After a 27% gain, it appears that the Bitcoin bulls are back in control!

Highlights

Well, it’s certainly been an entertaining month for cryptocurrencies and Bitcoin prices have finally started to reclaim ground that was lost in Q1. BTC prices are up 27% for the month, altcoins skyrocketed with many racking up double-digit gains and the cryptocurrency market cap is pushing $396 billion which is an amazing $150 billion gain from last month.

What’s Moving the Market?

- Maximum shill regarding cryptocurrencies and media euphoria continue with CNBC labeling Bitcoin Cash a buy and BTC purchasing interest and buy orders at their highest since March 2017.

- Tax season has passed and the entire market surged 20%+.

- Bad news regarding exchange hacks, regulations, and SEC crackdowns are clearly failing to negatively impact BTC as much as before, lending further support to the belief that a bottom was touched.

- Analysts, small investors, and institutional investors have all been liberally tossing the ‘bull market’ phrase around and as we travel through the early stages of Q2 we could be entering a bull reversal which many analysts forecast will push BTC price back to $20,000 and above.

Analysis

- BTC broke the 50-day MA at $8,500 and held above this point for more than 24hrs.

- BTC is trading well above the descending channel and the moving averages for multiple parameters support further upward movement.

4 HR Chart

- The 100-day MA is trending upwards and within kissing distance of the 200-day MA indicating continued upward movement as the path of least resistance.

- BTC is likely to meet resistance at $9,200 which was a previous point of resistance and near $9,800 where the 200-day MA is aligned.

- On April 14th the 50-day MA crossed the 100-day MA and is now well above the 100 MA and still curved upward.

Daily Chart

- Current support level in the event of a pullback are $8,400 and $7,750 but today’s short-term correction is likely to be a consolidation period before prices continue upward.

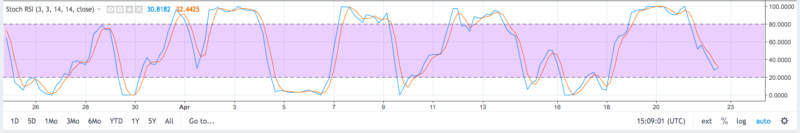

RSI

Stoch

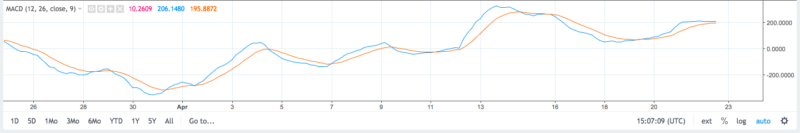

MACD

- All indicators suggest that BTC will continue towards $9,800 in the short term and possibly $10,000 before the month ends.The MACD and RSI remain in bullish territory while the Stoch is reflective of today’s pullback but the lines are displaying a hint of a reversal.

Vision

- BTC will continue to trade above the descending channel as support is at $8,400 and $7,750

- Today’s pullback will be short lived and BTC will break out towards $9,800 in the short term.

- BTC is likely to meet resistance at $9,500, $9,800, $10,000 and $10,500.

Disclaimer: The views expressed in this article are not intended as investment advice. Market data is provided by BITFINEX. The charts for analysis are provided by TradingView.

Where do you think Bitcoin price will go this week? Let us know in the comments below!

Image courtesy of Wikimedia Commons, Tradingview.com