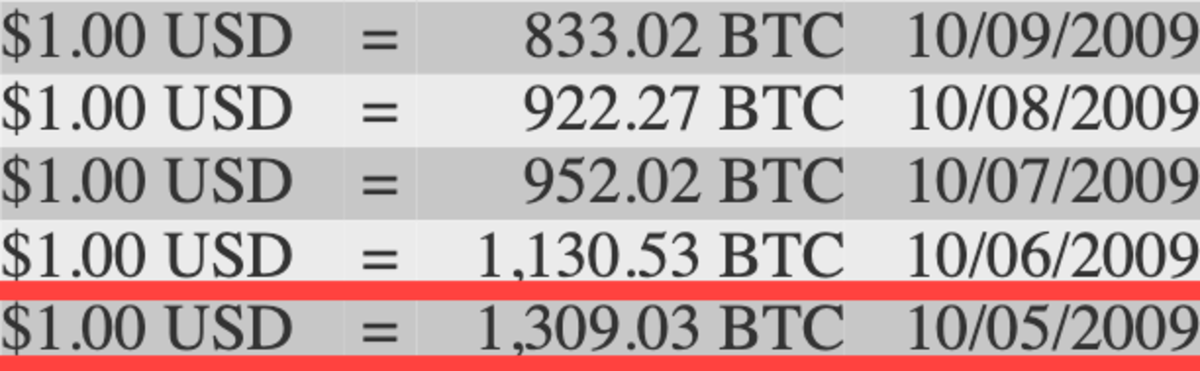

Twelve years ago today, pseudonymous Bitcoin user NewLibertyStandard published what is likely the first pricing of Bitcoin in US Dollar terms.

On his website of the same name, NewLibertyStandard went on to describe how they formulated their 2009 exchange rate:

“During 2009 my exchange rate was calculated by dividing $1.00 by the average amount of electricity required to run a computer with high CPU for a year, 1331.5 kWh, multiplied by the the average residential cost of electricity in the United States for the previous year, $0.1136, divided by 12 months divided by the number of bitcoins generated by my computer over the past 30 days.”

The pricing of Bitcoin in dollar terms is remarkable because it signals the first mark of demand for the asset, or one methodology of how an exchange dynamic could arise. This theoretical price signals the following:

Someone in the market was willing to part with $1 dollar for 1,309.03 BTC, because they valued that amount of Bitcoin more than $1 dollar. Conversely, a counterparty at that time (in this case probably NewLibertyStandard as well) was willing to trade 1,309.03 BTC for $1 dollar, because they valued the Bitcoin less than one dollar. The price of 1 BTC was $0.00076392.

On 6 October 2009, the price in Bitcoin rose by NewLibertyStandard’s measure. For a moment that day, the price of 1 BTC was $0.00088454.

At the time of writing, 1 BTC costs about $49,880.00.

Let’s compare:

5 October 2009: 1BTC = $0.00076392

5 October 2021: 1BTC = $49,880.00

49,880.00 - 0.00076392 = 49,879.9992

49,879.9992 / 0.00076392 = 65,294,794.3

65,294,794.3 * 100 = 6,529,479,430%

Bitcoin has risen 6,529,479,430% since it was first priced in US dollars. Bitcoin is the most appreciating asset in human history.