Discussions about another major rally for Bitcoin in this cycle have increased significantly within the space due to heightened volatility in the market lately. However, market experts are signaling that the next bull run for BTC might be on the horizon, driven by multiple crucial factors such as growing institutional interest and on-chain activity.

Is Bitcoin Gearing Up For Another Bull Run?

Despite persistent market downswings, recent technical indicators point to the possibility that Bitcoin is about to see a big price breakout as cited by on-chain expert, Tarekonchain in a recent research on the CryptoQuant platform.

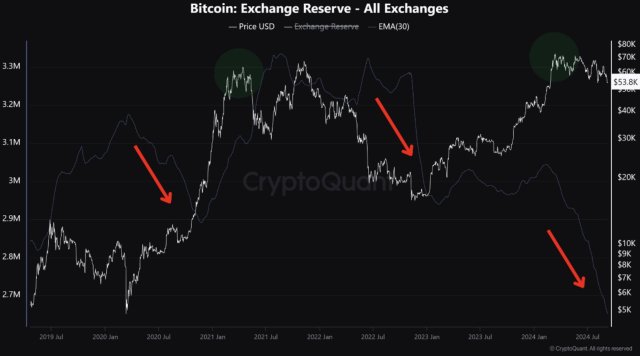

In his research, Tarekonchain underscored several recent developments around the flagship crypto asset that could serve as a catalyst to the anticipated bullish upsurge in the upcoming months. The first development pointed out by the on-chain analyst is the decline in Bitcoin’s exchange reserves.

According to Tarekonchain, exchanges’ BTC reserves have been steadily declining, a tendency that frequently precedes price increases. This dip indicates that investors are storing their BTC in cold storage, reducing the amount available. Given that price peaks have typically followed such movements in the past, the analyst thinks a similar situation might be playing out at the moment.

Another indicator highlighted by Tarekonchain is the notable rise in stablecoin‘s reserves on exchanges in tandem with BTC’s decline in exchange reserves, implying that investors are getting ready to purchase more BTC.

It is worth noting that the prevalence of stablecoins stands for ready-to-deploy capital, which indicates that traders are likely holding out for the right moment to enter the market. Thus this increase exchanges stablecoins reserve signals a high level of buying interest.

A Supply And Demand Mismatch Could Trigger A Breakout

Lastly, the expert points to a bullish market setup as a result of the combination of shrinking BTC reserves and increasing stablecoin reserves, laying the groundwork for a bullish price breakout in the near future.

Tarekonchain believes that the market is poised for a possible bullish breakout because now there is less Bitcoin and rising buying power, indicating a supply and demand imbalance that has resulted in notable price increases in the past.

Thus far, the expert has urged investors to be patient and be on the lookout for a potential price breakout in the upcoming weeks. “As the market supply tightens and buying power builds, we could be on the verge of a price rally,” he added.

At the time of writing, BTC was demonstrating a healthy performance with an increase of over 2% in the last 24 hours, trading at the $58,045 level. Bulls seem to be betting on the digital asset lately as its market cap and trading volume have grown by 2.51% and 18% in the past day.