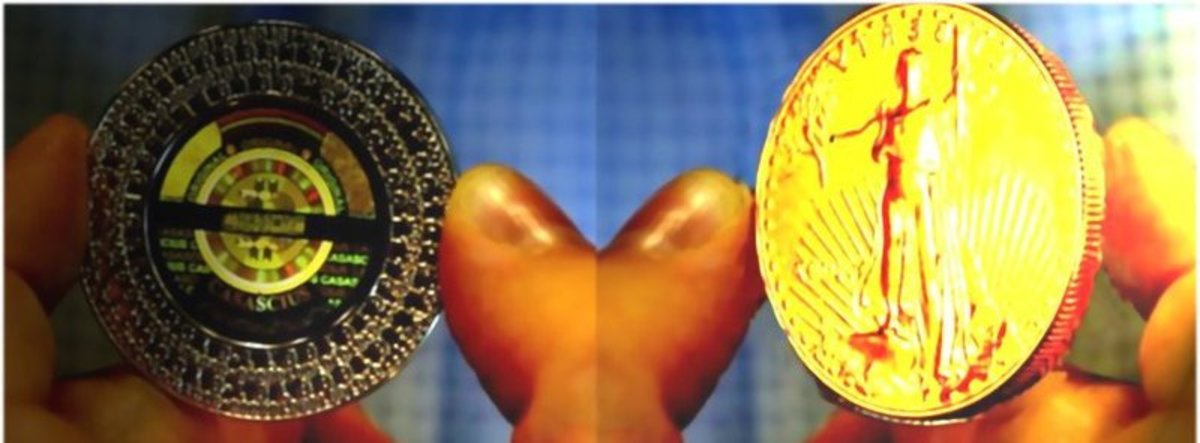

Bitcoin is often called “Gold 2.0” because they share many of the same traits. As we have magazines dedicated to “head to head” matchups in cars, motorcycles, computer parts, cell phones, etc. – perhaps we should have a head-to-head matchup between gold 1.0 and gold 2.0, Metal vs Digital. Money is commonly recognized to have six essential elements that make it ideal for transferring value between parties.

These will be our criteria:

- Durability

- Portability

- Divisibility

- Fungible

- Limited supply

- Acceptability

History

Gold was used as a currency for 5,000 years. The US confiscated the citizens’ gold in 1933 then arbitrarily raised the recognized the set price by 40, thus giving the country 40 inflation overnight. They continued to redeem dollars of gold in foreign affairs. The US printed dollars to pay for World War 2, then the Cold War and the space race to the moon. But the world became increasingly worried about non-stop spending and by the mid 60’s there were open conversations between nations worried about the US’s ability to service its debts. The common mantra of the US was the “dollar was as good as gold” because those nations could convert one to the other at will. Eventually the leaders figured the better value was opted to take the gold instead.

A speech given in 1965 by France president Charles De Gaulle speaking of America’s spending and debts sounds like it could have been given last week. He spoke of the “dollar crisis” as it allows the US to get into debt for free at the expense of other countries as the US insisted on paying in printed dollars.

Nixon gave a speech in 1971 in an address to the US that announced the closing of the “gold window” that had been allowing countries to convert their paper dollar debts to gold. The US strategic supply was dwindling. This effectively took the US off the Gold Standard that had been holding printed dollars to any kind of discipline. Nixon’s speech to the world indicated that the move was temporary and that if the US continued to only buy American products, they wouldn’t feel a price difference. He insisted that the dollar would be worth just as much tomorrow as it was that day. He blamed the move on “International Speculators” betting against the dollar.

Durability

Gold has proven itself to be one of the most durable substances on earth. It doesn’t degrade. Every ounce of gold ever mined is still around. (Excluding the small portion sent out of orbit) Gold has proven to be truly precious.

Bitcoins can only be destroyed for a brief moment in their creation during mining under unusual circumstances which likely has not happened. But if the hard drive containing the private key is buried in a landfill, those units are forever gone. You could argue that a pirate treasure chest of gold buried on an island beach and long forgotten is the same end. The bitcoin units exist on the public ledger which is copied into the cloud and thousands of hard drives around the world. We can’t predict what may happen to bitcoin in a few hundred years but for today’s generation, so far so good. But because bitcoin is officially an experiment, we’ll have to give this one to gold.

Winner: Gold

Portability

When talking about enough money to buy an average house or more, there is hardly a comparison to make. For the price of a $200,000 house you need about 12 pounds of gold. But then you have to have somebody verify that it isn’t fake with Tungsten metal core that has been uncomfortably common recently. Then you have to deal with security and insurance to move it. If you are moving even larger quantities, and across country borders, you also have to declare it, and pay all kinds of other fees and assessments in addition to even higher costs of security coordination between several entities. After you also include the cost of currency conversion (after all, how many people will accept gold directly as payment in full), all the friction may cost an additional 10 to 15. If that $200,000 house is in another country, you’ll need another 2 pounds of gold just to cover the overhead.

Bitcoin, you can transport anywhere in the world with Internet access although companies like Bitgold are trying to change that. It travels at the speed of light. It really doesn’t need to move as it is in a public ledger. The only thing that moves is the location of the private key required to unlock them for spending. The key can be copied, written down, or memorized. It needs no third parties, insurance, or fees. It’s “frictionless”. You can transport it across borders without effort in something as simple as your memory. Paper wallets can be a string of numbers so small as to fit on a scrap piece of paper the size of a fortune cookie. Hundreds of thousands of places will accept bitcoin for payment without needing to convert it to cash. It can be done with your smartphone.

Winner: Bitcoin

Divisibility

Gold can be subdivided but at great cost and labor. Not just anybody can subdivide it into ounces, or half ounces, etc. You can subdivide it down to the gram which is 1/31 of an ounce in physical form. Currently $45 is your smallest physical unit so if somebody would take gold as payment, making change for a $20.00 movie ticket would be tricky at best. Technically gold is very divisible with scientific know how and expensive equipment, but practically it is not.

Anybody can subdivide bitcoins as far as 8 magnitudes of order and can go deeper if needed. This is handled without effort by the computer system you are using. The charges happen automatically through the transactions. You can create any amount of free wallets to store your value into sub pennies of bitcoin to thousands of free wallets if you like. There is practically no limit.

Winner: Bitcoin

Fungibility

Having one unit exactly like and worth the same of a second is important. Pulling a dollar out of your wallet is the exact same value as the second dollar pulled out of your wallet. Gold isn’t as simple. There can be dilutions of the metal. Coins can be struck at 90 gold, 100 gold or other variations. Weights and measurements can be off. Counterfeits using tungsten metal have occurred. There are price differences depending on the country or mint that issued the coin. Premiums are also found with the age and condition of the coins. The smaller that you break the gold down, the more expensive the portions get. 10 1/10th ounce gold coins cost significantly more than a single one ounce coin.

Bitcoins have none of these problems. Each bitcoin has been recorded and cannot be counterfeited logically without billions of dollars invested into doing so for even a temporary benefit. It is practically impossible. One unit is always valued the same as the other sitting in the public ledger beside them. All of the pieces of a bitcoin add up 100 to the value of the whole.

Winner: Bitcoin

Limited Supply

Gold has a recognized limited supply. All the gold ever mined in history would fit in a cube block the size of a tennis court. It is getting even harder to find as the easy spots are thought to have been found. But there could in theory be a new big find which would depress the price.

Bitcoin supply is strictly defined. At a year, likely long after our death, bitcoin will finally reach the end of its new issuance in 2140. That is “hard-coded” into the currency. The rate at which it will be spawned into the system is also predictable. We can write contracts based on the known amount that will be issued. There is no need for speculation forward contracts. It is in much more restrictive limited supply than gold.

Winner: Bitcoin

Acceptability

Gold is accepted for payment in gold stores for swapping for other precious metals. For realistic commerce very few places around the world accept gold for payment as the hassles of verifying it are real, and the security required to maintain it and handle the aspects make it not worth the hassle. The smallest unit sold is a gram for around $45-60 dollars. You can’t make gold change for less than that. If your purchases don’t come in multiples of 50’s you might be out of luck getting change.

Bitcoin is accepted in thousands, if not millions, of locations already. There are exchanges all around the world and some with direct linking into your regular banks. The trend is for more companies to get on the bitcoin bandwagon as the technology and sophistication is allowing new generation’s access. Confidence in its value remaining steady or expectations of ever raising price values also increases its acceptance. As main street and Wall Street investors begin to invest large amounts of money into the system the network effect will allow it to get more attention of more merchants, which will have a domino effect for those that do not take it will suddenly be forced to accept it in ways all merchants eventually gave way to taking credit cards; if they didn’t they lost business. There is no movement to return our currency back to the 18th century. Outside the gold-bug crowd, gold as money is as foreign sounding to the new and upcoming generations as doing commerce with rocks.

Winner: Bitcoin

With a score of five to one, the clear winner is bitcoin. Gold bugs like Peter Schiff and Doug Casey might burst a vein in their head for you to say it, but their world of degrading bitcoin to prop up their business models will not last much longer as the tide turns. With more luck, we can finally pull all the gold stored underground in vaults back up above ground and melt it back into art and jewelry to be admired by all humanity.