it can avoid the security pitfalls that so ruinously struck Bitcoinica earlier this year. Given some of his security decisions, however, the question is: will he be able to?