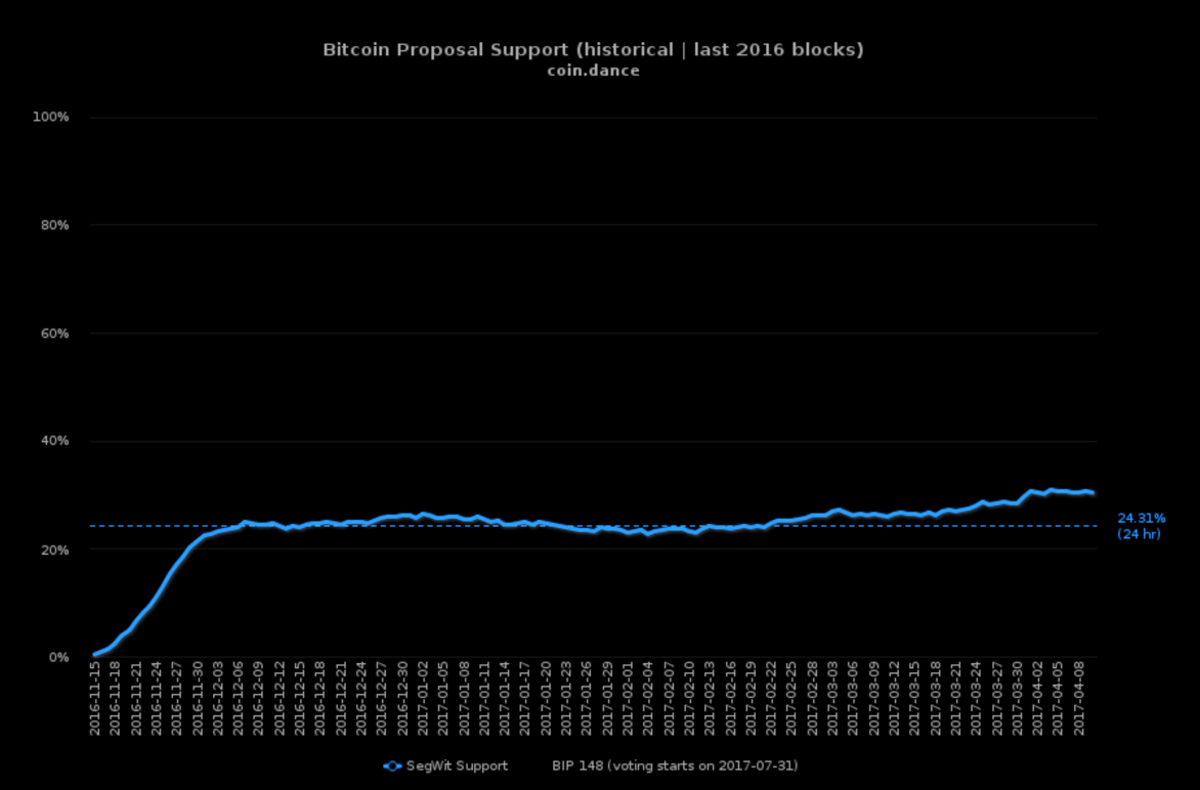

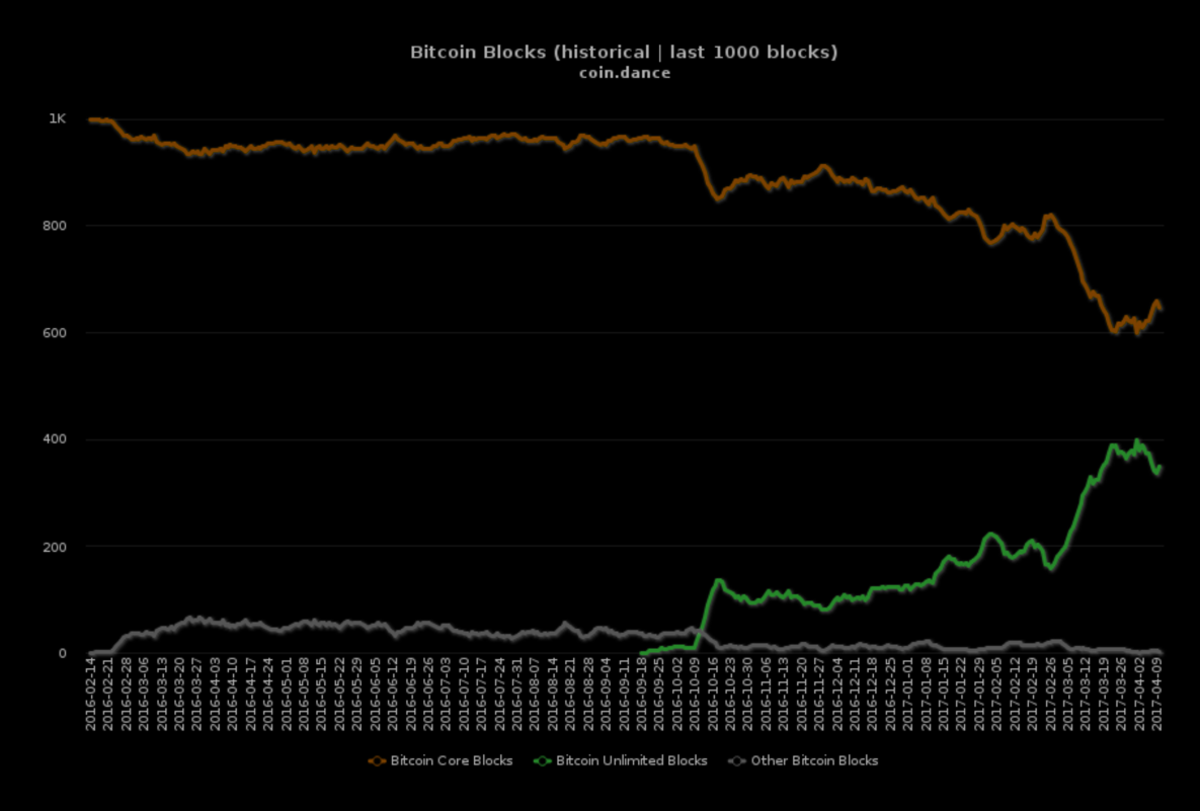

SegWit soft fork support continues to rise steadily as a viable option to the blocksize debate. New revelations regarding Jihan Wu and Bitmain’s possible motive to not support SegWit have surfaced, which based on the court of public opinion, have not been favorable for Bitcoin Unlimited (BU) support. Follow the BTU and SegWit proposal signaling breakdown per block here.

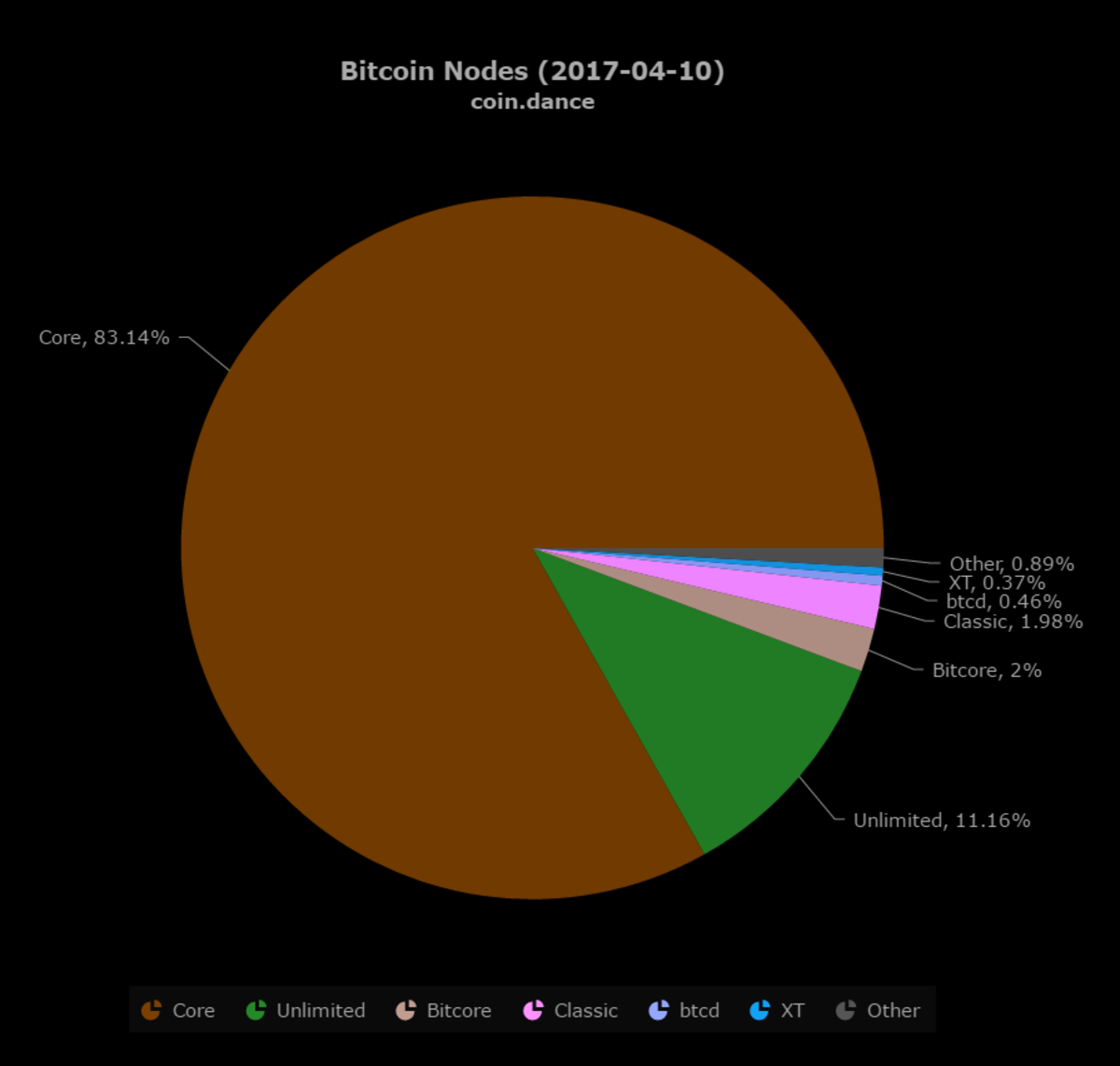

Nodes however, continue to heavily favor Bitcoin Core and Segwit.

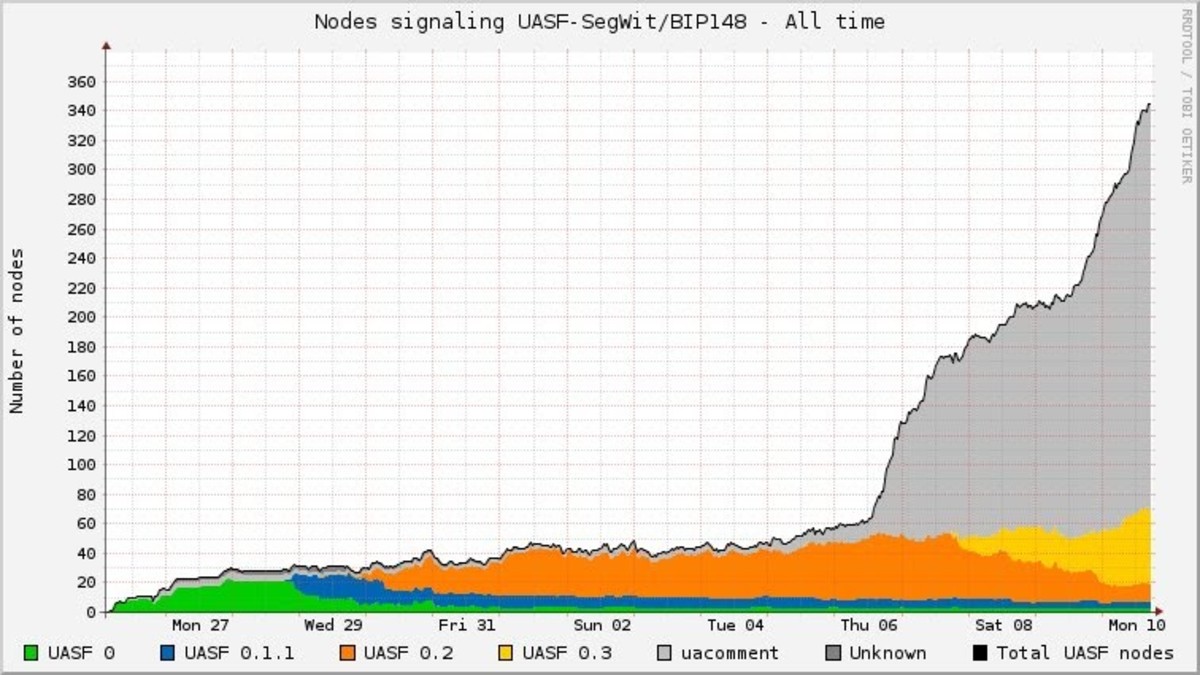

BIP148, otherwise known as the User Activated Soft Fork (UASF), continues to have a meteoric rise among nodes. Of the 5783 active core nodes (according to coin.dance), 340 have signalled for UASF. Additional reading behind the motivation and reasoning for a UASF can be found here.

As an investor and trader, Segwit adoption in this manner would be a significant event, especially if miners who do not support SegWit find ways to circumvent the UASF with a hard fork of their own. Fortunately, the UASF would occur at a specific date and timev which would give the market the ability to price in the new data as part of the efficient market hypothesis, allowing traders to react accordingly. We can expect the market to see a UASF, or SegWit UASF, as a highly favorable solution to the current blocksize ceiling.

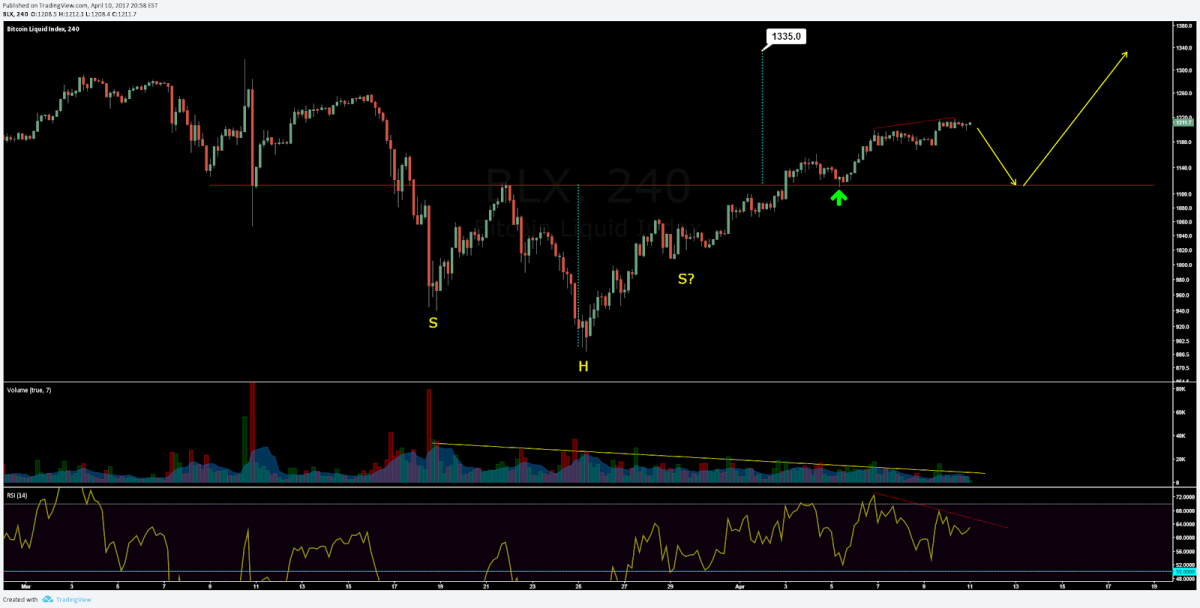

The price of bitcoin has quickly formed a W bottom after forming an M top. At the outset, this suggests that the price is finding a median, in this case ~$1100, before going higher or lower.

While there is certainly a bullish leaning bias for the longstanding trend, the current heavy volatility since establishing a new all-time high (ATH) is perhaps to be expected with continuing price discovery. Price has spent the past 15 days above the $1000 four digit psychological level. This is no small feat for an asset that has spent most of its lifetime far below that value; in fact, Bitcoin has only closed a daily candle above $1000 for 67 days lifetime, according to BLX. The immediate targets for a new ATH would be the 1.272 and 1.618 Fibonacci extension of the previous swing high and swing low, or $1400 and $1540 respectively.

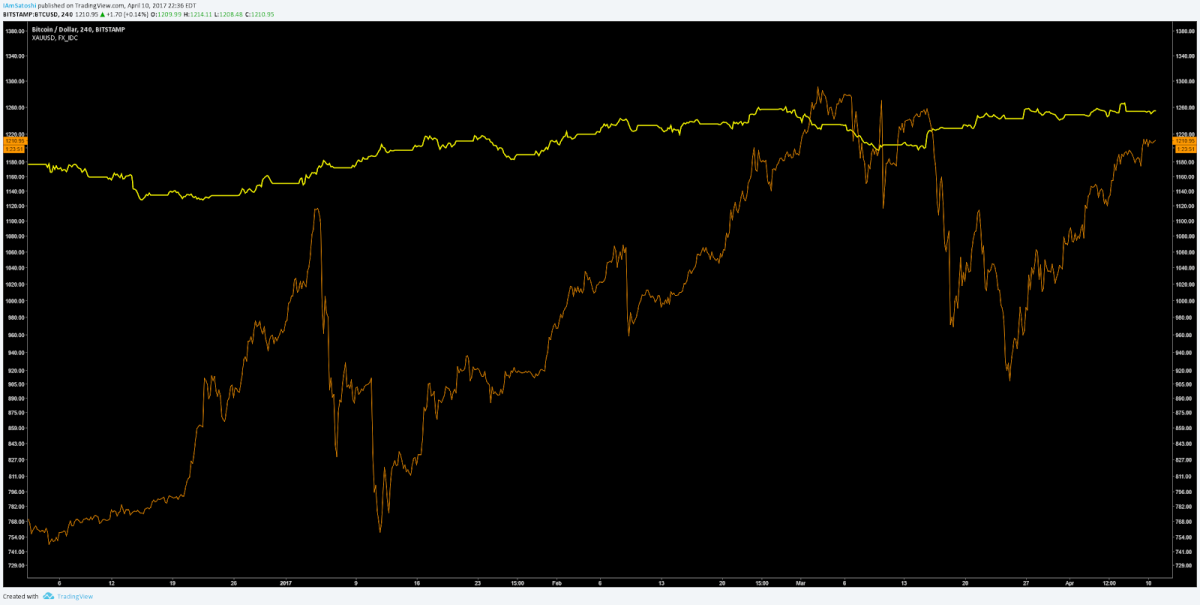

Additionally, the price is again flirting with gold parity, which always grabs flashy media headlines but is largely meaningless. What is more important is the psychological realization that a digital asset could be worth more than a physical asset relied upon for the past few thousand years.

The bullish reversal pattern, inverted head and shoulders, continues to play out but a few questions have emerged. The left shoulder of these patterns is often diminutive, but this structure may negate the idea of an inverted head and shoulders entirely.

With a chart pattern breakout, there is normally a large spike in volume at the resistance or support line signifying definitive resolution of the pattern. That spike in volume has not yet occurred. Furthermore, once a break of the horizontal resistance occurs, there is often a throwback to that horizontal level to confirm support, which may have already happened (green arrow). There is also a growing bearish divergence on the Relative Strength index (RSI), a momentum oscillator. This divergence suggests that price is rising on less momentum and predicts a reversal over continuation. Should this divergence play out, I’d expect a retest of the $1100 support. However, a higher high in price and RSI would negate the divergence.

Summary

- Miner support continues for BU and user support is growing for the SegWit UASF.

- A UASF would occur at a specified date and time, allowing for the market to react accordingly in a timely manner, should any reaction occur at all.

- Expect a new all-time high shortly before or shortly after a UASF as it would signify a large protocol change and improvement to the current block size bottleneck.

- A bullish reversal chart pattern’s existence and resolution remains an open question. Price continues in an expanded range with targets of $1100 and $1400.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.