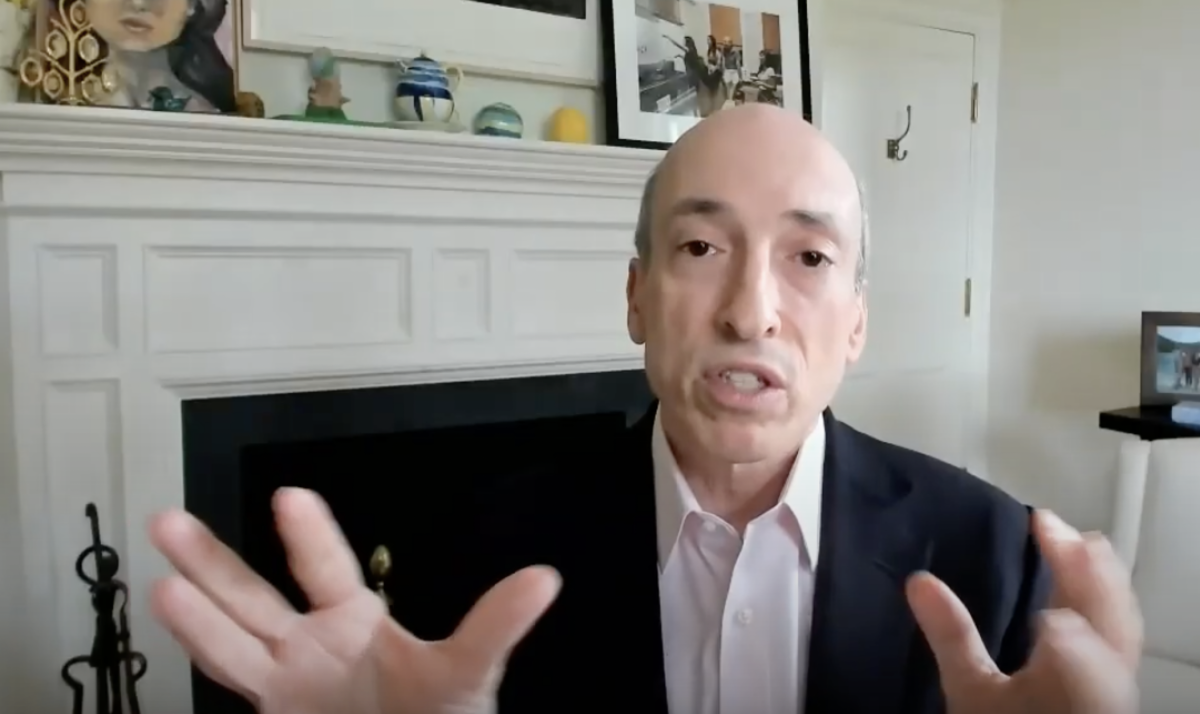

In a speech at the Aspen Security Forum Tuesday, incoming SEC Chairman Gary Gensler issued new comments about Bitcoin, at times drawing a dividing line between the market’s largest cryptocurrency and its wide field of imitators.

Of note is that Gensler took pains to establish credibility with the Bitcoin sector, recounting the history of the cypherpunk mailing list, citing Satoshi Nakamoto’s email announcing the project and repeatedly validating the network as a “real innovation.”

At one point he commented, “[Bitcoin] has been and could continue to be a catalyst for change in the fields of finance and money.”

Still, the event was billed as a non-partisan venue for global leaders, and the topic of discussion was most often national security. This meant at times Gensler made clear he supports stringent rules on companies and individuals seeking to build an economy around the protocol.

On several occasions, Gensler said that he as well as the SEC would be very interested in the identity of Satoshi Nakamoto, and during the Q&A, Gensler went so far as to ask the audience to come forward with any information on his or her identity.

Further, while Gensler only singled out Bitcoin among the cryptocurrencies by name, he described activities ongoing in the sector broadly and not always favorably.

“Primarily crypto assets provide a digital scarcity vehicle for speculative investment,” he said, adding: “Generally folks are buying these tokens in anticipation of profits.”

Unmentioned were developments such as the emergence of Bitcoin’s Lightning Network, and he repeatedly implied that bitcoin was not used by regular people as a unit of account or a medium of exchange, despite its ongoing adoption in El Salvador for such uses.

Neither did Gensler comment as to what extent altcoins such as Ethereum should be subject to the same regulations as Bitcoin, though he did note the growing ubiquity of other crypto assets, adding: “This is a truly worldwide market.”

He continued, “Unlike other trading markets, where investors go through an intermediary like the New York Stock Exchange, people can trade on crypto trading platforms without a broker — 24 hours a day, 7 days a week, from around the globe.”

ETFs and Economic History

Elsewhere, Gensler issued new remarks that shed light on how the SEC may act on the many exchange-traded fund (ETF) proposals now up for review by the agency, signaling that those based on Bitcoin futures may have the highest chance of approval.

“Given these important protections, I look forward to the staff’s review of such filings, particularly if those are limited to these CME-traded bitcoin futures,” he said.

Still, he was keen to frame the debate as part of a long history of conflict between private and public monies, noting an allowance for those backed by the faith and credit of governments.

Gensler, for example, began his speech by stating, “For those who want to encourage innovations in crypto, I’d like to note that financial innovations throughout history don’t long thrive outside of our public policy frameworks.”

Notably, some of his statements could be described as the antithesis of the sentiment among Bitcoin innovators, as he argued for the role of government as one that would continue to add trust to the financial markets, even those one day based on a Bitcoin standard.

Gensler concluded: “At the heart of finance is trust. And at the heart of trust in markets is investor protection. If this field is going to continue, or reach any of its potential to be a catalyst for change, we better bring it into public policy frameworks.”