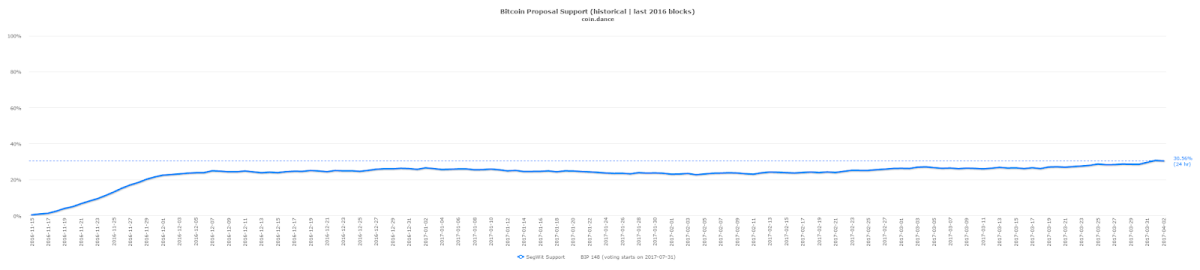

Bitcoin miner support for SegWit has continued to rise slowly over the past few days, currently sitting at 30%, but remains far from the needed 95% to activate the proposal. There is also a growing push for Litecoin, an alternative digital currency, to activate SegWit as well, currently sitting at 57% support.

In either case, a successful soft fork and the subsequent advantages of SegWit activation on scaling and block size should be beneficial for all digital currencies, merely as proof of concept. Sure, the testnet exists and shows validity of the proposal, but until a digital currency protocol with a billion dollar market capitalization is SegWit-functional, it’s harder for miners, nodes, users and traders to truly understand the benefit. Follow the BTU and SegWit proposal signaling breakdown per block here.

Even after a SegWit soft fork, a hard fork with another derivative of the bitcoin protocol is not out of the question. So long as there is 51-75% miner support, the hard fork may still occur. Whether the benefits of SegWit are enough to keep the hard fork possibility at bay remains to be seen.

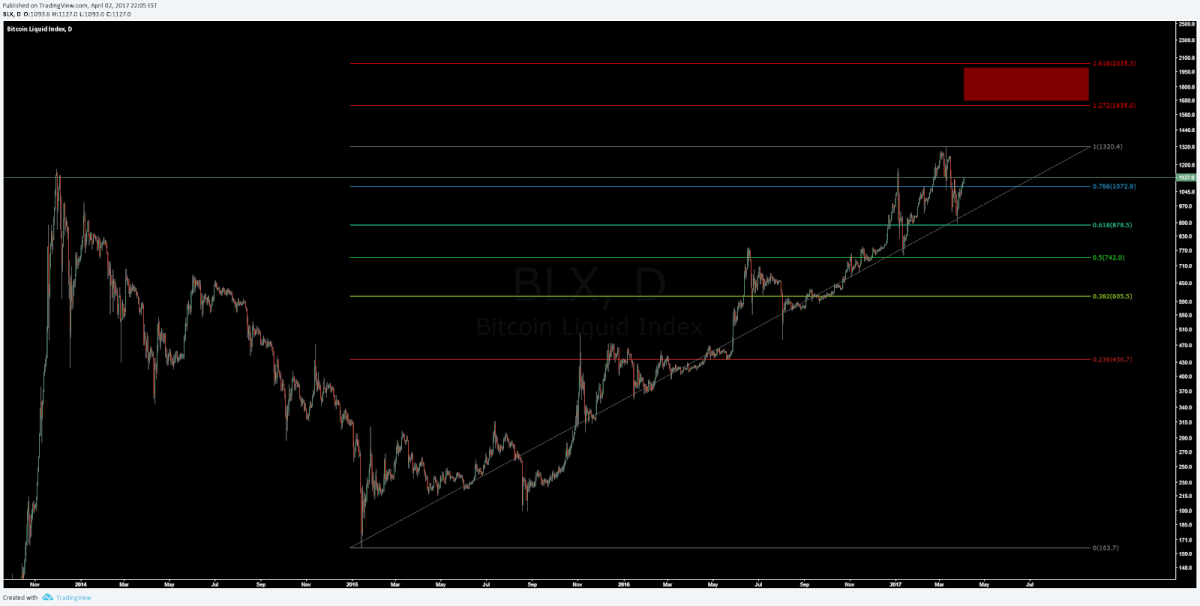

On the weekly chart, the price of bitcoin appears to have found support and will now range between the local low and all-time high.

The Relative Strength Index, a measure of momentum, gives the price plenty of room to continue upward past the previous all-time high (ATH). With a bullish fundamental event like SegWit activation, which begins to solve scalability problems, a substantial jump in price could be expected.

The next technical resistance appears to be the 1.272 and 1.618 Fibonacci extensions at ~$1600 and ~$2000 respectively. These levels ought to be easily obtainable should scaling become fixed.

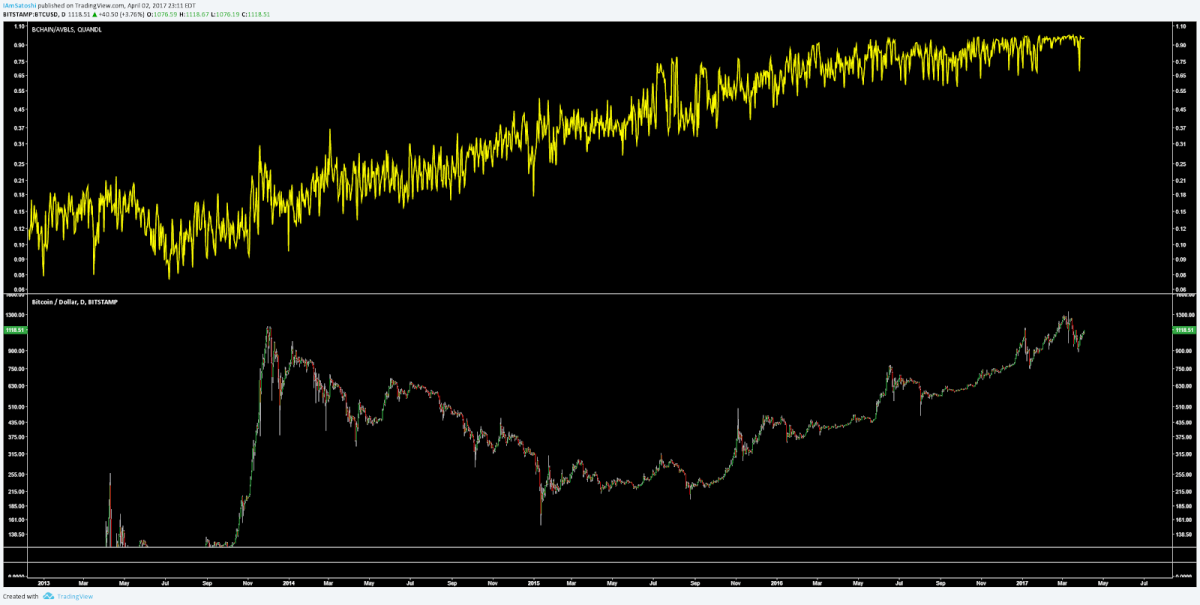

The logic for this assumption is that, with the current 1MB ceiling, the rate of transactions per block has effectively stagnated. With a marginal increase in block size leading to the ability for future off-chain transactions through the Lightning Network, the network as a whole would become much stronger and more useful to the general public. Price banging on an ATH while banging on the block size ceiling should be seen as no coincidence.

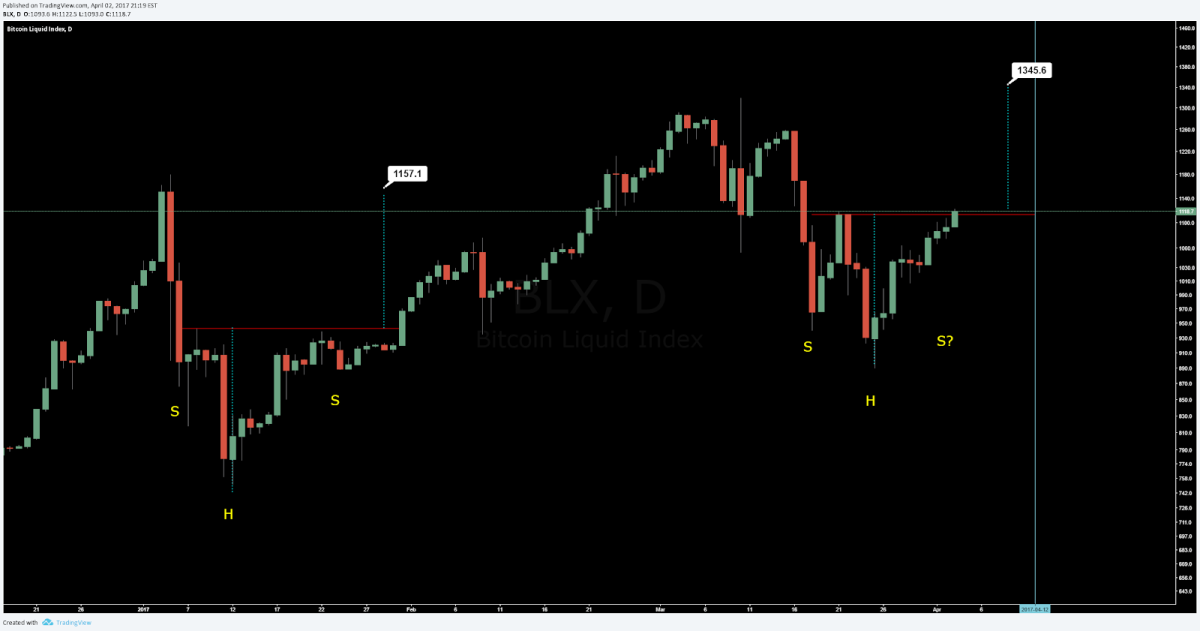

The most important active pattern at the moment is the building inverse head-and-shoulders pattern. On this daily timeframe chart, you can see how this is a repeating fractal pattern from the downward move in January. This should signal a bullish reversal once the neckline is cleanly broken. The right shoulder does not need to meet the same horizontal support as the left shoulder and is often diminutive, as is seen in the previous pattern.

Summary

1. Despite the growing support for SegWit, I still expect a push for a hard fork, allowing Bitcoin Unlimited to compete with SegWit. How this will affect the price of either asset is really an open question, but should Segwit hold up to its promises as a viable scaling solution, BTU will likely not live on for long. The soft fork vs. hard fork timeline and order will be very important for the price in the coming months.

2. Bitcoin’s price found support on a previous resistance zone. The next resistance zone will be between the previous and current ATH.

3. With block size expansion, expect the probability of a price expansion as well.

4. There is an active chart pattern on a high timeframe calling for bullish reversal. A convincing candle close above the current horizontal resistance should yield a price of ~$1350 within the next month.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.