At any given time, all markets consist of buyers and sellers. When there are more sellers than buyers, prices go down, and when there are more buyers than sellers, prices go up. Right now, more people are buying bitcoin than selling it. It’s that simple and as much as everyone will try to find reasons for the phenomenon, there does not need to be one. The most obvious reason for the rising price is being attributed to the Winklevoss Bitcoin ETF, COIN, which is due for a U.S. Securities and Exchange Commission (SEC) decision by March 11, but may occur at any time before that date.

Several USD exchanges made new all-time highs (ATHs) in price today. Bitfinex, Bitstamp, BTC-e and Coinbase, exchanges that established their previous ATHs in 2013, all made new highs. Brave New Coin’s index, BLX, also made a new ATH, while GDAX, Coinbase’s asset exchange, broke its previously established high of $1,175 on January 2, as well.

Gemini, an exchange owned by the Winklevoss twins, also broke their ATH. GBTC, a bitcoin investment trust that once held a large premium, which has been shrinking in recent months, has not yet made a new ATH and is now trading below spot price.

The Chinese exchanges OKCoin and BTCC have not made ATHs at the time of writing this article. This suggests that demand and price action are largely driven by USD buyers. The previous OKCoin high was 8888 CNY. As per regulatory request of the People’s Bank of China (PBOC), bitcoin withdrawals are currently halted on these Chinese exchanges as well.

Because there is no actual resistance remaining on the chart, traders must use mathematical methods to attempt to predict a price target. It is always possible that these targets become meaningless with price entering a large parabolic leg upward until no buyers remain.

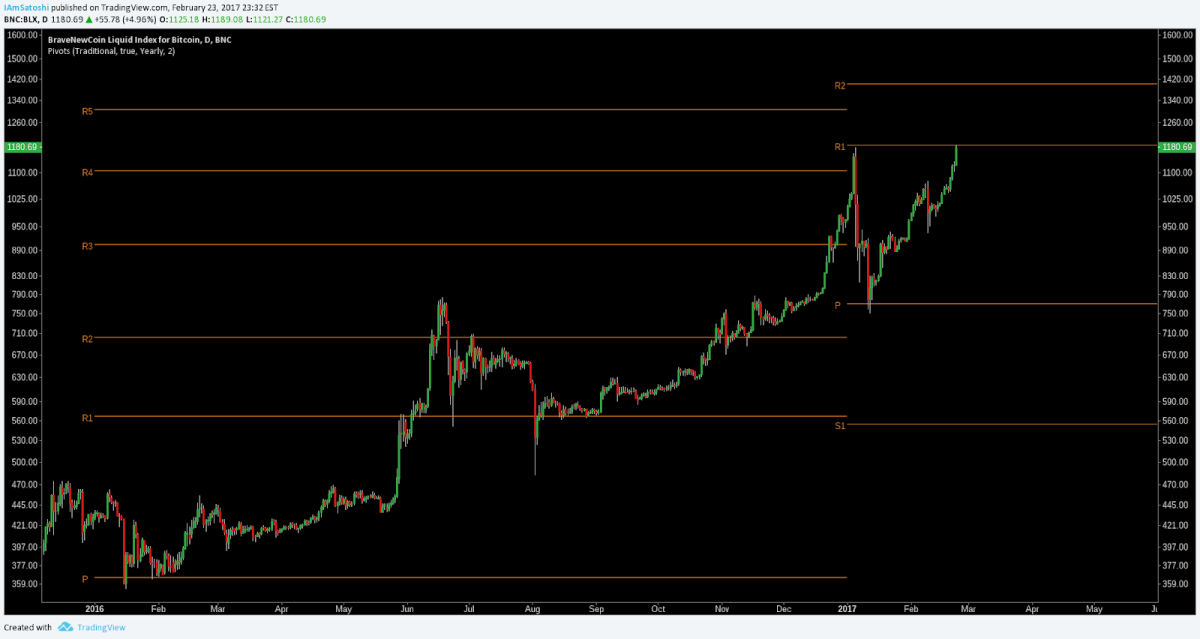

Pivot points are calculated from previous support and resistance levels. For yearly pivots, the horizontal support (S) and resistance (R) levels are calculated on January 1 of each year and do not change until the next year. Currently, price is sitting just below the R1 pivot. A clean break of the R1 would suggest a reach and test of the R2 pivot at $1,400.

You can see how accurate these levels have been the prior year as well.

Fibonacci extensions are another way of calculating support and resistance levels based on previous price, in this case an extreme high and an extreme low.

The 1.618 extension yields a target of $1,445 as a potential resistance zone.

Psychological resistance can also manifest, where traders subconsciously tend to focus on factors such as:

1. Round, even numbers like 1,000 or 1,050;

2. Culturally relevant numbers like 666. The number four is bad luck in China, whereas the number eight is good luck;

3. Comparing markets to other assets. Should digital gold, bitcoin, be worth more than actual gold per ounce?

4. The now defunct exchange, Mt. Gox, had an established ATH of $1,242, which may act as a type of psychological resistance as well because bitcoin price has never been higher than this in USD terms.

Summary

1. USD exchanges and demand have driven bitcoin prices higher while Chinese exchanges have taken a backseat.

2. Although no resistance remains beyond the ATH, there are mathematical methods to calculate the next resistance zones, such as pivots and Fibonacci extensions, which yield targets of $1,400 and $1,445 respectively.

3. Bitcoin has never traded above $1,242, a Mt. Gox ATH, or above the USD price of gold per ounce.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.