Bitcoin is on the way back to the top, so far. After a massive crash that pulled the market down with it, the first cryptocurrency by market cap is showing some strength in the lower timeframes, and it’s making a push at critical resistance north of $40,000.

At the time of writing, BTC trades at $41,825 with sideways movement in the 1-hour chart and a 17.5% rally in the daily chart. To wage an effective attack on the bears and secure a successful recovery, Bitcoin must reclaim the higher area at the current price levels.

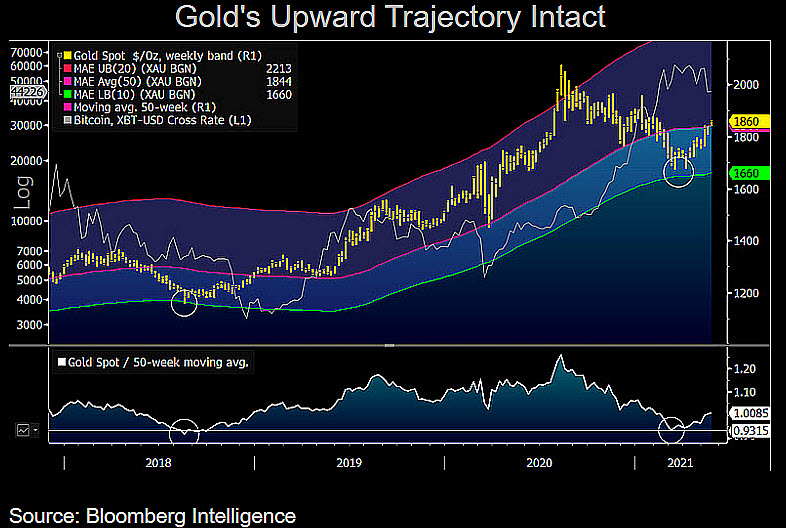

The cryptocurrency could benefit from Gold’s performance. The precious metal has seen a surge since early April when its price stood close to $1,650. Now, it’s high above the $1,878 with bullish momentum with $1,900 as a major resistance if the bulls want a chance at returning to previous 2020 highs around $2,000.

Gold’s rally was driven by the Covid-19 pandemic and a rise in concerns about more inflation on the U.S. dollar. The Federal Reserve increases the dollar’s monetary supply as the government approved measures to keep the economy afloat.

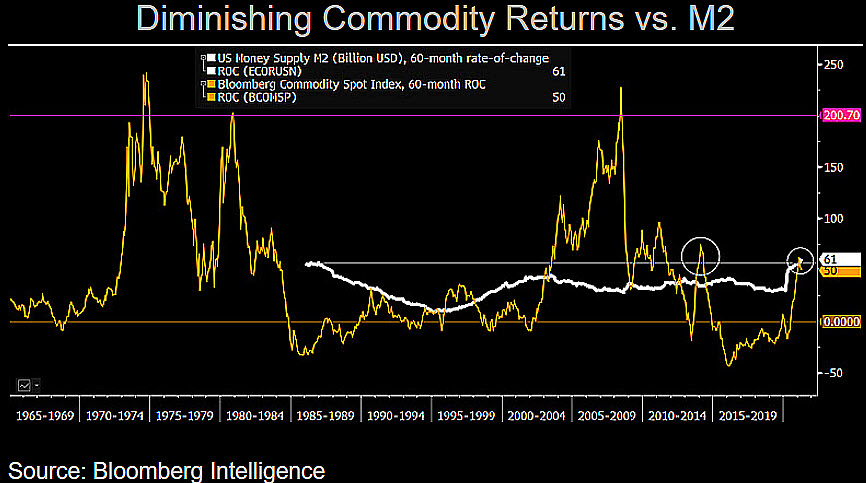

Bitcoin’s price benefits from this demand as investors look for a new store of value capable of providing yield and a hedge against inflation on the U.S. dollar. As Senior Commodity Strategist Mike McGlone pointed out, the return on a commodity is decreasing as the U.S. monetary supply rises.

McGlone believes Gold is on a similar path as in 2018 when the price reached a bottom on the spot market. As seen in the chart below, Gold dropped and then resume its rally to reached 2018’s highs. The current scenario could be similar, with Bitcoin as a headwind to its upside, the expert said.

Bitcoin Next Leg Up Could Be Driven By Gold

As the crypto market still licks its woods, Gold’s performance could become more relevant for future price action. In addition, the equities market could have a negative impact if the downtrend display during May continues.

As shown in the chart below, the S&P 500 Index has been recording a negative return in the past week. Bitcoin could have a harder time returning to its previous high with the equities market moving sideways or trending downwards.

The U.S. Federal Reserve and the Covid-19 pandemic are also two major factors that could impact BTC. Anonymous analyst MacroScope said the following on the correlation between Gold, Bitcoin, and the potential actions of the financial institution:

BTC traders should be watching the dollar and gold closely here. They will telegraph how credible Fed is on taper talk. Dollar ticked up Wednesday on Fed. But if that doesn’t hold and gold remains very interestingly bid, could prompt next leg up for BTC.