On-chain data from Glassnode shows the recent volatility hasn’t been enough to make the ‘diamond hands of Bitcoin’ budge.

Bitcoin Long-Term Holders Continue To Increase Their Holdings

According to data from the on-chain analytics firm Glassnode, HODLing has remained the main dynamic among the long-term holders. The “long-term holder” (LTH) group is a Bitcoin cohort that includes all investors who have been holding onto their coins since at least 155 days ago.

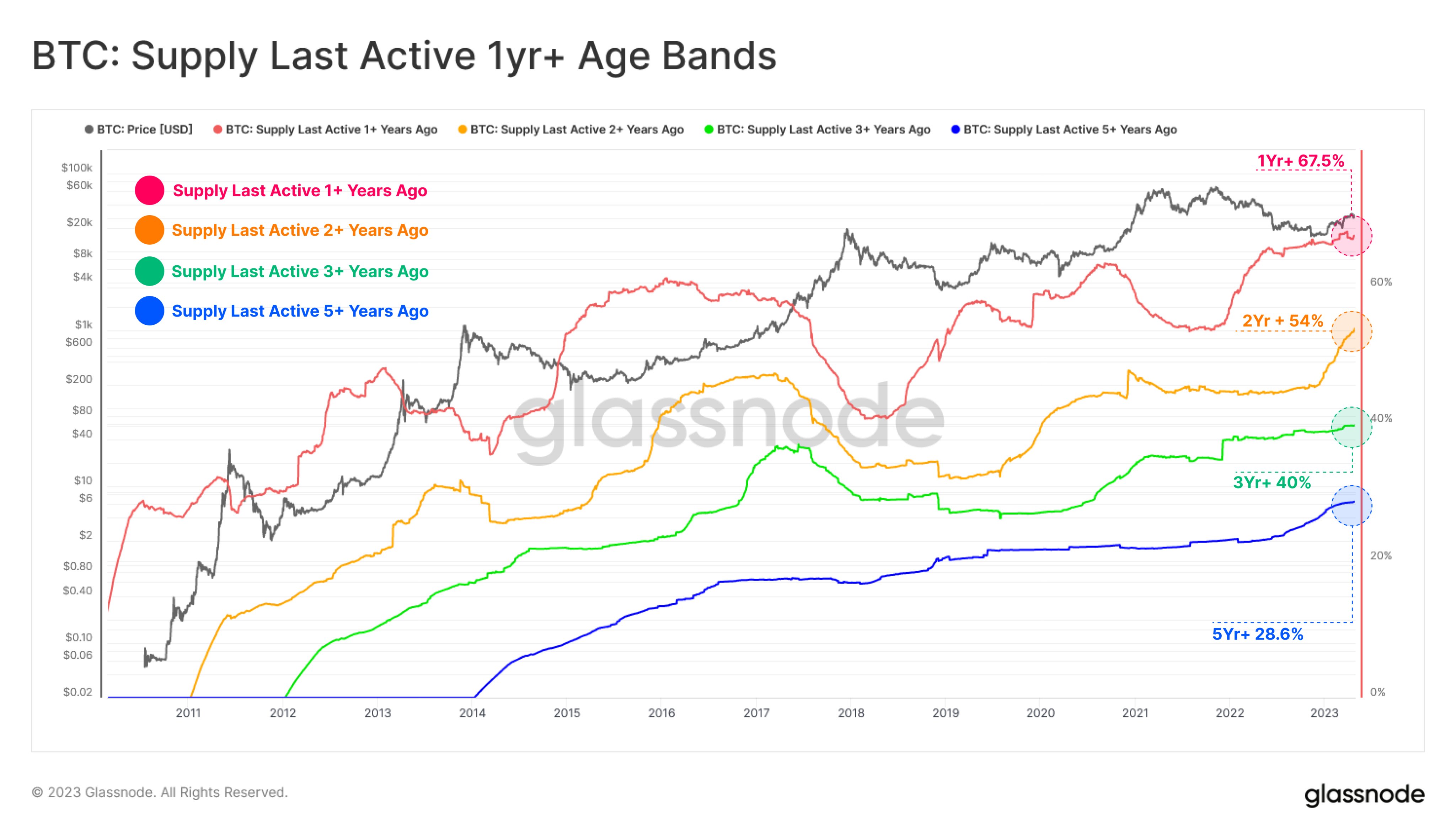

An indicator called the “Supply Last Active Age Bands” can break down the total amount of supply that each “age band” in the market is holding right now. Coins are divided into these age bands based on the total amount of time that they have been sitting dormant on the blockchain for.

With the help of this metric, not only can the supply of the LTHs, in general, be tracked, but the behavior of the different segments of this group can also be studied.

In the context of the current discussion, the relevant parts of the LTHs are those carrying coins since at least one year ago. To be more particular, the age bands being considered here are the 1+ years, 2+ years, 3+ years, 4+ years, and 5+ years groups.

Here is a chart that shows the trend in the supply of these LTHs over the entire history of the cryptocurrency:

Note that the age bands here don’t have upper bounds. This means that the younger groups also include the supplies of the age bands older than them. For example, the 1+ years band includes the combined data of all these other bands as it’s the youngest one.

Now, it’s visible from the above graph that all these Bitcoin age bands have been rising in recent months, implying that the investors in the market have been holding coins long enough for them to mature into these ranges.

BTC has experienced some pretty high volatility recently, but these investors still haven’t shown any significant changes in their supplies. “This suggests that HODLing remains the primary dynamic amongst longer-term investors, insinuating that further volatility in price action is required to entice old hands to spend,” explains Glassnode.

Currently, the supply of the 1+ years cohort makes up for 67.5% of the entire circulating BTC supply, a very significant figure. The percentages naturally drop with each next group, as their supply can’t be larger than the group higher to them, as explained before.

Generally, the longer an investor holds their coins, the less likely they become to sell at any point. This is partially because of the fact that the more aged coins are, the likelier they are to have become permanently lost (due to the keys of their wallets no longer being accessible).

From the chart, it’s visible that the older age bands have generally observed lesser fluctuations compared to the groups younger than them. This interesting trend shows the aforementioned statistical fact in action.

BTC Price

At the time of writing, Bitcoin is trading around $28,000, up 2% in the last week.