The below is from a recent edition of the Deep Dive, Bitcoin Magazine's premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Almost immediately after we released our November Monthly Report last Friday, the bitcoin market experienced a series of swift liquidations taking price down to a potential bottom around $42,000.

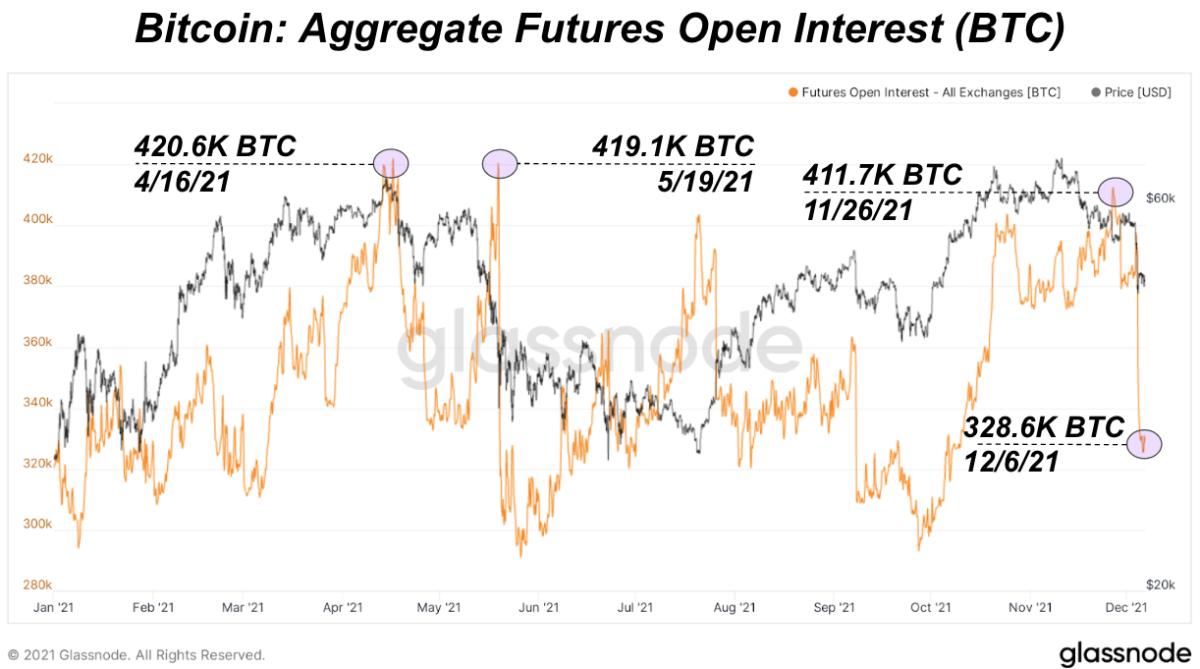

We highlighted the increased risk of the overextended total futures open interest and long liquidations in the monthly report saying,

“The bitcoin total futures open interest in the derivatives market has risen to new elevated levels that have historically preempted increased healthy, liquidation flushes in the market. Although futures open interest is elevated largely because of increased CME Futures ETF demand, the rise is still cause for concern as perpetual funding rates rise higher as price is falling. These dynamics usually signal a derivatives market reset and thus a lower bitcoin price.”

In a sharp drawdown, aggregate futures open interest fell from 411,700 BTC to 328,000 (BTC-denominated).

Bitcoin Aggregate Futures Open Interest

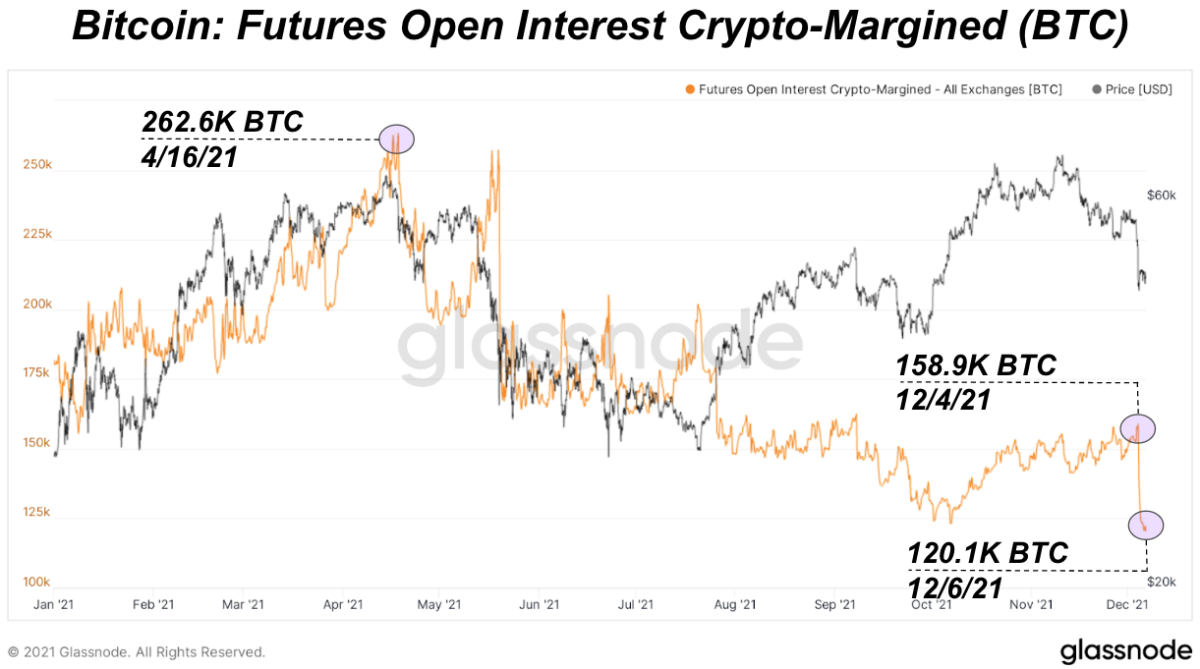

Crypto-margined derivatives open interest witnessed a drawdown to its 2021 lows with the long liquidations, falling by more than 20,000 BTC in mere hours.

Bitcoin Futures Open Interest, Crypto-Margined

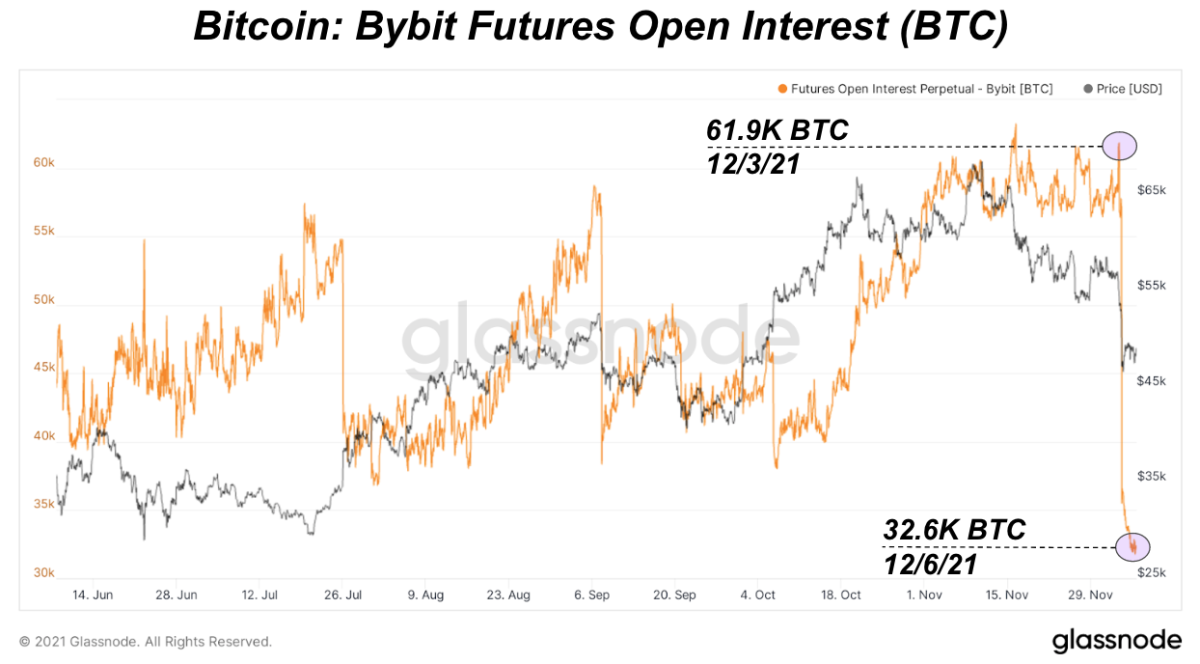

In particular, open interest on Bybit saw massive liquidations. We highlighted Bybit open interest and derivatives in particular in the monthly report published to paying subscribers on Friday.

Bybit Futures Open Interest

Funding on perpetual futures also went steeply negative for the first time in months as the price was driven far below that of spot markets due to the cascading liquidations. The funding rate on “perps” can be thought of as a tether to the spot index, and when a large amount of liquidations occur due to excessive leverage, funding goes negative due the price of “perps” going far below that of spot indexes.