A bruising start to the week for Bitcoin shows signs of evaporating as the cryptocurrency reclaims critical resistance levels this Thursday.

Buying opportunities near $30,000—a level Bitcoin touched after its decline from $41,986—renewed traders’ short-term bullish bias. The BTC/USD exchange rate leveled a sharp retracement against the downside outlook caused by the appearance of a Head and Shoulder bearish pattern, instilling hopes of a broader upside move towards $40,000.

Bullish Bitcoin Metrics

Two of the most brighter market outlooks came from CryptoQuant, a blockchain analytics platform that tracks BTC movements across the exchanges. Its CEO Ki-Young Ju asserted amid Wednesday’s choppy price moves that institutional investors purchased Bitcoin between $30,000 and $32,000. That gave the cryptocurrency a natural defense against short-term dumping sentiment.

“Speculative guess, but if these guys are behind this bull-run, they’ll protect the 30k level. Even if we have a dip, it won’t go down below 28k,” Mr. Ju added.

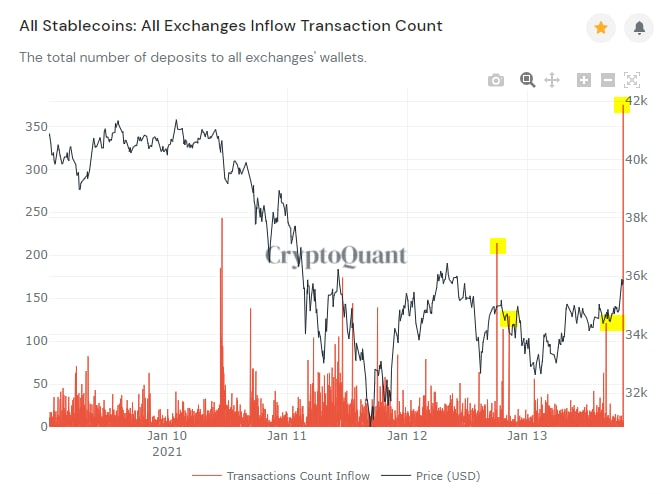

Meanwhile, Nuggets News AU’s co-founder/CEO, Alex Saunders, highlighted another CryptQuant chart that showed an increase in stablecoin deposits across all the crypto exchanges. For speculators, the inflow of dollar-pegged tokens into trading platforms equates to a potential boom in buying behavior.

Yield Correlation

Recent strength in the US dollar was a likely contributing factor to weakness in the Bitcoin market.

Meanwhile, rising bond yields also added to the downside pressure on the cryptocurrency. Many speculators agree that investors jumped into riskier assets like Bitcoin in 2020 because of negative-yielding debt in shorter-maturity bonds and below 1 percent returns in the longer-dated Treasuries.

The newfound sentimental correlation between Bitcoin and yields proved troublesome as the percentage-returns on the US 10-year Treasury note surged above 1 percent for the first time since March. The recovery started after Democrats won key Senate run-offs last week, sparking hopes that the incoming Joe Biden administration will bring additional stimulus to boost the US economy.

That improved growth and inflation expectations, leading both the dollar and the benchmark yield higher. Bitcoin turned lower in response.

The last 24 hours witnessed yields correcting lower, which, in turn, prompted Bitcoin to pare its early-week losses. As of Wednesday, the US10Y was rising all-over again, signaling potential downside correction ahead for the cryptocurrency.

Felipe Villarroel, a portfolio manager at TwentyFour Asset Management, sees the yields rising to 1.5 percent by the end of this year on revised US growth expectations. That would drive up the US Treasury supply higher than anticipated, driving prices lower and yields higher.