Gold bugs everywhere lost some luster today when bitcoin broke parity with gold in USD terms. Interestingly, gold, as an element, had many advantages over other possibilities as a use for currency. Arguably, Bitcoin, with its secure network and utility, is a better version of gold for today’s digital age. The psychological resistance of gold price and bitcoin price parity has long been held among many traders, especially those who trade legacy FOREX markets. It is also a metric frequently touted in popular media. Could a digital asset really ever be worth more than a physical one that has withstood the test of time?

Let’s take a look at a few charts:

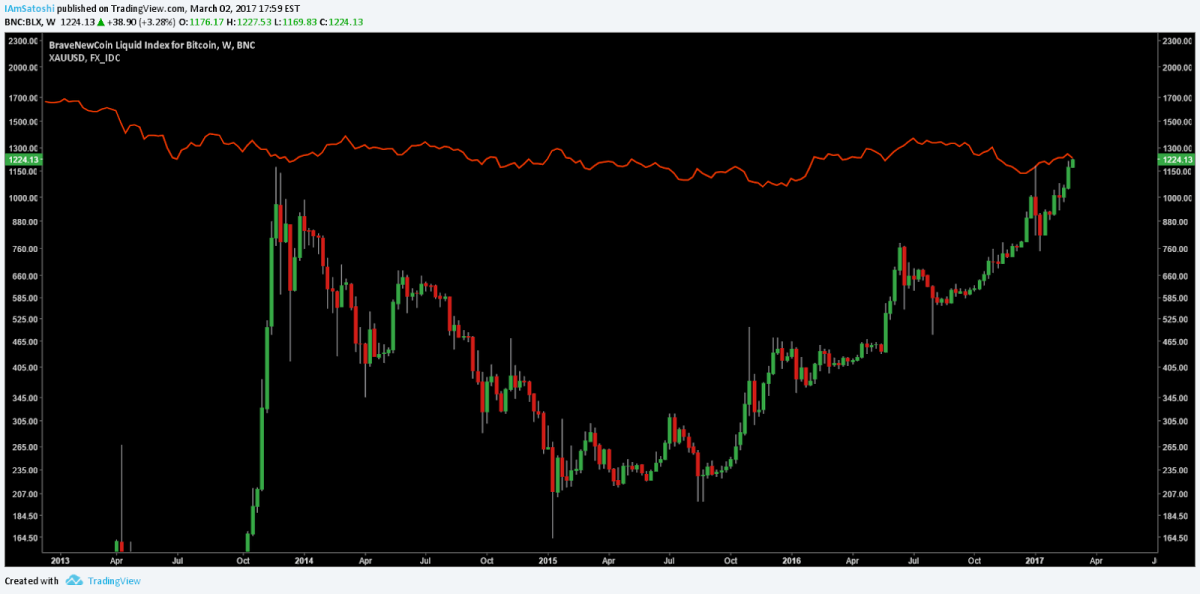

1W BLX vs. XAU-USD

Even before January, bitcoin had made large gains on the price of gold, closing the parity gap very quickly over recent months as gold remained in a sideways range. The index currently shows the price sitting at near parity. Teasing that apart further, we can see two things: BTC-USD has made a clean break above XAU-USD, and BTC-CNY remains below XAU-CNY.

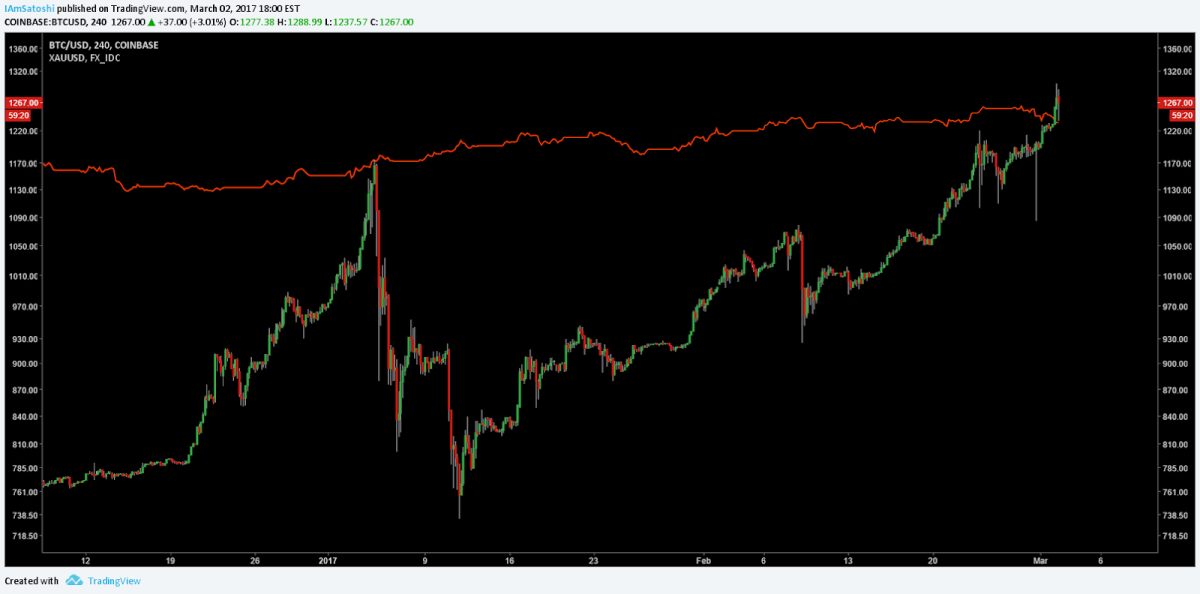

4h BTC-USD — Coinbase vs. XAU-USD

4h BTC-CNY — OKCoin vs. XAU-CNY

In January, when BTC-CNY broke gold parity, BTC-USD did not. This was largely because of the greater demand in BTC-CNY versus BTC-USD. The exact opposite can be said for current market conditions. Bitcoin’s price is being driven by USD demand, thus BTC-USD has broken gold parity, whereas BTC-CNY has not.

In my opinion, gold parity will not truly be broken until the index of both BTC-USD and BTC-CNY are above their respective gold prices. The current dichotomy suggests that, just as BTC-CNY was overbought in January when it broke gold parity, BTC-USD is likely overbought now.

With the COIN ETF decision quickly approaching on March 11, USD demand is slowly pricing in an approval decision from the SEC. I’d expect BTC-USD to continue holding above XAU-USD until the ETF decision, when we may see the “buy the rumor, sell the news” paradigm, causing the BTC-USD price to break below gold parity again.

Although it is an exciting milestone for Bitcoin, it’s largely an ideological bump in the road and has little meaning for the network or future price itself. Based on utility, ease of access, fungibility, security and storage, bitcoin stands far above gold for today’s world. After all, bitcoin is easily spendable, but it’s rare to find a merchant, online or otherwise, who accepts gold as payment.

Trading and investing in digital assets like bitcoin is highly speculative and comes with many risks. This analysis is for informational purposes and should not be considered investment advice. Statements and financial information on Bitcoin Magazine and BTCMedia related sites do not necessarily reflect the opinion of BTCMedia and should not be construed as an endorsement or recommendation to buy, sell or hold. Past performance is not necessarily indicative of future results.