Analysts have been repeatedly (and incorrectly) calling the Bitcoin price bottom for over a year now, pretty much since prices started falling. So before diving headlong back into its murky waters, how can we be sure things are different this time?

Comparison To Other Bubble Bottoms

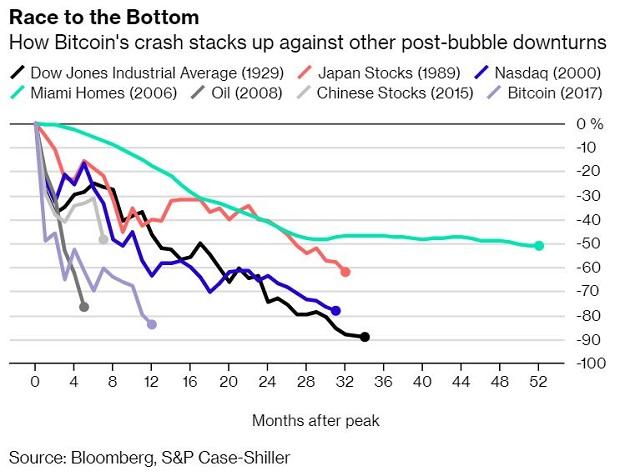

One way might be to look at great bottoms from history (I’m gonna let you make your own jokes) for comparison. That could seem like a reasonable place to start, at any rate. So what do we find?

In terms of value, bitcoin price has lost more from its peak than all of these bubbles other than the Dow Jones Industrial Average from 1929. And in terms of speed, we would have hit bottom harder than all but Oil (2008) and Chinese Stocks (2015).

Of these examples, the NASDAQ bounced back hard, to double in the five years after bottom. However, the Japanese stock market crash led to a period of economic stagnation known as the lost decade/score. So it seems there is no consensus on how to judge bottoms, and how they will then play out.

And anyway, if Bitcoin was incomparable to any other bubble, why compare bottoms?

Comparison To Bitcoin Bubble Bottoms

Perhaps we’d be better off making comparisons with previous Bitcoin bubbles and bottoms? Although we have less data to go on, this is not the first Bitcoin bubble, and at least we are comparing like for like.

So, of Bitcoin’s four bubbles (and at least three bottoms) thus far, how does this one compare?

Well, we’ve lost 84% of value from the peak, which is within the 83%-94% range of previous bottoms. According to veteran trader, Peter Brandt, the current chart is a rough analog of 2015’s ‘double bottom’, suggesting that another potential parabolic breakout could happen again if history does indeed rhyme.

A chart of Relative Strength Indicator (RSI) from analyst, plan₿, shows a value of 50 and rising. This is also comparable to 2015’s bottom.

The analyst also re-iterated a tweet from last month of five key indicators why bitcoin would not drop below $2000. All of the indicators have become even stronger in the past month, which brought BTC a month closer to next years reward halving. The halving has also historically seen large price increases in the year running up to it.

But all of the indicators and historical data in the world cannot ‘guarantee’ that bitcoin has bottomed. They do however, ‘indicate’ quite clearly that things could indeed be different this time.

Recent gains and the subsequent holding of these positions have made bitcoin a pleasant place to play again. By the time the BTC/USD bottom has been truly confirmed, bitcoin price will be well on its way back upwards. So do you take the plunge? Right now, the water’s lovely.

Do you think bitcoin price has bottomed? Share your thoughts below!

Images via Shutterstock