The price of Bitcoin in Venezuela is now doubling roughly every three weeks as hyperinflation continues to plague the country. At the same time, Bitcoin trading volumes keep hitting record highs as people are scrambling for an exit.

86,857 Percent Annual Inflation Rate

Just a year ago, a cup of coffee in Venezuela would have cost you 2,300 bolivars. Today, however, according to Bloomberg’s Café Con Leche Index, you’d have to pay roughly around 2 million bolivars. What better way to exemplify the rampant inflation plaguing the country?

Unfortunately, it doesn’t stop there. The International Monetary Fund (IMF) projects that the inflation rate will hit the unparalleled 1 million percent by the end of 2018. In other words, at the current inflation rate, prices in the country are doubling roughly every 18 days.

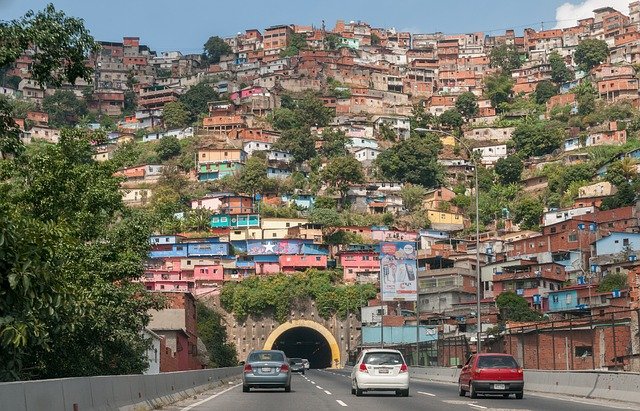

The wide majority of the country’s citizens are reportedly living in poverty, having to spend astronomical amounts of money on simple day-to-day staples like flour, eggs, and bread.

Bitcoin to the Rescue?

Bitcoinist reported earlier in June that hyperinflation is causing Bitcoin buying spree which marked new highs every week. This trend is not only continuing, but it’s growing at rampant rates. Since June, the weekly Bitcoin traded volumes have more than doubled, reaching upwards of 17 trillion bolivars worth of BTC this week alone according to coin.dance.

At the time of writing this, 1 BTC is worth a just under 1 billion bolivars, according to exchangerate.guru. Though the actual exchange rate in the country is unknown amid a thriving black market as the country’s central bank, Banco Central de Venezuela has become an unreliable source due to the hyperinflation.

The astronomic increase in the traded volumes of BTC in the country, however, signals that locals are looking for an alternative store of value. The constant appreciation of Bitcoin’s smallest unit called the “satoshi” against the Venezuelan bolivar is a prime example of the ultimate fate of fiat currencies.

As the hyperinflation goes on, Bitcoin adoption is only expected to further accelerate within the country.

What do you think of the economic situation in Venezuela? Can Bitcoin provide a safe alternative? Don’t hesitate to let us know in the comments below!

Images courtesy of Coin.Dance; Shutterstock