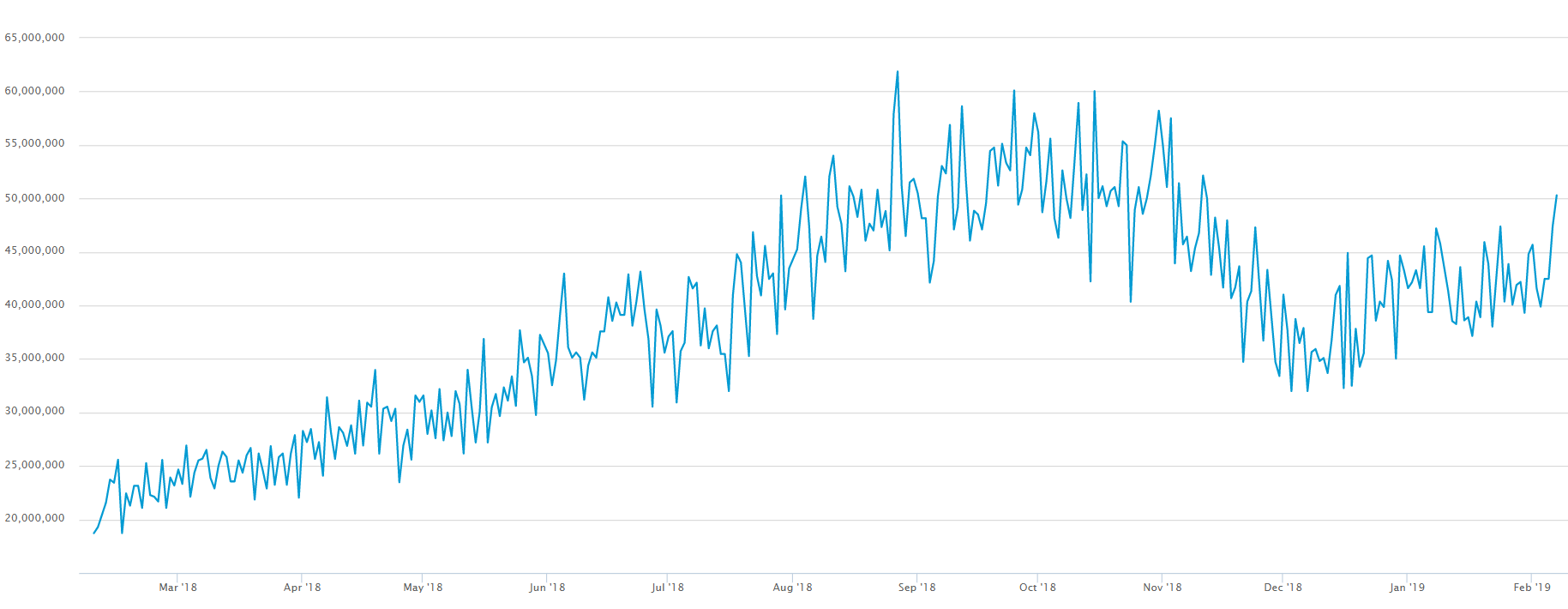

Bitcoin hashrate, the computing power of the network, has hit levels last seen in November 2018. Bitmain-operated hashrate, however, has hit its lowest point in the last 16 months.

Bitcoin Hashpower at a 3-Month High

As of yesterday, February 7th, Bitcoin hashrate has hit over 50 quintillion hashes per second according to data from Blockchain.com.

The last time the computing power of Bitcoin’s network saw these levels was in November 2018.

The rise in hashrate translates into new miners joining the network as the mining difficulty has dropped for the first time in 2019 by about 1.5 percent at the end of January.

Bitcoinist reported at the beginning of the year that Bitcoin mining difficulty has adjusted 10% upwards for the first time in months as the hashrate started to stabilize following November’s decline.

The uptick could be a bullish sign for bitcoin price as some believe miners invest in the future spot price of bitcoin.

“Price follows hashrate and hashrate chart continues its 9 yr bull market,” says Wall Street veteran, Max Keiser.

Others, like Casa CTO, Jameson Lopp, believe that its the other way around as miners are speculating on some future price of bitcoin. Lopp explains:

Hashrate follows price. Some folks believe price follows hashrate, possibly because hashrate doesn’t simply track ~spot~ price, but rather tracks some ~speculative~ future price. Miners are speculators too!

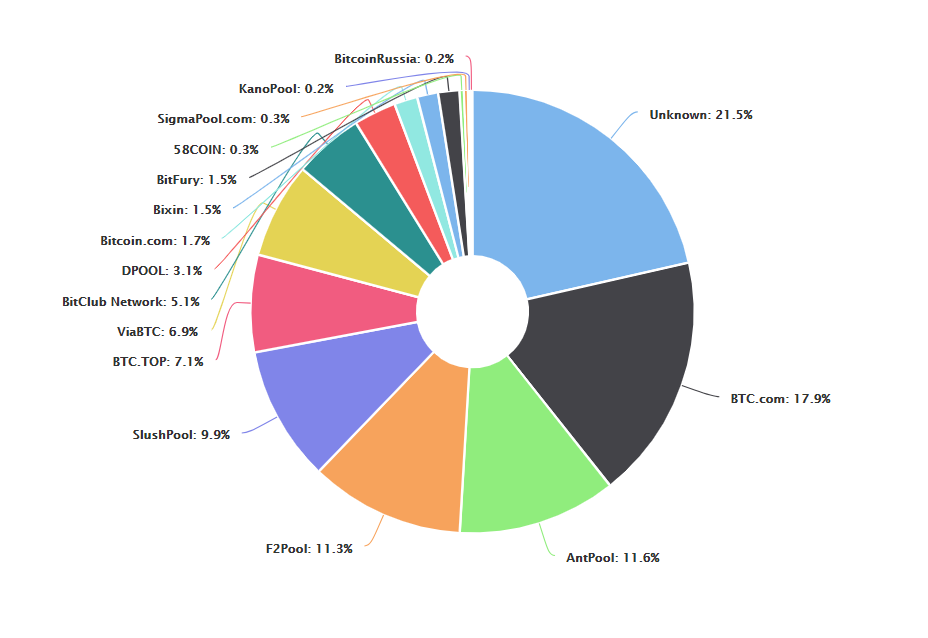

Bitmain Losing Market Share

In the first half of 2018, Bitmain-operated hashrate through Antpool and BTC.com was peaking. According to data from BTC.com, both pools attributed to over 40 percent of the entire network’s computing power.

Their dominance, however, has been shrinking ever since. At press time, BTC.com and Antpool combined control less than 30 percent of the network’s hashrate, according to Blockchain.com.

The last time Bitmain’s share was so low was at the beginning of October 2017 – 17 months ago.

Indeed, the second half of last year has turned out to be rather challenging for the company as rumors of massive losses in the third quarter cast serious doubts over its financial condition.

Bitcoinist reported in late 2018 that Bitmain’s monopoly was collapsing as it put its mega mining facility project on ice in Rockdale, Texas. The company was laid off its entire Bitcoin Cash development team.

In any case, as Bitmain loosens its grip on Bitcoin mining, Bitcoin mining seems to be getting more decentralized, which increases security and eliminates the possibility of a 51 percent attack.

Is hashrate icreasing a good sign for price? Don’t hesitate to let us know in the comments below!

Images courtesy of Shutterstock, blockchain.com