On-chain data shows ancient Bitcoin investors have been waking up at a higher rate than ever before during the current cycle so far.

Bitcoin 10+ Year Old Tokens Have Been Seeing Large Movements Recently

As explained by CryptoQuant Head of Research Julio Moreno in a post on X, the current Bitcoin cycle has seen more OG investors of the asset awaken than ever before.

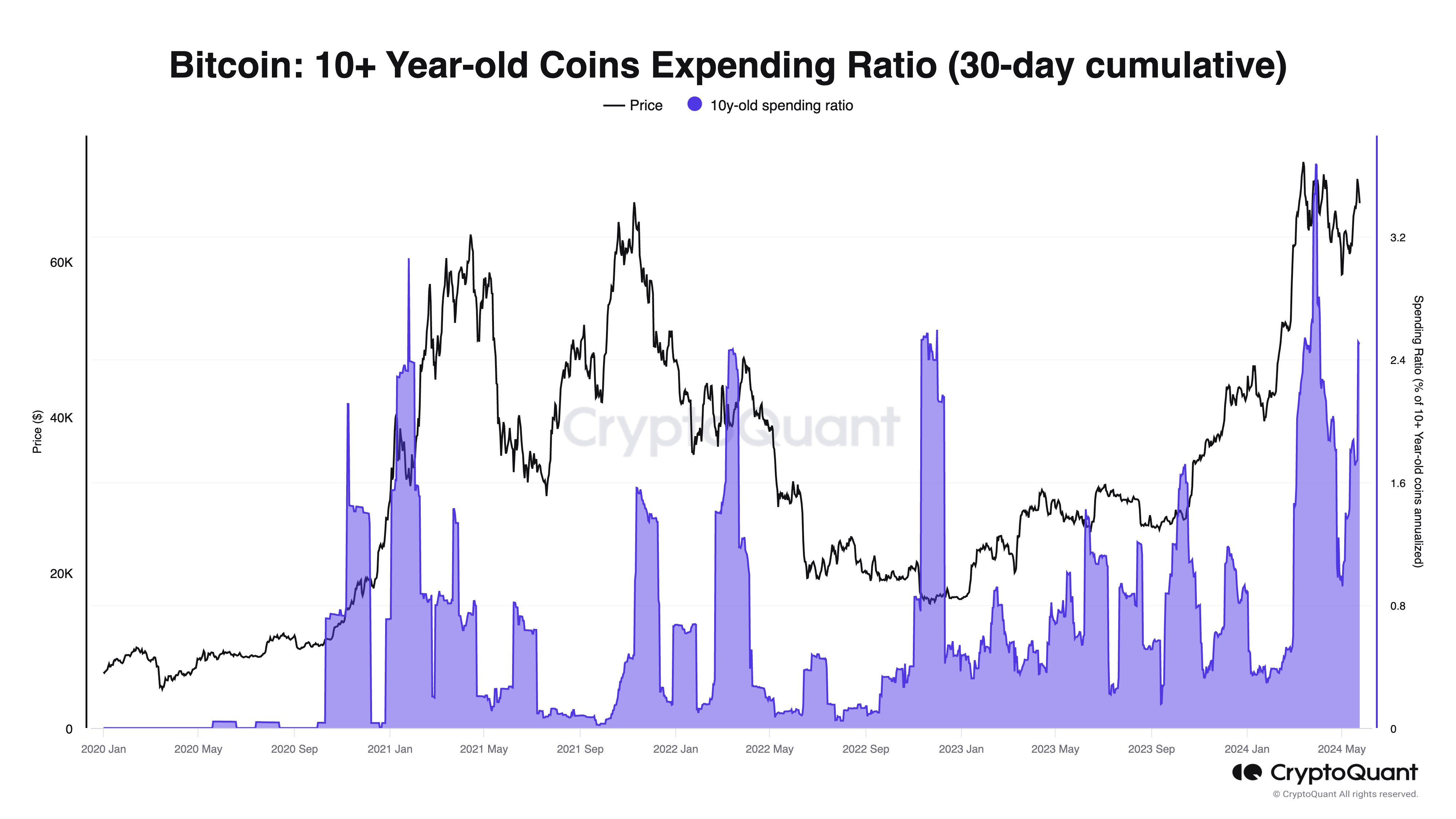

The on-chain indicator of interest here is the “10+ Year-old Coins Expending Ratio,” which basically tells us what percentage of coins dormant for 10 years or more saw movement during the past 30 days.

When the value of this metric is high, it means that some old investors on the network have finally been breaking their silence over the past month. Movement of coins so old is generally not a common event, so this kind of trend can be worth looking out for when it develops.

Now, here is a chart that shows the trend in the 10+ Year-old Coins Expending Ratio for Bitcoin over the past few years:

As is visible in the above graph, the indicator had observed a huge spike back in March. At the peak of this spike, the metric’s value reached 3.7%, which is the highest it has witnessed in the asset’s history so far.

This sharp movement in dormant coins had come as the cryptocurrency’s price had set a new all-time high (ATH). Usually, when such old coins move, it’s for selling purposes. In the case of this spike, especially, profit-taking would appear to be the likely motivation, given the ATH break.

After this peak, the ratio’s value registered a notable decline as the Bitcoin price itself struggled. With the latest recovery that the cryptocurrency has observed, though, the indicator has also bounced back.

At present, the metric’s value stands at 2.5%, which, while lower than the earlier record, is still a high level when compared to the past. Therefore, it appears that ancient whales have continued to wake up at a significant rate over the last few months.

Who would be these investors moving such old coins? Generally, the movement of dormant tokens is associated with the HODLers of the market. Though, when coins age so much so as to fall in the 10+ years bracket, chances become higher that HODLing isn’t why they have been sitting dormant.

Rather, coins of this type are probable to have reached this old age by being ‘lost,’ due to the keys of their wallets being misplaced or their existence simply being forgotten.

Some of the holders selling recently could have indeed been the OGs sitting tight all this time, but it’s very much possible that a lot of these investors would in fact be those who just recently got their hands on the wallets containing these dormant coins.

BTC Price

At the time of writing, Bitcoin is trading at around $68,500, up over 2% in the last seven days.