Optimism towards Bitcoin‘s potential in the future is growing within the crypto sector as evidenced by recent developments around BTC’s Long-Term Holders (LTH) exchange inflows, which have fallen significantly over the past few days in the midst of persistent market uncertainty.

Bitcoin LTHs Takes Extra Caution

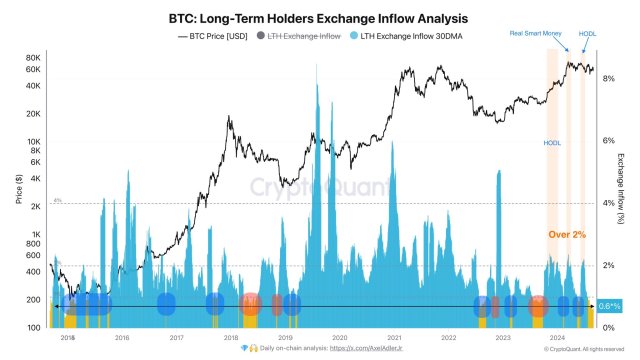

Recent reports show that Bitcoin’s long-term holders’ exchange inflows have dropped to a crucial level, indicating that the holders are beginning to exhibit signs of caution. Axel Adler Jr, a macro researcher and author shared the development on the X (formerly Twitter) platform earlier today.

According to the macro researcher, the average volume of the BTC long-term holders’ exchange inflow dropped to about 0.6% of the entire volume. This decrease suggests that instead of dumping their holdings during unfavorable market conditions, these old investors are opting to hold onto them, demonstrating their confidence in the crypto asset’s prospects in the long term.

Furthermore, Adler noted that the new level is remarkably low for the previous 10 years. During the period, the decline in long-term holders‘ exchange inflows has resulted in a price decrease in four scenarios and a price uptick in over 8 similar instances.

The post read:

The average volume of LTH exchange inflow has decreased to 0.6% of the total volume. This is an extremely low figure for the last ten years. In eight similar cases, this led to further price increases, while in four, it resulted in declines.

While the metric has declined, the expert highlighted in another X post that the average exchange inflow/outflow ratio for Bitcoin is currently displaying robust buying pressure. The strong buying pressure implies that investors are moving their BTC off exchanges to personal wallets.

This development according to Adler marks the sixth time it has taken place in the last 10 years. “Retail investors, of course, won’t react, they will enter when the price is above $70,000,” he added.

Overall, this trend is considered a bullish indication that could lead to a price increase in the near future, since it reflects confidence in the value of Bitcoin in the long term as investors desire to keep their holdings rather than trade it.

BTC’s Overall Outlook Is Far From Bullish

Leon Waidmann, head of research at Onchain Insights, has pointed out a negative outlook for BTC in the short term, as the liquidity conditions of the asset are still “looking rough.”

In spite of ongoing price fluctuations, there are still limitations on the depth and availability of liquidity. Even though some signs of hope have emerged, Waidmann claims that the overall outlook for Bitcoin is “far from bullish.”

With the market showing a weakening trend, the expert believes that the likelihood of BTC hitting a new all-time high soon is slim. As a result, he has urged investors to brace themselves for upcoming price swings before eventually reaching a new peak.