Nasdaq-listed bitcoin miner Bitfarms said Monday it purchased 1,000 BTC in the first week of January, an amount that increased the company’s bitcoin holdings by about 30%. The company said it now holds 4,300 BTC in its treasury.

“Our guiding company strategy at Bitfarms is to accumulate the most Bitcoin for the lowest cost and in the fastest amount of time for the benefit of our shareholders,” Bitfarms’ CEO Emiliano Grodzki said in a statement.

Bitfarms said the $43.2 million purchase sought to capture the discounted bitcoin price as hardware prices remain high, an investment venue the company explores to expand its operations and increase hash rate output. The 1,000 new bitcoin bought in a week represents what the miner added to its holdings in each of the third and fourth quarters of 2021. However, the company said the cash allocation shouldn’t get in the way of its hash rate goal for 2022, which would put the company’s capacity at eight exahashes per second (EH/s) by year-end.

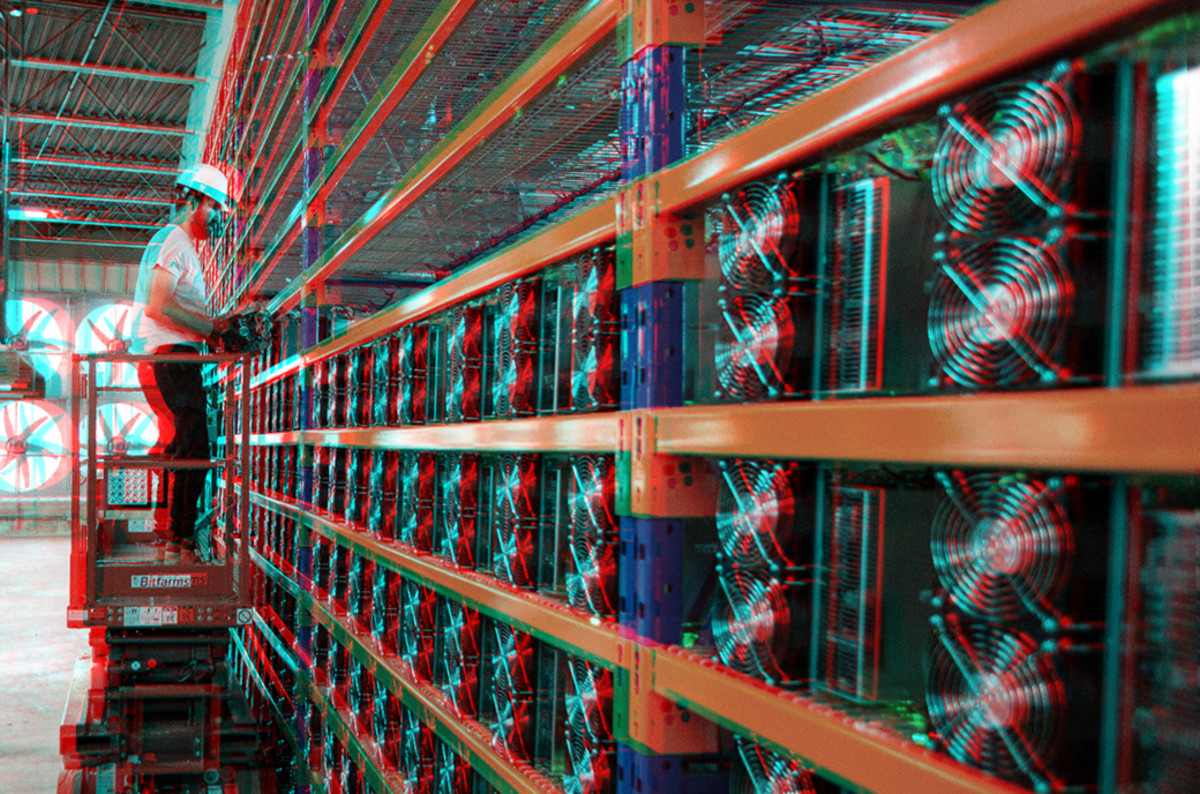

Bitfarms is a Canadian company that recently tipped its toes into U.S. territory with an acquisition of a 24-megawatt facility in Washington state. The miner, which also operates five farms in the Canadian province of Québec, was listed on the Toronto Stock Exchange in 2019 and entered U.S. markets in June when it began trading on the Nasdaq.

Bitfarms mined 339 BTC in November and 363 BTC in December to surpass the mark of 3,000 bitcoin produced in 2021, the majority of which the company deposited into custody. At the end of last year, the miner also secured a $100 million bitcoin-backed credit facility with Galaxy Digital LLC, an affiliate of Galaxy Digital Holdings. The initial $60 million draw of the revolving, multi-draw credit facility was made with a six-month term at an annual interest rate of 10.75%.