Franklin Templeton, a financial juggernaut overseeing an impressive $1.5 trillion, has recently announced its strategic entry into the highly competitive domain of spot Ethereum Exchange-Traded Funds (ETFs) within the United States. This strategic move comes hot on the heels of their successful initiation into the Bitcoin ETF arena, indicating a growing confidence in the expansive and dynamic digital asset landscape.

Ethereum Staking Strategy: Franklin’s Innovative Approach

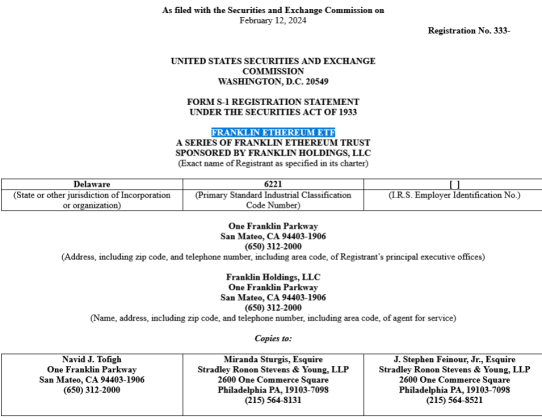

While following the footsteps of its competitors in mirroring the structure of their Bitcoin ETF, Franklin Templeton adds a unique twist to its proposed “Franklin Ethereum ETF.” The company plans to stake a portion of its Ethereum holdings, potentially allowing investors to earn supplementary income through the network’s distinctive validation mechanism. This innovative approach echoes strategies employed by industry players such as ARK 21Shares, adding an additional layer of sophistication to the already fiercely competitive race.

We are excited about ETH and its ecosystem. Despite the midlife crisis it’s recently experienced, we see a bright future with many strong tailwinds to push the Ethereum ecosystem forward -EIP 4844 -Alt DA -Community Revitalization -Restaking

— Franklin Templeton (@FTI_US) January 17, 2024

Although Franklin Templeton enters the Ethereum ETF race slightly later than some counterparts, the company has a proven track record of embracing innovation. Recent expressions of admiration for the fundamentals of Ethereum and other blockchains hint at broader ambitions beyond Bitcoin. This strategic pivot aligns seamlessly with CEO Jenny Johnson’s vision of embracing emerging technologies, exemplified by the company’s playful adoption of the “laser eyes” meme on social media.

The Ethereum ETF Landscape: A Crowded Field with Regulatory Hurdles

In the pursuit of approval from the Securities and Exchange Commission (SEC), Franklin Templeton finds itself amidst a crowded field, with heavyweight competitors like BlackRock, VanEck, and Fidelity already in the race. The SEC has set deadlines ranging from May to August for decisions on these applications, implying that Franklin may need to exercise patience in this regulatory process.

The Path Ahead: Potential Benefits And Regulatory UncertaintiesHere’s the most recent table of other filers that I have pic.twitter.com/xCRRMwK76r

— James Seyffart (@JSeyff) February 12, 2024

If the Franklin Ethereum ETF secures approval, it could offer investors a regulated and convenient channel to gain exposure to Ethereum, potentially attracting new participants to the ever-evolving crypto landscape. The increased institutional adoption may play a role in legitimizing the industry and boosting Ethereum’s price. However, investors must tread cautiously, given the regulatory hurdles and the inherent volatility associated with the cryptocurrency market.

Analysts’ perspectives on the likelihood of Ether ETF approvals in 2024 remain divided. Bloomberg’s Eric Balchunas recently adjusted his odds from 70% to 60%, underscoring the uncertainty surrounding the SEC’s stance on these financial products.

Franklin Templeton’s entry into the Ethereum ETF race adds a layer of complexity to an already intense competition. While potential benefits are enticing, investors must remain mindful that ETF approval is not guaranteed, and a comprehensive understanding of the market is crucial before making investment decisions in this rapidly evolving landscape.

Featured image from Pexels, chart from TradingView