Bitcoin’s price action might be unfavorable for bullish proponents, but it remains a focal point for serious money movements on-chain. Bitcoin fell below a major support level of $54,000 again in the past 24 hours, giving many short-term investors a big reason to worry.

However, despite this short-term volatility, a fascinating trend is unfolding beneath the surface. Interestingly, on-chain data reveals a big accumulation trend among long-term investors, with over $728 million worth of BTC withdrawn from exchanges in the past week.

Massive BTC Withdrawals From Crypto Exchanges

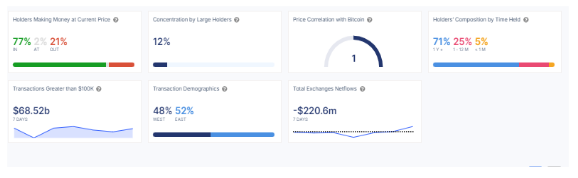

On-chain data suggests that long-term investors are taking advantage of this dip by accumulating more Bitcoin. This interesting trend was noted by IntoTheBlock, an analytics platform known for its in-depth tracking of on-chain data surrounding Bitcoin and other cryptocurrencies. According to IntoTheBlock, a cumulative $728 million was withdrawn in BTC from aggregated crypto exchanges for the entirety of last week.

In addition to this significant withdrawal figure, IntoTheBlock’s data points to a negative net flow of 220.6 million in aggregated exchanges over the past seven days. This means that the volume of Bitcoin flowing out of exchanges has far exceeded the volume flowing in, suggesting that more investors are pulling their assets off exchanges than are depositing them. Notably, IntoTheBlock credits the withdrawal trend to addresses holding between 100 and 1,000 BTC.

What Does This Mean For Bitcoin?

Withdrawals from exchanges are generally good for crypto assets, as they reduce the amount of cryptocurrencies readily available for sale. The more the Bitcoin that leaves exchanges, the more scarce the supply becomes, which could drive the price higher.

However, while this accumulation trend by a few major holders indicates strategic trades, it doesn’t necessarily reflect the broader market sentiment around Bitcoin at the time of writing. Despite the notable withdrawals, Bitcoin has struggled to meet investor expectations, with its price falling below key psychological levels. In fact, Bitcoin ended August with a disappointing negative price performance and declined by 8.6% throughout the month.

Furthermore, this accumulation trend by large holders is being counterbalanced by other concerning developments in the market, particularly the outflows from Spot Bitcoin ETFs based in the US. This is because these ETFs ended the week with $169.97 million worth of outflows on Friday, bringing the run of outflows to eight consecutive days.

This decline in inflows into Spot Bitcoin ETFs suggests a growing bearish sentiment among institutional investors, who appear to be pulling funds from these products. This, in turn, further complicates Bitcoin’s price outlook in the short term.

At the time of writing, Bitcoin is trading at $54,614 and is still at risk of breaking further to the downside.

Featured image from PCMag, chart from TradingView