Bitcoin has managed to make a recovery back above the $44,500 mark, but what’s fueling this surge? Here’s what on-chain data suggests.

Bitcoin Has Jumped More Than 4% To Near The $45,000 Level

After weeks of struggle at lower levels, Bitcoin finally appears to be showing some fresh bullish price action, as the asset is now approaching a retest of the $45,000 level after surging over 4% during the past day.

The chart below shows how the coin has performed over the past month:

From the graph, it’s visible that this is the first time that the cryptocurrency has hit these levels since the crash post the launch of the spot exchange-traded funds (ETFs). There are many factors contributing to the asset’s surge, but one major reason may be found through on-chain data.

BTC Whales Have Been Accumulating Recently

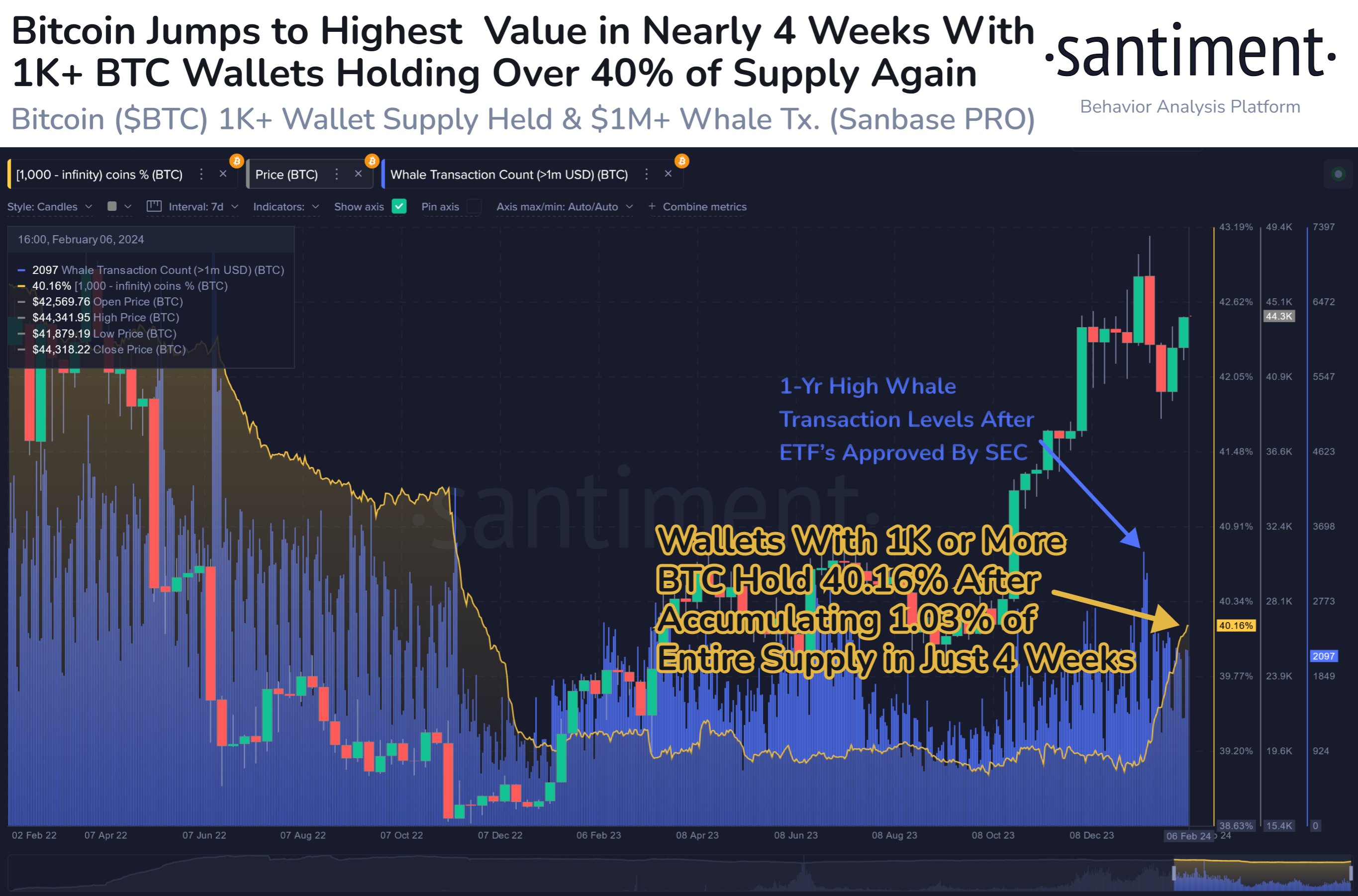

According to data from the on-chain analytics firm Santiment, the holdings of the BTC whales have registered a sharp increase recently. The indicator of relevance here is the “Supply Distribution,” which keeps track of the percentage of the total Bitcoin supply that each wallet group is holding right now.

Addresses are divided into these cohorts based on the total number of coins that they are currently carrying in their balance. The 1 to 10 coins group, for instance, includes the investors holding between 1 and 10 BTC.

In the context of the current topic, the “whales” are of interest. These are humongous entities carrying at least 1,000 BTC in their wallets. At the current exchange rate, this amount is worth more than $44.8 million.

As these holdings are so large, the whales can naturally carry some influence in the market. Due to this reason, it can be worth keeping an eye on what these large holders are doing.

The chart below shows how the Bitcoin Supply Distribution has changed specifically for these whales over the past couple of years:

As displayed in the above graph, the percentage of the Bitcoin supply held by the whales has trended up recently, suggesting that these large investors have been expanding their holdings.

During the past four weeks alone, the whales have added 1% of the entire supply to their wallets. Following this jump, these humongous entities now control more than 40% of the cryptocurrency’s supply, the most in over fourteen months.

It would appear that while the general market was panicking about the post-ETF approval struggle, these large hands were quietly gobbling up the supply at the lower price levels.

Although not the only reason, this accumulation from the whales would likely be one of the impetus behind the latest recovery of the coin. It now remains to be seen if this cohort would continue to back Bitcoin in the coming days or if they would sell here to harvest their gains.