MicroStrategy, a leading American business intelligence and analytics company, has unveiled plans to buy Bitcoin once again. The AI-powered firm upsized its initial $500 million offerings on convertible notes to $700 million, intending to use the proceeds to acquire an equivalent amount of Bitcoin. This massive Bitcoin purchase could see the price of the cryptocurrency rising, triggered by the boost in demand amidst price volatility.

MicroStrategy Set To Increase Bitcoin Holdings

In a recent press release, MicroStrategy announced the sales of its new $700 million convertible notes offerings, which it plans to use to buy more Bitcoin and expand its already substantial holdings. The company disclosed the pricing of the $700 million debt notes, featuring a 2.25% interest rate and a maturity date in 2032.

MicroStrategy has revealed that the convertible senior notes will be sold privately to exclusively qualified institutional investors, following Rule 144A under the amended Securities Act of 1933. The business intelligence firm has also disclosed plans to grant initial purchasers of the convertible senior notes the option to buy up to an extra $100 million aggregate principal amount of notes within 13 days from the issuance date.

Additionally, MicroStrategy highlighted in its press release that the company intends to use the proceeds from the sales of the convertible senior notes to acquire more Bitcoin for general corporate purposes. The estimated net proceeds from the $700 million in debt notes will be approximately $687.8 million after deducting necessary commissions, the company’s estimated offerings expenses and the initial purchaser’s discounts.

Additionally, the net proceeds could generate as high as $786 million if the initial purchasers buy the extra $100 million convertible notes.

Earlier on April 29, MicroStrategy released its first quarter 2024 financial results, announcing its total Bitcoin holdings which have reached a staggering $214,400 valued at $7.54 billion at an average purchase price of $35,180 per BTC. According to CoinGecko, among public companies, MicroStrategy holds the rank as the world’s largest Bitcoin holder, with a net worth or market capitalization of approximately $26.53 billion as of June 14, 2024.

The company has revealed no plans to halt its Bitcoin acquisition spree, despite witnessing major losses over the past few years. MicroStrategy’s strong commitment to expanding its Bitcoin holdings has also allowed it to achieve remarkable milestones, now owning approximately 1% of all Bitcoin in existence.

Bitcoin’s Strong Accumulation Phase Could Trigger New Highs

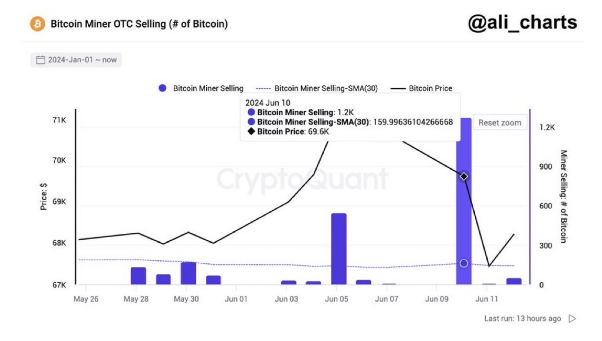

Bitcoin’s price is currently on a downward trend, fueled by selling pressures from Bitcoin miners who have sold more than 1,200 BTC, valued at $79.20 million. As of writing, the cryptocurrency’s value has fallen to $66,145 reflecting a 4.70% decrease over the past seven days, according to CoinMarketCap.

With selling pressures increasing, MicroStrategy’s upcoming $700 million Bitcoin purchase during this correction could serve as a catalyst for a potential price rebound. Moreover, MicroStrategy has not been the only investor demanding more Bitcoin. A crypto analyst identified as ‘Jelle’ revealed in an X (formerly Twitter) post that Bitcoin has been in a major re-accumulation range for the past three months.

He disclosed that investors have been heavily accumulating the pioneer cryptocurrency, taking advantage of its recent price drop to purchase more BTC in anticipation of a gain. According to Jelle, the total balance of Bitcoin on exchanges has dropped by 200,000 over the past three months.

Featured image from Pixabay, chart from TradingView