Bloomberg Intelligence analysts James Seyffart and Eric Balchunas have ramped up their approval odds for a Bitcoin spot Exchange-Traded Fund (ETF) to 65%, based on recent industry developments. This marks a substantial increase from the mere 1% chance they assigned to it a few months ago.

“Based on recent events and new information Eric Balchunas and I are officially increasing our spot Bitcoin ETF approval odds to 65%,” Seyffart remarked on Twitter, adding, “that’s from 50% a couple of weeks ago and 1% a few months ago.”

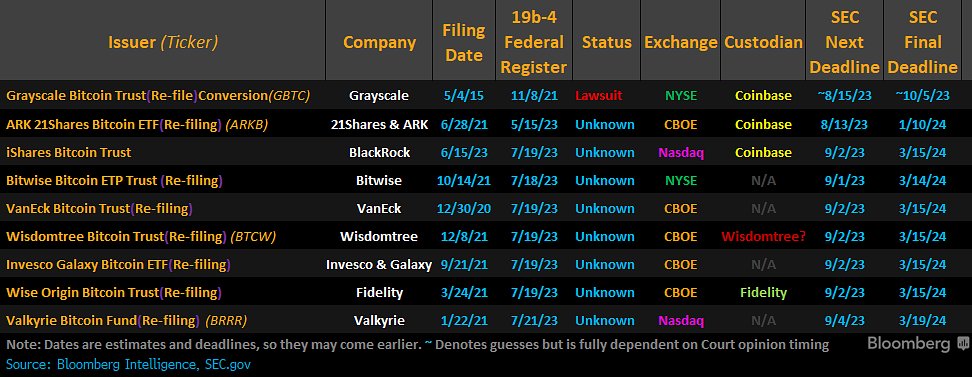

Driving this revised prediction are multiple factors, including recent statements from SEC chair Gary Gensler, developments from leading digital asset manager Grayscale, and the SEC’s perceived approval of Coinbase’s Bitcoin exchange.

“The odds of a Bitcoin spot ETF launching this year are up to 65%, in our eyes, after a flurry of developments; Gary Gensler downplaying his role at the SEC, the commission tacit approval of Coinbase’s Bitcoin exchange, Grayscale’s attempt to minimize other filings and the SEC loss in front of the same judges in the Grayscale case,” Seyffart wrote.

The Events Favoring A Bitcoin Spot ETF

Gary Gensler recently downplayed his role within the SEC during an interview, emphasizing that he is one among four commissioners and hence, can’t singularly determine the outcome of a Bitcoin spot ETF approval. This move from Gensler to minimize his influence within the SEC could be an indicator of a softer regulatory environment ahead for Bitcoin spot ETFs.

Moreover, Seyffart and Balchunas see the SEC’s approach to Coinbase and Grayscale as potentially transformative for the cryptocurrency sector. As Seyffart puts it, the spotlight now shines brightly on Grayscale’s ongoing legal tussle with the SEC. “The lynchpin for this current thesis is a Grayscale victory over the SEC in Federal court. Which COULD set things up for a wave of SEC approvals sometime in the 4th quarter? All depends on how much Gensler wants to fight here,” Seyffart tweeted.

Just a few days ago, Bloomberg’s Eric Balchunas highlighted a recent case in which the SEC lost to SPIKES futures in DC Circuit Court, where the court referred to the SEC order as “arbitrary and capricious”. This might bode well for Grayscale, which used similar legal terminology in their suit against the SEC. Remarkably, the chief Judge Sri Srinivasan (nominated by President Obama in 2013) is also one of the three judges deciding the Grayscale case.

Though the recent developments have created an optimistic outlook, it’s essential to remember that the approval remains highly unpredictable. Seyffart added, “BlackRock and the Coinbase SSA drastically changed any and all spot Bitcoin etf analysis. Not to mention the ripple case which is less important but still relevant. We update our views and opinions as new information comes to light. But you’re right. We don’t have a crystal ball.”

At press time, the BTC price stood at $29,467.