Bitcoin developer and educator Willy Woo has warned Bitcoin prices could soon dip under 2018’s record low of $5,900.

Bitcoin’s ‘Slow Bleed’ Lower

In an analysis on social media, Woo, who hit the headlines earlier this month after defending Bitcoin over Blockchain at the Consensus 2018 conference, nonetheless predicted what he describes as a “slowish bleed” below February’s floor.

In his comments, Woo wrote:

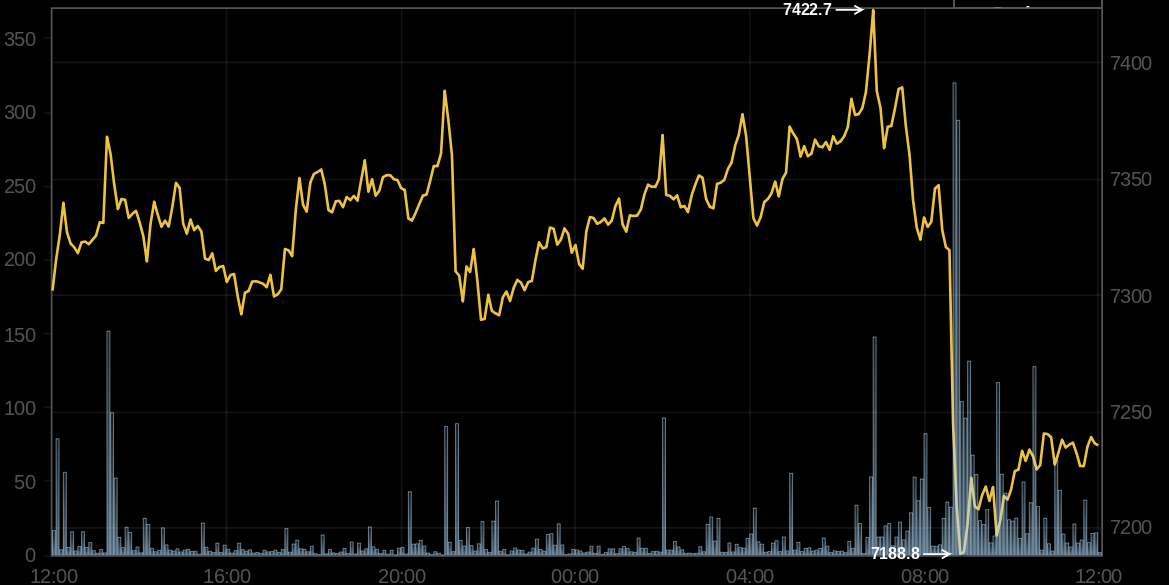

I think we are gonna go to $5500-5700 next, I can’t see $7000 holding.

Most likely we’ll balance a bit, then we’ll slide through. Long timeframes here, looking into June for rough timing of this to play out at a best guess.

I think we are gonna go to $5500-5700 next, I can't see $7000 holding. Most likely we'll balance a bit, then we'll slide through. Long timeframes here, looking into June for rough timing of this to play out at a best guess. /1 pic.twitter.com/pCN0N97vp6

— Willy "not giving away ETH/BTC" Woo (@woonomic) May 26, 2018

Bitcoin Transactions Cheapest Since 2011

Bitcoin has struggled to maintain upward momentum as part of a long-term downtrend which began after the cryptocurrency hit its all-time high of $20,000 in December 2017.

Since then, $12,000 and, more recently, $10,000 have proven insurmountable ceilings for BTC/USD, while key support at $9,000 and $8,000 has failed to materialize.

As of press time, May 28th, Bitcoin was challenging $7,000 support, with a first drop to $7,185 consolidating above $7,200.

For Woo, however, any break with the losing cycle is only likely in Autumn.

“2014 had a 2-phase drop. I doubt we’ll see that this time around,” he continued, comparing historical price patterns. “I think we’ll see this center section cut out. Next up cycle will take less time. Q3/Q4 2018 (in my opinion).”

Bitcoin, meanwhile, continues to improve on its status as a “currency,” commentators noting that fees this week are at their lowest in seven years, even beating rival altcoin Bitcoin Cash, which developers tout as a “lower-fee alternative” to Bitcoin.

What if I told you that median Bitcoin transaction fees – expressed in Satoshis – have never been lower since around March 2011?

(also they've been lower than Bcash fees – in satoshis – for around a week now) pic.twitter.com/RGEXhS3rrm— Alistair Milne (@alistairmilne) May 27, 2018

The fee’s bonus comes at a time when SegWit continues to increase its adoption on the Bitcoin network, with Bitcoinist reporting last week that its share of transactions would shortly hit 40%.

What do you think about Bitcoin’s future prices and network fees? Let us know in the comments section below!

Images courtesy of Twitter/@woonomic, Twitter@alistairmilne, Bitcointicker, and Shutterstock.