Despite CFTC suing Binance, Bitcoin on-chain data has so far shown no signs of FUD developing among traders on the cryptocurrency exchange.

Bitcoin On-Chain Metrics Related To Binance Are So Far All Normal

Yesterday, news came out that the US Commodity Futures Trading Commission (CFTC) has filed a lawsuit against Binance and its CEO, Changpeng Zhao, for violating derivatives trading rules in the US. Following the announcement, the market reacted with the price of Bitcoin, which went below the $27,000 level.

Users on the exchange itself, however, seem to be calm so far. As an analyst in a CryptoQuant post explained, FUD around the exchange is currently not visible in BTC on-chain data.

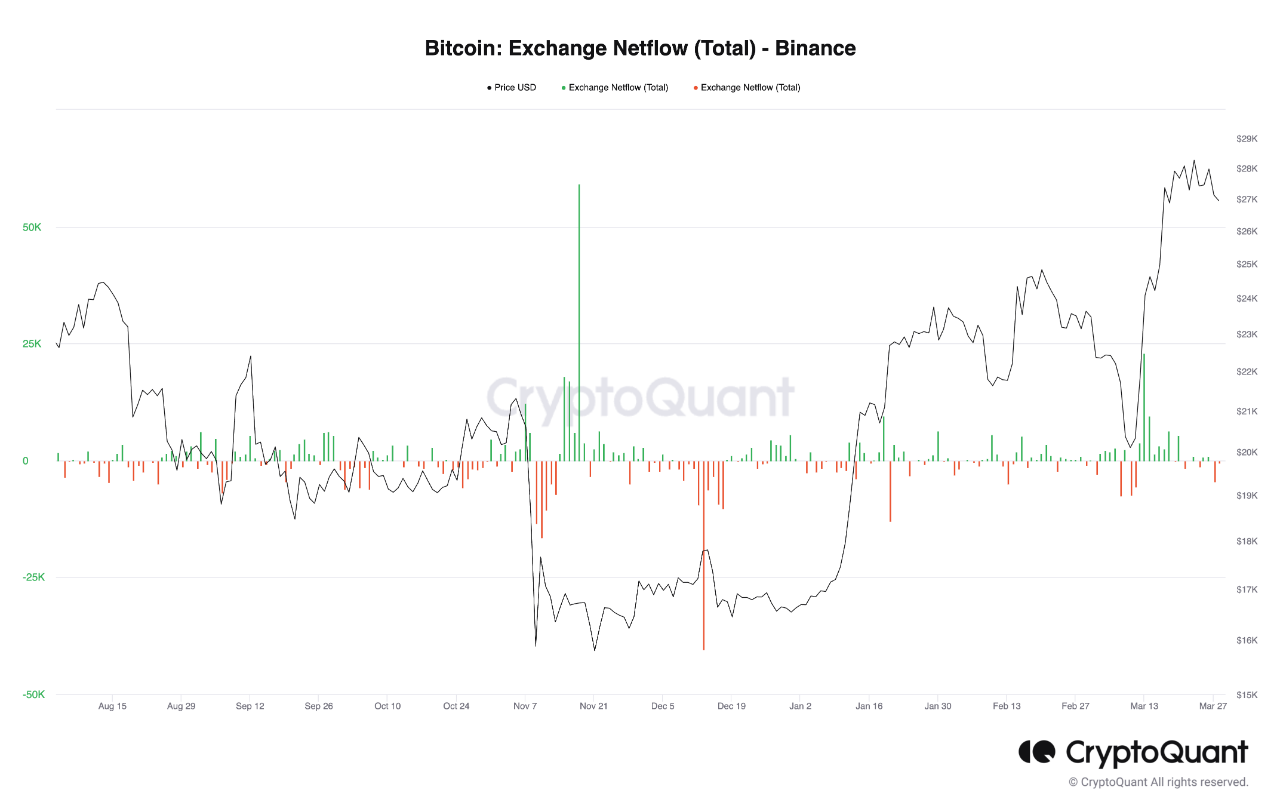

The first relevant indicator here is the exchange netflow, which measures the net amount of Bitcoin entering into or exiting the wallets of the exchange. The below chart shows the recent data for this metric.

As displayed in the above graph, the Bitcoin Binance netflow has had a negative value recently, meaning that investors have withdrawn a net number of coins from the platform.

Normally, when exchanges have trouble surrounding them, investors develop FUD, and many withdrawals are seen from the exchange. However, while some withdrawals have been seen, their magnitude is still relatively low.

From the chart, it’s apparent that bigger spikes were seen earlier this month alone. This suggests that users haven’t gone into a state of panic yet as they feel safe enough to keep their coins in the custody of Binance.

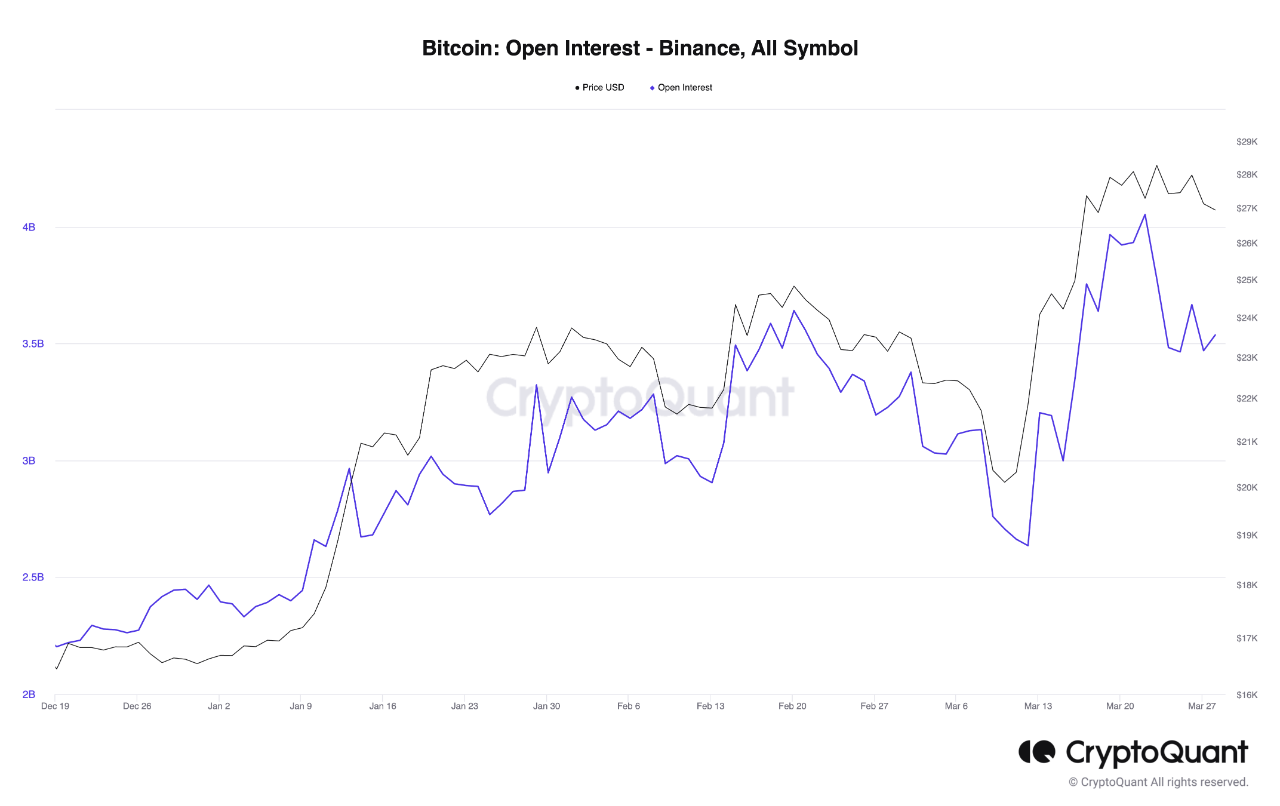

Next is the metric related to the derivative market, the open interest, which measures the total amount of Bitcoin futures trading contracts that are open on Binance.

As is visible in the graph, the Bitcoin open interest on Binance has climbed too high values with the recent price surge. The metric’s value has registered no significant change following the CFTC news, suggesting that the derivative traders have also not closed a large number of contracts and, thus, have not shown any signs of FUD.

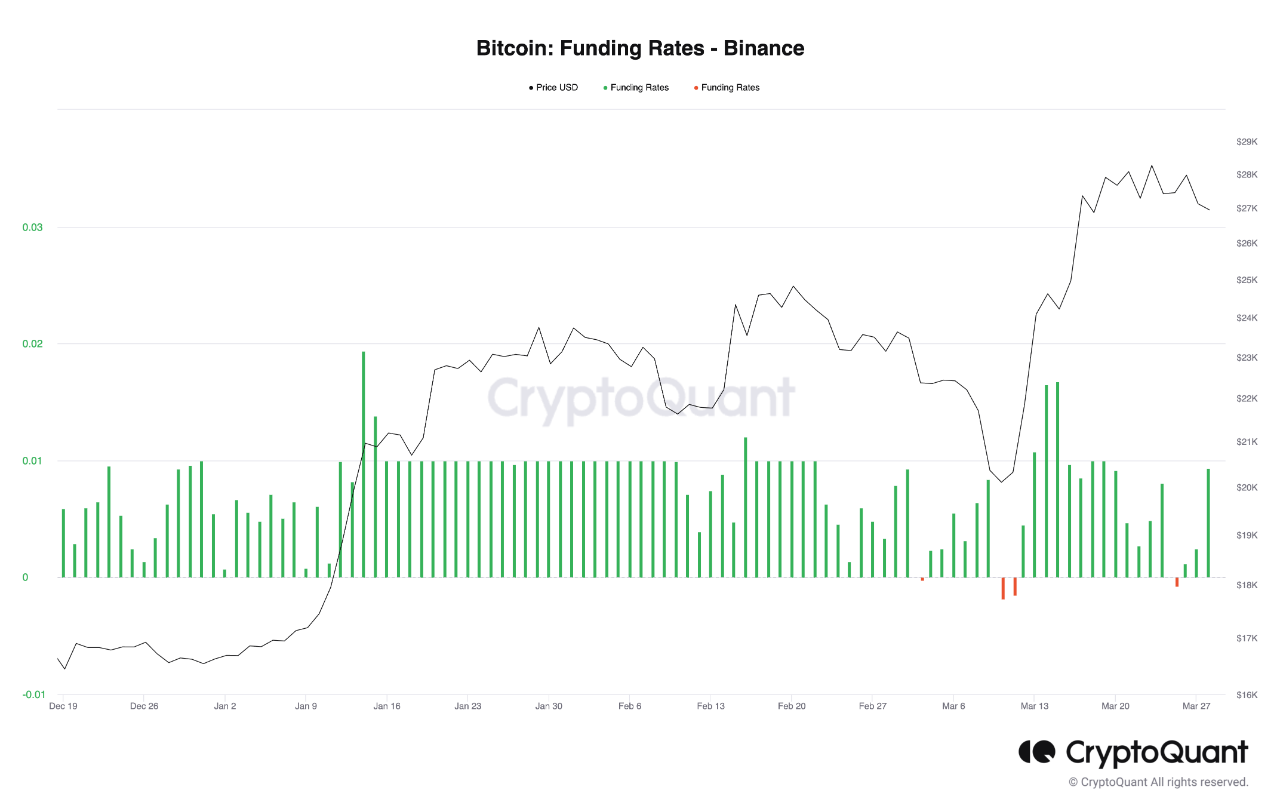

The funding rate, a measure of the periodic fee that futures contract traders are exchanging with each other, has also remained positive, showing that investors on the platform continue to be bullish about BTC.

All these indicators show that traders on the platform, whether spot or derivative ones, have not shown any noticeable reaction to CFTC suing the exchange. That is, of course, at least the story so far; it’s currently unclear whether things might change in the coming days.

BTC Price

At the time of writing, Bitcoin is trading around $26,800, down 4% in the last week.