There’s no doubt that Bitcoin’s price action has been weird over recent weeks. As the S&P 500 has entered a range, so too has the cryptocurrency.

In the past week, BTC has literally traded in a 5% range. And over the past two months, the asset has been stuck in a 15% range.

Although this seems to be the first time Bitcoin has traded like this in a while, some are likening the recent price action to 2020’s February highs.

Similarities Between Bitcoin’s 2020 Highs And Now Grow

On July 4th, a pseudonymous cryptocurrency trader noted that Bitcoin’s recent price action is more harrowing than it may initially seem.

Commenting on the chart he shared below, the analyst wrote: “It’s going to be so hard for a lot of you.”

As is depicted, Bitcoin’s rally in February and the rally seen recently have both formed rounded highs. More importantly, they formed these highs around the exact same level: $10,500.

Should history repeat itself, the leading cryptocurrency could soon be subject to a strong breakdown.

The analyst didn’t convey an exact price target, but he did include Fibonacci Retracements of the move from $3,700 to $10,500. The nearest retracement level is the 38.2% retracement at $7,919 and the one closest to that is the 50% retracement at $7,146.

This isn’t the only similarity analysts have observed between the highs then and the highs now.

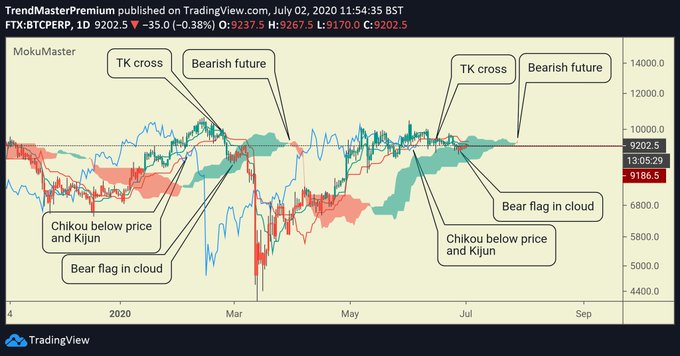

As reported by Bitcoinist previously, an Ichimoku Cloud specialist shared that from the perspective of the cloud, Bitcoin is in a very similar spot now to February.

Just look at the analyst’s annotations. They show that the bearish Ichimoku Cloud signals that formed before Bitcoin’s crash in March are returning.

Crucial Differences

Despite the similarities, there are some crucial differences worth pointing out.

Analyst Eric Thies remarked that taking note of time, if Bitcoin tops here, it will be highly abnormal.

He published the chart below late in June. It shows that all of Bitcoin’s tops over the past approximately two years have formed in around a month’s time. The current top, by comparison, is reaching 60-70 days:

“BTC stucturally looking less like a local top and more like a launchpad as of now. Naturally speaking, things may need to go down before they really go up but this time looks promisingly different.”

Bitazu Capital’s Mohit Sorout has also noted there are stark differences between then and now.

He noted that unlike all of Bitcoin’s major highs over the past year, the funding rates of BTC futures markets are currently negative to neutral. This is important as it shows that longs are not overleveraged, meaning Bitcoin has room to rally to the upside.

Featured Image from Shutterstock Price tags: xbtusd, btcusd, btcusdt Charts from TradingView.com Bitcoin's Chart Is Looking More and More Like February's $10,500 Top