On-chain data shows the Bitcoin transaction fee surpassed that of Ethereum during the last week as it hit a total of $61 million.

Bitcoin Transaction Fees Has Been Higher Than Ethereum Recently

According to data from the market intelligence platform IntoTheBlock, BTC transaction fees have recently surpassed that of ETH. The “transaction fees” here refer to the amount that every sender on the respective network has to attach with their transfer as a reward for the chain validator who processes the move.

How much fees the average user would attach depends on the traffic conditions on the blockchain at the time. When there is a high amount of traffic on the network, some transfers can get stuck for a while, as the chain validators have only a limited capacity to handle them.

Since the chain prioritizes the transfers with the highest fees, any user who wants to get their move through ASAP in such a time of congestion would have to go for fees notably larger than the average.

Thus, when the blockchain is observing a large number of users making transactions at the same time, the fees can quickly shoot up as senders compete against each other to get in on the precious blockspace.

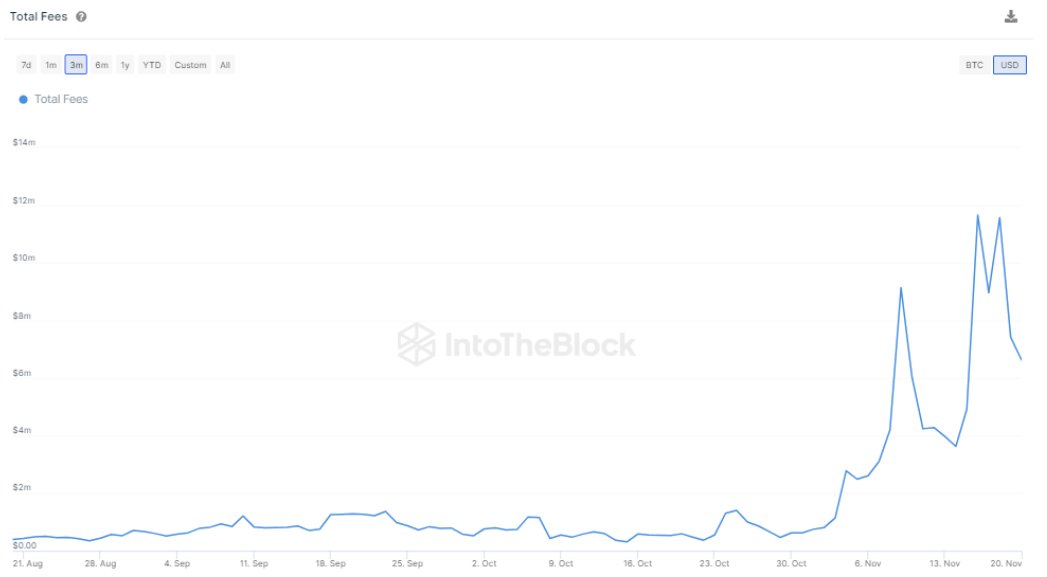

The Bitcoin network has recently observed a sharp spike in its total transaction fees, as the below chart shows:

The “total fees” here are naturally the total sum of the transaction fees that individual users have been attaching to their transactions. Since this amount has blown up recently, it obviously means that the network has been quite congested recently.

One reason behind this high traffic that immediately comes to mind is the rally that the cryptocurrency has enjoyed recently, which is bound to have ignited some fresh interest in the asset.

Interestingly, though, the total transaction fees last week actually surpassed that of Ethereum, measuring at about $61 million. ETH has also seen a surge recently, so the coin would also be seeing some burst of activity itself.

Despite this, Bitcoin’s total transaction fees have still overtaken that of ETH, suggesting that there is also something specific to BTC that has been fueling the indicator.

Indeed, the “Inscriptions” have seen a revival recently and have blown up in recent times. Inscriptions basically refer to pieces of data directly inscribed into the BTC blockchain.

These allow for a number of applications on the blockchain, such as NFTs and BRC-20 tokens. Inscriptions are like any other transaction on the network, so they also influence any economics related to them.

The traffic due to the rally and this application of the network has meant that the transaction fees on the network have shot up, and the miners have been able to make bank.

BTC Price

Bitcoin had earlier crossed the $38,500 mark, but the asset has registered some drawdown since then as it has slipped towards $37,000.